- Opening Bell

- December 16, 2024

- 3 min read

Bank of England to Hold Rates: Faster Cuts Expected in 2025

The Bank of England (BoE) has opted to keep interest rates steady at its latest meeting, signaling a cautious approach compared to its European counterparts. Here’s what you need to know about today’s decision and the outlook for the coming months.

Why the Bank of England Is Holding Rates

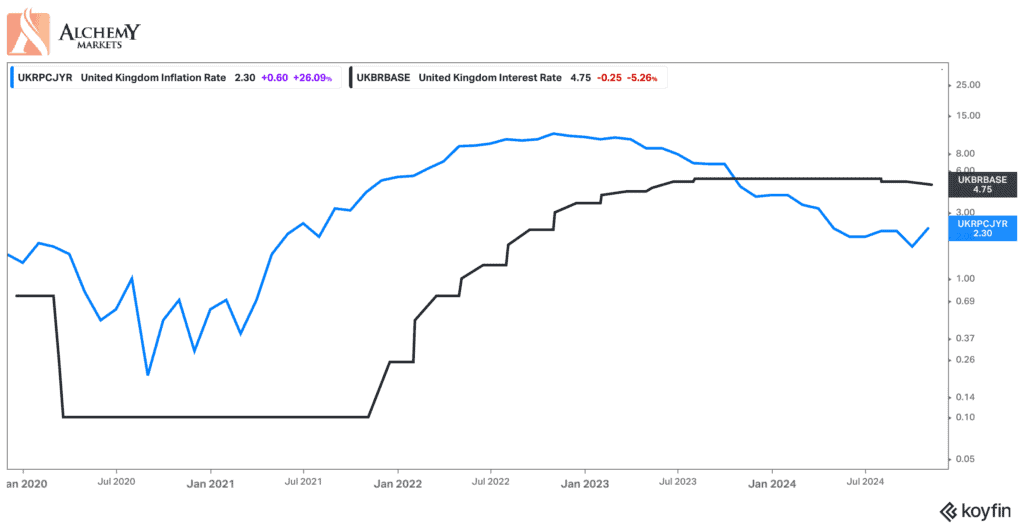

While central banks across Europe, such as the European Central Bank (ECB) and Sweden’s Riksbank, have been cutting rates more aggressively to address slowing growth, the Bank of England has taken a slower path. It has only cut rates twice so far and is unlikely to change course soon.

The key reason? Sticky services inflation.

- Services inflation, currently hovering around 5%, remains significantly above its pre-Covid average of 2.5%.

- This stubborn inflation is driven by lingering labor market tightness and strong private sector wage growth.

With these pressures, the Bank seems content with its gradual approach, voting 8-1 to keep rates on hold this week. There was no press conference or updated forecasts, further underscoring the decision to stay the course for now.

What Changes Could Be Coming in 2025?

While the BoE appears cautious for now, there are signs that rate cuts may accelerate starting in the spring of 2025.

- Cooling in the Jobs Market

- Employment in non-government sectors is falling, and job vacancies are now below pre-Covid levels.

- Wage growth is slowing, which could ease inflationary pressures.

- Core Services Inflation Decline

- Stripping out volatile items like travel, rents, and hotels, core services inflation is already down to 4.5%.

- By mid-2025, this measure is expected to drop closer to 3%, making it more acceptable to policymakers.

- Stronger Economic Growth

- Government spending, particularly on public sector wages, is set to boost growth in 2025.

- The recent National Insurance hike for employers may raise costs slightly, but softer labor market conditions could offset its inflationary impact.

What to Expect Next?

If inflation eases as expected and growth strengthens, the Bank of England could accelerate rate cuts in the spring. Analysts predict six rate cuts in 2025, potentially bringing the Bank Rate down to 3.25% by the end of the year.

This measured optimism reflects a balancing act: addressing inflation while supporting the economy as it gains momentum in the next fiscal year.

Conclusion

While the BoE is holding firm for now, the economic landscape suggests more aggressive rate cuts are on the horizon. For borrowers and businesses, the coming months could mark a turning point, with financial conditions gradually easing as inflation subsides and growth picks up.

Stay tuned for spring 2025—it could bring a significant shift in the Bank’s monetary policy.