- Opening Bell

- January 7, 2025

- 3min read

ISM Services Data in Focus as Markets Gauge U.S. Economic Momentum

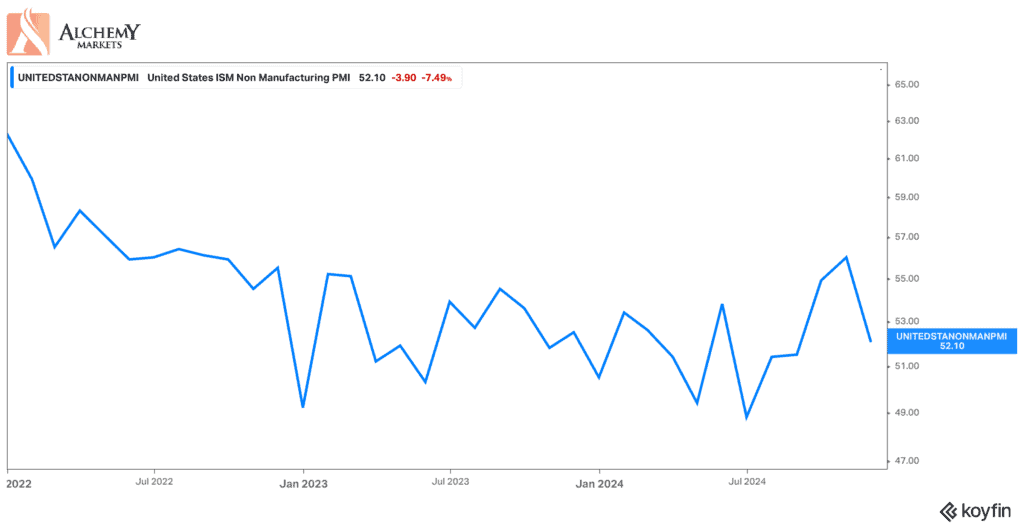

Markets are watching closely as the ISM Services PMI for December is set to be released today, with expectations pointing to a slight improvement to 53.5, up from November’s 52.1. While this would suggest modest growth in the services sector, it’s worth noting that the index has been on a steady decline since November 2024, when it stood at 56. This downward trend raises concerns about whether services—a critical driver of the U.S. economy—can sustain their resilience as manufacturing continues to struggle, as reflected by ISM Manufacturing PMI readings stagnating below the 50 threshold.

If today’s ISM Services PMI fails to meet expectations and shows further contraction, it could amplify fears of a slowing U.S. economy. A miss, coupled with weaker signals from other forward-looking indicators such as consumer confidence, may indicate that broader economic momentum, including GDP growth, is losing steam.

The Dollar’s Position: Consolidation or Reversal?

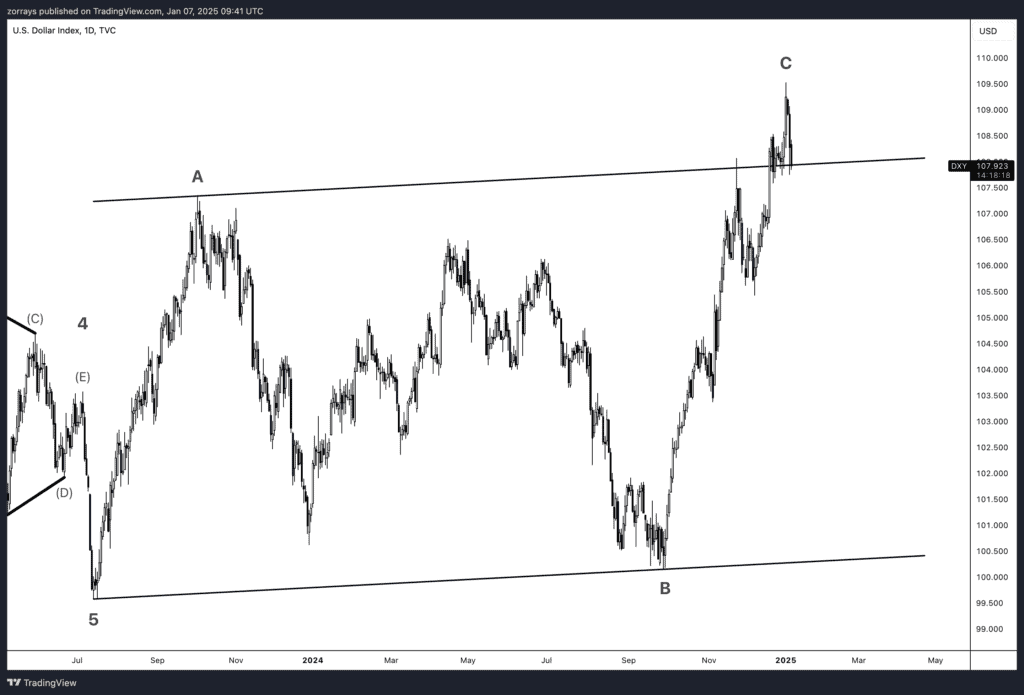

The U.S. dollar (DXY), which saw strong gains throughout December, appears to be taking a breather since the start of the new year. After a consistent rally in late 2024, the dollar’s recent pullback suggests two possibilities: it could be undergoing a technical correction before the next leg higher, or it may be signaling a potential reversal if incoming economic data underwhelms.

Should today’s ISM data miss projections, alongside signs of declining economic confidence, it could weigh on the dollar further. Conversely, an upside surprise may reignite demand for the greenback, especially if markets begin pricing in more resilience in the U.S. economy.

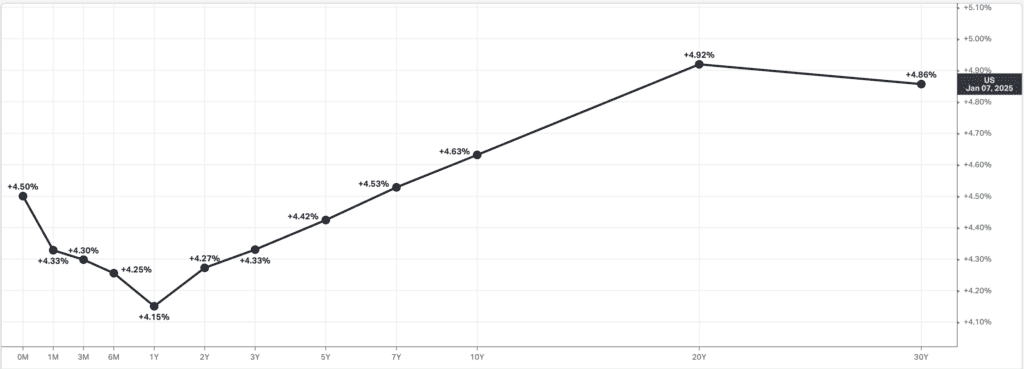

The Yield Curve: Improving but Still Steep

Another key factor to monitor is the U.S. yield curve, which, while improving slightly, remains inverted. Short-term rates remain higher than long-term rates, signaling persistent concerns about economic slowdown risks. Historically, an inverted yield curve has been a reliable predictor of recessions, and although the inversion has eased recently, it remains a red flag for economic momentum. Today’s data will be pivotal in determining whether these concerns will grow or diminish.

Technical Outlook: Is the Dollar Topping?

On the technical front, the DXY appears to have reached the peak of wave C, suggesting a possible corrective phase or reversal. However, the dollar’s trajectory will ultimately depend on macroeconomic fundamentals and global risk sentiment. If ISM Services PMI surprises to the downside or if global growth concerns escalate, the dollar may face additional pressure. On the other hand, improving sentiment or stronger-than-expected U.S. data could support a new rally.

Key Takeaways Ahead of ISM Services PMI Release

- A print below 53.5 could raise alarm about the U.S. economy’s ability to maintain growth.

- Dollar movements will hinge on whether data beats or misses expectations.

- Yield curve dynamics underscore lingering concerns about recession risks, even as it shows gradual improvement.

- Technical indicators suggest the dollar may be at a crossroads, awaiting confirmation from macro fundamentals.

With ISM Services PMI and broader economic data setting the tone, the markets remain in a delicate balancing act between optimism and caution. Keep an eye on the DXY and U.S. Treasury yields as potential leading indicators for what’s next.