- Opening Bell

- June 17, 2025

- 2min read

BoJ Stays Dovish, USD/JPY Breakout in Play?

The Bank of Japan held its policy rate steady at 0.5% in its June meeting, reaffirming a dovish tone amid global monetary normalisation. While market participants had priced in the possibility of a rate hike in Q3, Governor Ueda dialled back expectations, citing soft inflation anchoring and downside risks from U.S. trade policy. Notably, the BoJ also announced it would halve its bond purchases starting April 2026 — a slower-than-expected pace of quantitative tightening aimed at preserving stability in Japan’s government bond market.

Governor Ueda’s messaging suggests the BoJ is in no rush to tighten financial conditions. Inflation risks, he argued, are not yet persistent or broad enough to warrant immediate action, especially as tariff-related uncertainty clouds Japan’s corporate wage outlook heading into year-end. Markets interpreted this as confirmation of a wait-and-see approach well into 2026, pushing back expectations for any near-term rate moves.

What This Means

The BoJ’s dovish stance keeps Japan as one of the last major economies with ultra-low interest rates. In contrast, the U.S. remains firmly in a higher-for-longer regime. That yield differential creates an ongoing incentive for carry trades, where investors borrow in yen and invest in higher-yielding assets — a structural force that weakens the yen.

From a forward-looking perspective:

- As long as U.S. real yields stay elevated and the BoJ delays hikes, USD/JPY is likely to stay bid.

- If inflation in Japan surprises higher, or the Fed cuts faster than expected, this view would need re-evaluation — but neither is base case.

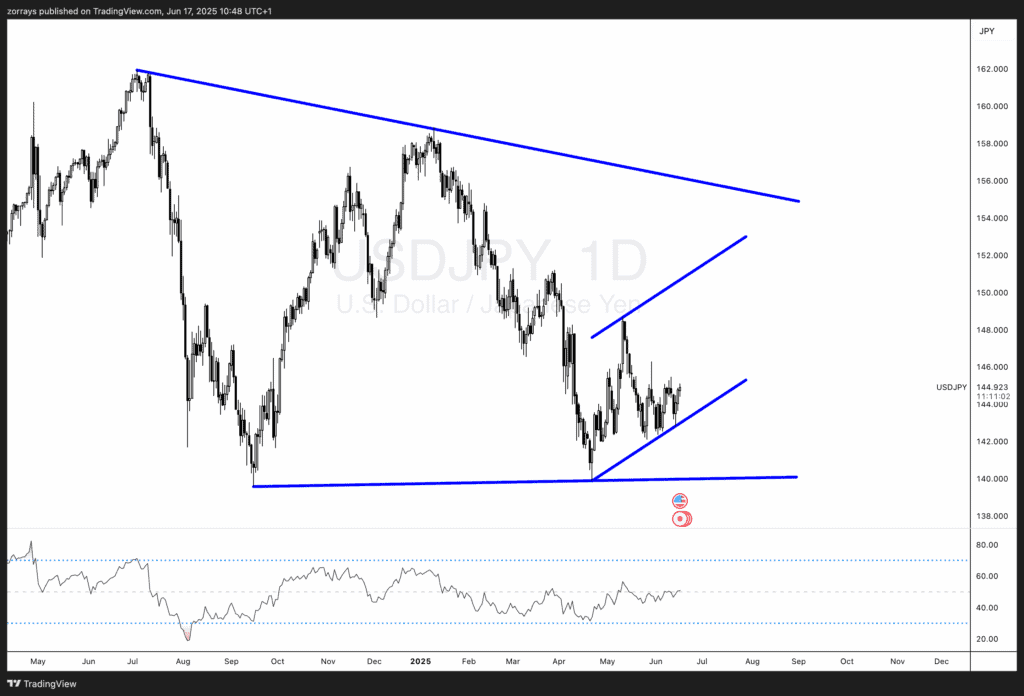

Technical Setup: USD/JPY in Ascending Channel

Looking at the chart, USD/JPY is currently trading within a clean ascending channel. After bouncing from the 140 area in early May, the pair has respected rising support and now sits just under 145.

If the current macro regime holds (BoJ dovish, Fed cautious), the path of least resistance is higher, with a move toward the upper bound of the channel (~151–152) a realistic scenario over the summer.