- Opening Bell

- November 7, 2024

- 4 min read

Policy is King: All Eyes on BOE Gov Bailey and Fed Chair Powell

The GBP/USD pair is set for some volatility as the Bank of England (BoE) and the Federal Reserve (Fed) prepare to announce their policy decisions. Market participants are closely watching how hawkish or dovish each central bank will be, as this will likely establish a clear direction for the pound-dollar exchange rate.

Current Rates and Technical Setup

With the BoE’s rate at 5% and the Fed’s effective rate at 4.75%, the pound currently has an advantage in terms of returns on interest. However, the technical picture shows mixed signals for GBP/USD. In the short term, we see a 50/50 probability for the pair’s movement, though a bearish trend may dominate the medium term.

Technical Breakdown: GBPUSD Weekly Chart

| For now, we think the price of GBP/USD is in a 50/50 scenario in the short term, bearish mid term. |

Bullish Scenario: GBP/USD is testing a support level formed by the midline of an ascending channel, which could prompt further upside. If the pair rises, it could retest the upper trendline of this channel around $1.35. A rally like this would likely require a hawkish tone from the BoE and no surprises from the Fed that might strengthen the dollar, and in turn weaken the pound.

Bearish Scenario: Conversely, the weekly chart is showing the candle approaching a close below the 20-week exponential moving average (EMA), a historically bearish signal. A close below this level could indicate a potential rollover, with GBP/USD likely retesting recent lows or even the bottom of the ascending channel. If the channel were to break, we might see GBP/USD revisit its 2023 low of $1.20 or its 2024 low near $1.22.

The Market Has Likely Priced in the 25bps Rate Cut

Let’s start with the Fed decision, which is somewhat easier to predict given current market sentiment.

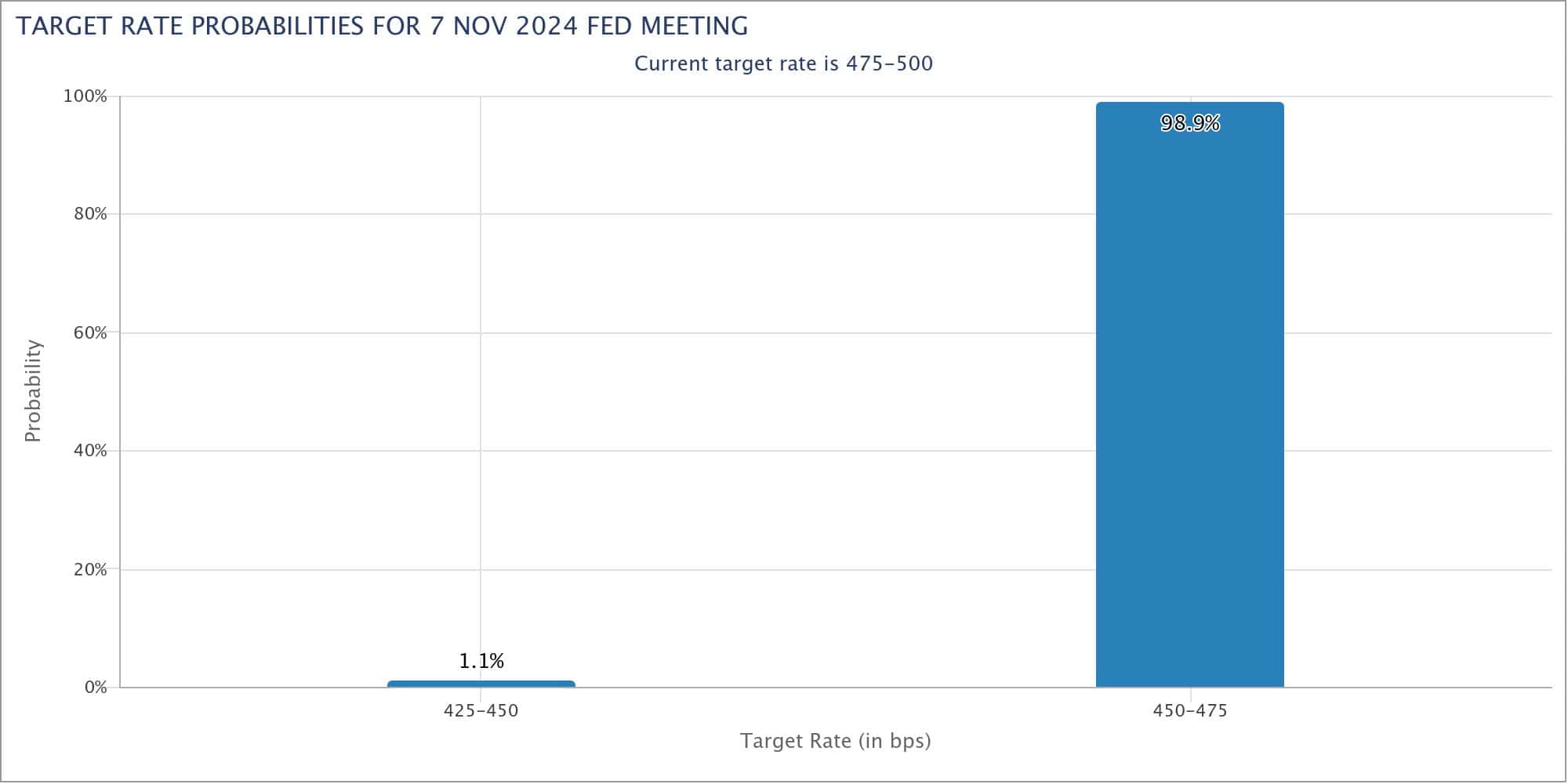

According to the CME FedWatch Tool, a 25-basis-point rate cut has a near-universal (98.9%) probability of occurring. Given these expectations, it’s likely that the rate cut is already priced in, with the dollar rally we’re seeing likely driven by a surge in demand for U.S. assets—spurred on by the recent electoral victory of Donald Trump. Some refer to this rally as the “Trump Trade.”

Source: CME Group Fedwatch Tool

For GBP/USD, the Fed decision will play a key role. Here’s what to watch for:

- No Rate Cut (Holding at 475-500 bps): This would be bearish for GBP/USD, suggesting the Fed is maintaining a tighter stance than anticipated.

- Deeper Rate Cut of 50bps: A larger-than-expected cut would be bullish for GBP/USD as it could signal the Fed’s commitment to easing policy.

- Rate Hike: Although highly unlikely, a rate increase would be a major shock to the market, significantly bearish for GBP/USD.

What to Watch from the BoE

In general, the markets are leaning towards a dovish stance from the Bank of England. This comes down to two critical factors: inflation rate, and sluggish economic growth.

UK inflation has dropped to 1.7% as of September 2024, falling below the central bank’s 2% target for the first time in over three years. As a result, the central bank may see less need to tighten monetary policy to control inflation. Adding fuel to the fire is the UK’s limited economic expansion, which has only expanded by 0.2% in October (GDP month-over-month).

Pictured: UK GDP m/m, Source: ForexFactory

These factors combined could lead the BOE to remain dovish, leading to a rate hold or even a rate cut. According to The Times UK, there is a general sentiment that GBP’s borrowing rate will be reduced by 25 basis points in today’s meeting.

A hawkish stance—maintaining or increasing rates—would signal confidence in the economy’s resilience, while a dovish approach might suggest caution.

Closing Thoughts: All Eyes on Central Banks

As the BoE and Fed decisions approach, GBP/USD is poised to react to even the slightest policy cues. For GBP/USD bulls, a dovish Fed stance paired alongside a steady or hawkish BoE tone, could potentially fuel GBP/USD to rise higher in the short term.

In contrast, any unexpected dovish signals from the BoE or a surprise move from the Fed could lead to renewed bearish pressure for the pound.

Key Stats to Watch:

- UK Inflation Rate: 1.7% in September, below the 2% target for the first time since 2021.

- UK GDP m/m (October): +0.2%, highlighting limited economic expansion.

- BoE Rate Hold Probability: 30%; Rate Cut Probability: 70%, as per market sentiment.

- FedWatch Tool: 98.9% probability of a 25bps Fed rate cut, suggesting that the market has largely priced in this decision.

With central bank policy driving market sentiment, investors are awaiting any insights that Governor Bailey and Chair Powell may provide on their next steps.

You may be interested in: