- Opening Bell

- June 3, 2025

- 3 min read

ISM Weakness Deepens: What It Means for SPY and the Market’s Next Move

Markets opened the week with fresh ISM data that continues to lean heavy. New orders contracted for a fourth straight month — coming in at 47.6, barely up from April’s 47.2, and still below the 12-month average of 48.6. This isn’t a one-off. We’ve now got a clean streak of weakening demand since the back half of 2022.

Panel commentary from the report backs that up. There’s no momentum shift here — still the same mix of soft overseas orders, ongoing tariff-related negotiations, and a slight edge toward concern on forward demand. The ratio of positive to negative comments? About 1 to 1.5 in favour of cautiousness.

Inventories told a similar story. Dropped to 46.7 from 50.8, back into contraction. First time we’ve seen that since February. The pull-forward on materials (tariff protection) looks done — now it’s about aligning stock levels with weaker expectations. Of the major manufacturing sectors, just two expanded inventory-wise last month. That’s not rotation — that’s hesitation.

Across the board, sectors are either sitting flat or easing. Not enough strength to push the needle forward, and not enough panic to scream recession — but very much a stall. A pause. A market that’s waiting, unsure if growth’s going to pick back up or if we’re drifting into a mild slowdown.

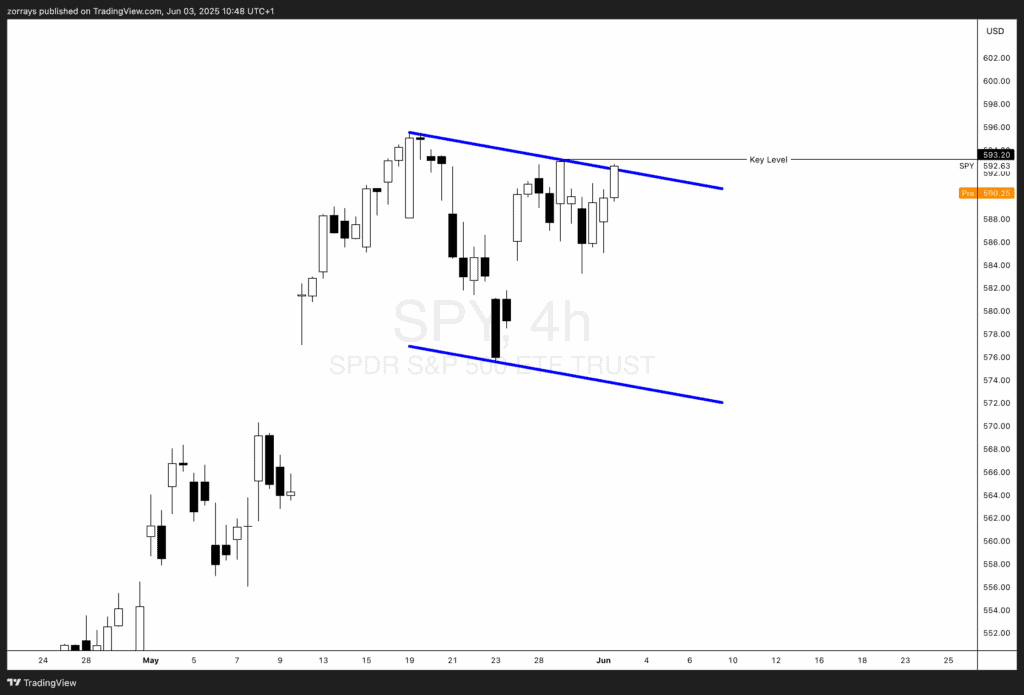

Now to the SPY chart…

Here’s where price confirms the macro. We’re still inside this descending channel that’s been building since late May. SPY tapped into the upper bound around $593 and got cleanly rejected. That zone lines up with a key structure level, and unless we get a surprise macro bid, it’s acting as a ceiling.

If the market keeps digesting soft data and pricing in a mild recession — which I already leaned toward in my recent weekly — we’ve got space to the lower bound of this channel. Call it $570–$572 as the next downside magnet.

Price action is holding up — barely — but if this week doesn’t bring a macro tailwind (jobs data, Fed tone shift), that lower level’s going to look increasingly attractive. No real signs of broad sector rotation out of cyclicals or into defensives yet, but participation is narrowing. That’s a warning sign.

Final Take

ISM didn’t crater — but it didn’t bounce either. This was the fourth straight month of contraction in new orders, and inventories flipped negative. That’s not what a bottom looks like.

Until we see a shift in forward orders or inventory build-up, the story stays the same: slowdown, not collapse. SPY reflects that — trapped under resistance, trading a range. Reclaim $593 and we talk upside. Fail here, and $570’s right back on the table.