- Opening Bell

- November 14, 2024

- 4 min read

Dollar Bulls Hold Steady on Strong U.S. CPI and Fed Watch

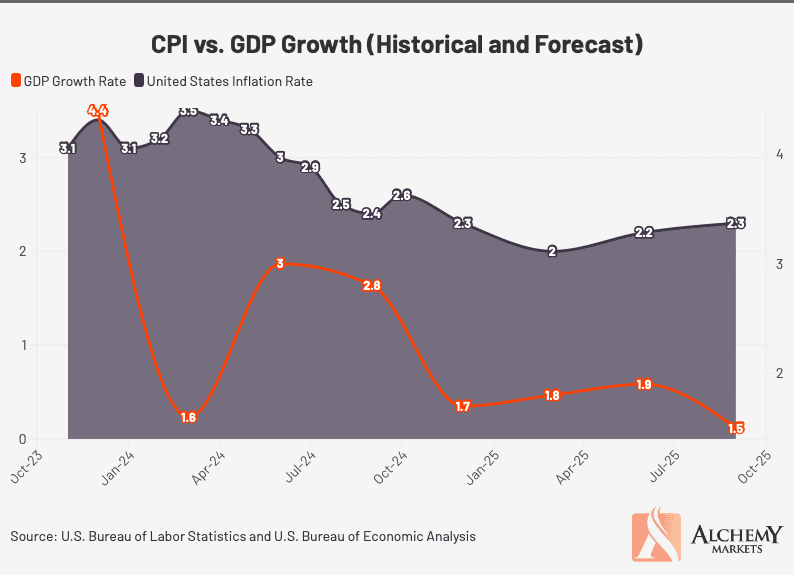

The U.S. dollar remains in the spotlight this morning as investors eagerly snapped up the greenback following yesterday’s U.S. Consumer Price Index (CPI) report. The dollar’s strength appears to reflect market confidence in a dollar-positive policy mix under President Trump’s agenda, pointing to a bullish dollar sentiment that could persist throughout 2025. However, despite this broader momentum, some short-term corrections may be in the cards, creating a nuanced near-term outlook.

U.S. Dollar: Strong Start Amid Bullish Outlook

Market activity following this week’s CPI release has offered a preview of potential FX dynamics in the second Trump term. Brief pullbacks in the dollar – like those seen after yesterday’s CPI figures – are quickly being seen as attractive buying opportunities, further reinforcing a structural bullish view on the dollar.

The election of John Thune as the Republican Senate leader, however, could introduce minor political friction. Thune, an advocate for free trade, contrasts with Trump’s protectionist stance, which could lead to differences in policy direction. While these dynamics are worth noting, they are unlikely to significantly disrupt the dollar’s broader bullish trend.

Upcoming U.S. Events: PPI Data and Fed Chair Powell’s Speech

Today brings additional critical events for dollar-watchers. First, the Producer Price Index (PPI) report is set for release, with analysts expecting headline PPI to tick up to 0.2% from a previous 0.0%, while the core rate remains steady at 0.2%. As the Fed’s favored inflation gauge, the PPI data will be closely scrutinized; any unexpected downside could spark a short-term dollar dip due to market positioning, which remains quite strong in the dollar’s favor.

Later today, Federal Reserve Chair Jerome Powell will address an audience in Dallas, where he is likely to discuss the economic outlook in detail. The Q&A portion could be particularly interesting, as Powell might face questions about inflation and how Trump’s protectionist policies could influence monetary policy. If Powell hints at a cautious approach to aligning Fed policy with Trump’s agenda, it could create a temporary softening in the dollar, as traders might view this as slightly dovish.

Despite a potential short-term pullback, the dollar’s underlying strength remains firm, with any correction unlikely to push the DXY index below the 106.0 level. Dip-buying interest is expected to remain strong.

EUR and AUD: Global Currency Watch

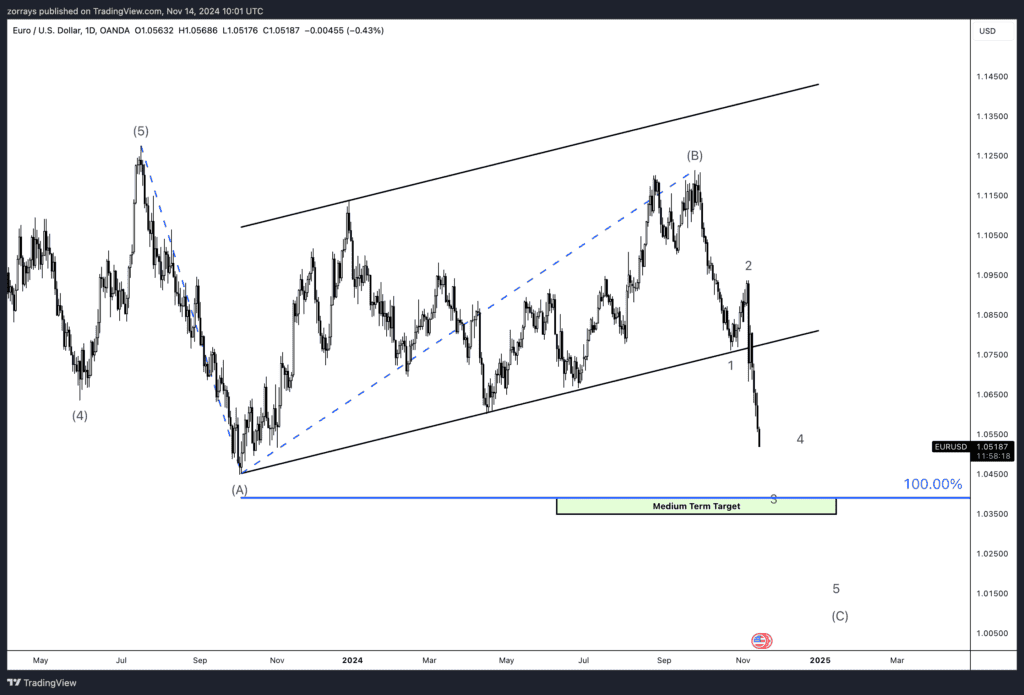

Euro’s Risk Premium

The EUR/USD pair continues to feel the impact of dollar strength, supported by a wide interest rate differential favoring the dollar. Additionally, Trump’s foreign and trade policies are seen as creating a euro-negative risk premium of over 1.5%, reflecting the potential economic challenges facing the eurozone. While a modest EUR/USD rally is possible, it’s likely to face selling pressure at higher levels, making a sustained climb above 1.070 less probable.

In today’s eurozone news, we’ll see the first revision of Q3 GDP and employment data, along with the minutes from the ECB’s October meeting. These data points may hint at dovish sentiment, though markets might need more concrete signs of an economic slowdown or lower inflation to fully price in a December rate cut.

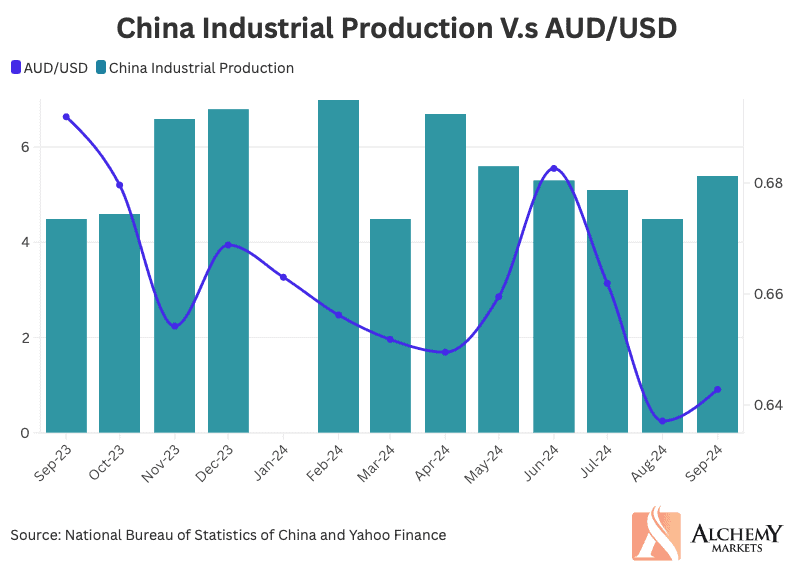

Australian Dollar’s Resilience

Overnight, Australian employment data showed a rise of 16,000 jobs in October, though less than expected. The AUD remained largely unaffected and continues to move in line with dollar trends. Interestingly, the AUD has outperformed the euro since the election, suggesting that markets are more concerned with eurozone risks than China’s outlook, which influences the Australian economy. Should a USD correction occur, the AUD might see a stronger rebound than other currencies, potentially moving toward the 0.6550 level in AUD/USD.

Final Thoughts

Today’s focus on U.S. inflation data and Fed signals should help clarify the dollar’s near-term path, though the broader outlook remains positive for the dollar given the ongoing support from U.S. policy expectations. While minor corrections could emerge, dollar bulls are well-positioned to capitalise on these dips, particularly as positioning stays firmly in favour of the greenback.