- Opening Bell

- October 15, 2024

- 6 min read

Dollar and Oil Divergence

The Dollar Surges as Oil Declines

Source: European Central Bank

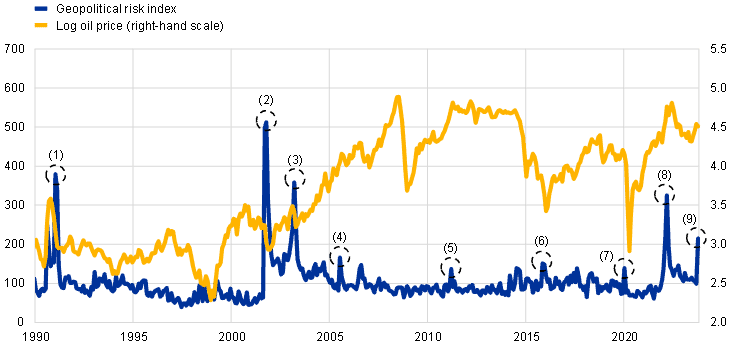

Yesterday, the dollar and oil prices took divergent paths in the financial markets. The U.S. dollar strengthened broadly across currencies, while oil prices dipped following reports that Israel does not currently intend to target Iran’s oil and nuclear facilities. This news dampened speculation about potential supply disruptions in the Middle East, easing fears that had been partially propping up crude prices.

Another factor contributing to the weakness in oil prices was investor disappointment regarding China’s stimulus measures. China, a major oil importer, announced its economic stimulus plan over the weekend, but the measures fell short of expectations, fuelling concerns that demand for oil from the world’s largest importer could remain subdued.

Data Source: CME Group

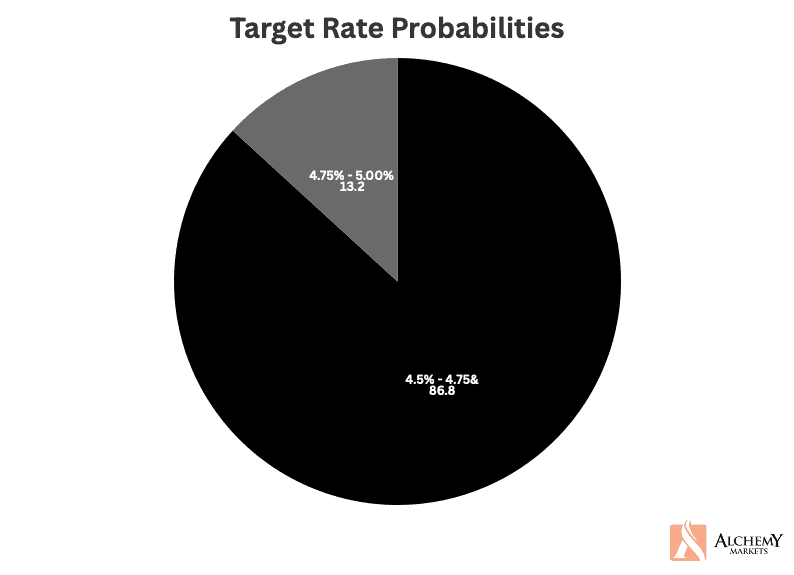

As U.S. markets reopened today after a long weekend, there was a possibility of the dollar reconnecting with oil’s softer story. However, the dollar’s strength could also be attributed to other factors. The interest rate outlook for the U.S. remains supportive for the greenback, with markets pricing in only 44 basis points (bp) of Federal Reserve easing by the end of the year. This restrained easing expectation reflects that recent U.S. economic data—though not overwhelmingly strong—hasn’t been weak enough to push markets to fully embrace aggressive rate cuts.

Another element influencing dollar strength could be positioning ahead of the U.S. presidential election, now just three weeks away. Asset markets seem to be pricing in a win by Kamala Harris, who is seen as a less disruptive candidate. The tight race in swing states may be prompting defensive positioning, leading to dollar inflows as investors seek safety before the vote.

On the data front, the U.S. calendar is relatively quiet, with the Empire State Manufacturing Index being the only significant release today. Market participants will likely focus on comments from Federal Open Market Committee (FOMC) member Mary Daly, a neutral voice in the committee, to gauge consensus views after the higher-than-expected jobs and inflation reports last week. Her remarks, along with comments from fellow neutral member Chris Waller—who yesterday called for caution on rate cuts—are contributing to the dollar’s continued strength.

Technical Analysis: Dollar Index (DXY) and US Oil

Dollar Index (DXY): Approaching Resistance

Looking at the technicals, the U.S. Dollar Index (DXY) has been pushing higher but is currently encountering resistance around the 103.50 level, as shown in the second chart. The fundamental reasons for the dollar’s strength, including restrained expectations for Fed rate cuts and defensive positioning ahead of the U.S. election, seem to align with the dollar’s current rally.

This resistance zone around 103.50 could indicate a potential short-term reversal or correction. If the dollar fails to break convincingly above this level, we may see some profit-taking or repositioning, which could lead to a pullback. However, with the U.S. election approaching and the relatively supportive interest rate environment, the dollar’s overall bullish momentum might persist, even if we witness a temporary dip.

U.S. Oil (WTI): Falling Towards Support

On the other hand, U.S. crude oil (WTI) has seen a notable decline, dropping below $72 per barrel. This sell-off is largely driven by easing geopolitical concerns following the reports that Israel is not planning to target Iranian oil infrastructure. Additionally, the underwhelming economic stimulus from China has raised concerns about future demand from one of the largest consumers of oil globally.

Technically, WTI is approaching a major support zone around the $68-$70 range, as shown in the first chart. This area has historically provided strong support, and traders will be watching closely to see if prices hold at this level or break below it. A break beneath the support zone could signal further downside for oil prices, possibly bringing them closer to the $65 mark.

At this point, we need to monitor how oil behaves around the key support area. If price action starts to consolidate or form bullish patterns, it could suggest that this zone will hold, and we might see a rebound. Conversely, a clean break below could open the door for further declines, especially if demand concerns from China persist or if geopolitical tensions continue to ease.

Conclusion

In summary, the dollar’s strength is backed by a confluence of factors, including limited expectations for Fed easing and positioning ahead of the U.S. election. While the dollar is testing a key resistance level, it could face a short-term correction if the fundamental drivers weaken. Oil, on the other hand, remains pressured by both easing geopolitical risks and disappointing demand signals from China. As WTI approaches a critical support zone, the next few days will be crucial in determining whether this level will hold or if further downside is on the horizon.

Frequently Asked Questions (FAQs)

- Why did the dollar strengthen despite falling oil prices? The dollar’s strength is primarily due to limited expectations for Fed rate cuts, defensive positioning ahead of the U.S. election, and relatively stable U.S. economic data.

- What caused oil prices to drop recently? Oil prices fell due to easing geopolitical concerns (reports that Israel won’t target Iranian oil facilities) and investor disappointment with China’s stimulus measures, which could impact future oil demand.

- Will the dollar continue to rise? The dollar’s upward momentum could continue, especially with limited Fed easing expectations and potential election-related positioning. However, it may face resistance and see a short-term correction.

- What is the key support level for U.S. oil prices? The key support zone for WTI crude is between $68 and $70 per barrel. A break below this level could signal further downside.

- Could oil prices rebound from here? If oil finds support at the $68-$70 level and geopolitical or demand concerns stabilise, we could see a rebound. However, a clear break below this support could lead to further declines.

- What data or events should we watch for to understand oil and dollar movements? Key factors include U.S. economic data, Fed member speeches, geopolitical developments in the Middle East, and demand signals from China.