- Opening Bell

- July 10, 2024

- 3min read

Dovish Tone in Fed Chair Powell’s Testimony Creates Optimism

On July 9th, 2024, Jerome Powell spoke before the Senate Banking Committee in Washington, DC. While Powell stated that more data is needed before a rate cut, the overall tone was more dovish, and cautiously optimistic, rather than hawkish.

Key Takeaways:

- Powell agrees that the PCE data is promising, but states that the Fed wants to be more confident before reducing how tight the loosening policies are.

- Powell also stated that the Federal Reserve will step in to cut rates if the labour market falters.

PCE Data Indicates Continued Progress in Lowering Inflation

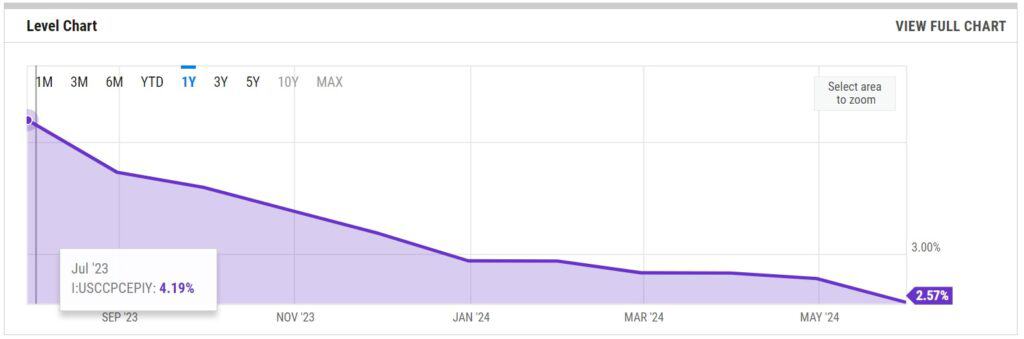

During the testimony, a reporter referenced the recent PCE data, suggesting it might justify a rate cut. Chair Powell acknowledged the promising nature of the PCE data but emphasised the Federal Reserve’s need for caution. Powell stressed that they want to avoid repeating their oversight in 2023, when premature optimism led to an unexpected surge in inflation in early 2024.

That being said, this agreement – and perhaps proud remark – from Fed Chair Powell about the PCE data looking promising is a dovish sign for the markets, and bearish for the dollar.

Personal Consumption Expenditures (PCE) currently sits at 2.57%, which is almost half of its value of 4.19% in July 2023.

What is Personal Consumption Expenditures (PCE)?

Personal Consumption Expenditures (PCE) measures the prices U.S. consumers pay for goods and services, including durable goods, non-durable goods, and services. It reflects changes in consumer behaviour and spending patterns. As a leading indicator for the Consumer Price Index (CPI), PCE provides early signals of inflation trends. The lower PCE is, the lower CPI inflation data is going to be.

Fed Ready to Cut Rates if Labour Market Falters

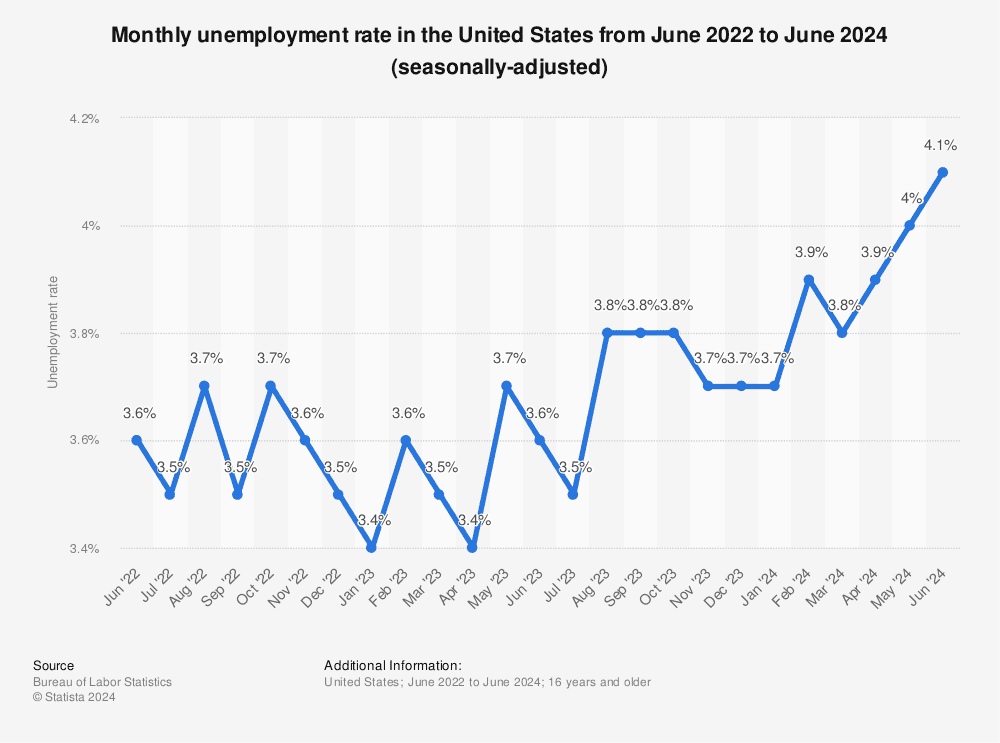

During the conference, Powell stated that the Federal Reserve will indeed step in to cut interest rates if the labour market weakens significantly. This provides a huge clue into how the Federal Reserve plans to react to economic data in relation to the labour market.

Although the current U.S. labour market remains strong, there are signs of a slowdown. The total nonfarm payroll employment increased by 206,000 in June 2024, which is lower than the monthly average of 220,000 over the past 12 months. Additionally, the monthly unemployment rate has ticked up from 4.0% to 4.1%, showing a clear accelerating uptrend.

If upcoming nonfarm payroll, unemployment, or jobs-related data come in much lower than expected, the Federal Reserve may be prompted to take action.

Target Rate Probabilities and Upcoming News

Chair Powell will be speaking again at 14:00 UTC, 15:00 UK time, and 10:00 NY time. Additionally, the U.S. Core CPI m/m, CPI m/m, and CPI y/y data will be released tomorrow.

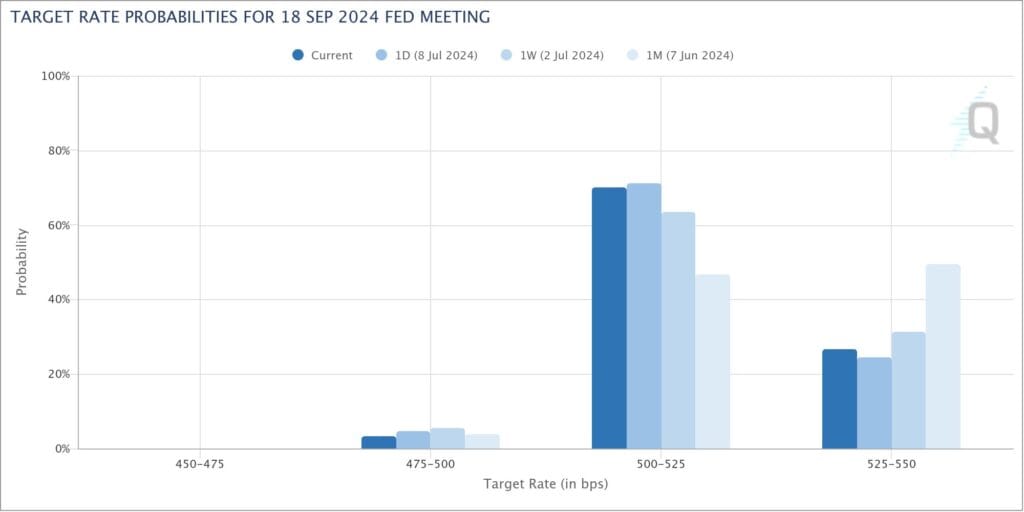

The target rate probabilities, as reflected in the CME Group Fedwatch Tool, may be affected by the upcoming announcements. Currently, there is over a 70% expectation for a reduction of 25 basis points in September, with a 90% expectation of a hold in July 2024.

Source: Fedwatch Tool

Technical Analysis of DXY (July 10th, 2024)

Aligning with the fundamental factors, the technical chart of the Dollar Index is currently looking bearish:

- Fallen outside of an ascending channel on the Daily and Weekly timeframe

- Under 20, 50, 100, 200 Exponential Moving Averages on the 4H timeframe.

- EMA Cluster aligns with the position of the daily 50 EMA.

If the DXY (US Dollar Index) fails to close back into the ascending channel on the daily timeframe, above approximately 105.300, the dollar may begin to lose its strength.

Should this occur, the DXY could fall to lower levels such as 104.231 and 100.617 – causing assets such as Gold, Bitcoin, and Nasdaq 100 to potentially rise.

You may also be interested in:

BTC July 9th Analysis

USDCHF Diverging Monetary Policies Analysis