- Opening Bell

- October 16, 2024

- 3 min read

All Eyes on Tomorrow’s ECB Interest Rate Decision

The European Central Bank (ECB) is widely expected to cut interest rates by 25 basis points (bp) at its upcoming meeting, as inflation continues to slow across the Eurozone. Markets have already priced in this rate cut, but surprises could still shake the markets. Here’s what to watch as we approach the ECB decision.

Key Expectations for Tomorrow’s ECB Meeting

- 25bp rate cut expected: The ECB has hinted at a rate cut due to a cooler-than-expected September inflation figure and weaker economic surveys.

- Further cuts anticipated: Markets expect a series of back-to-back 25bp cuts, with at least four cuts in the pipeline based on current pricing.

- Risk of a policy shift: If the ECB decides to hold rates or offer more dovish guidance than anticipated, the markets could see significant volatility.

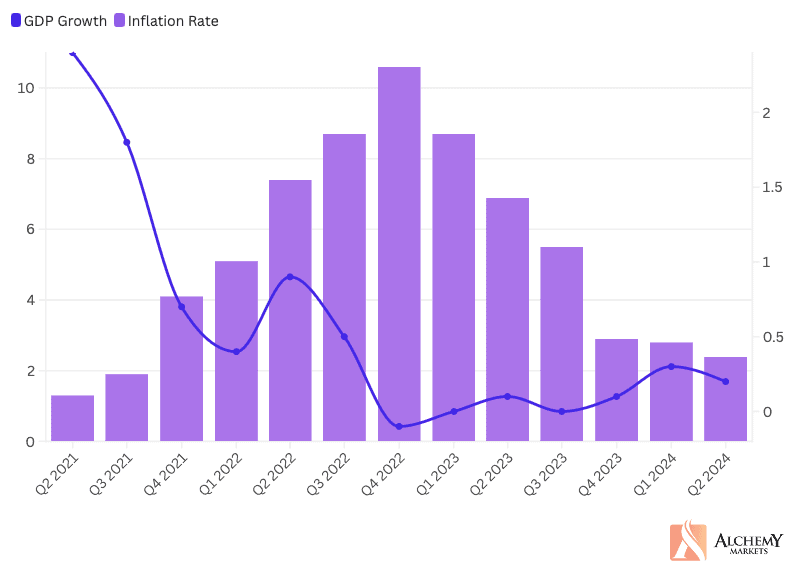

Inflation & Growth Outlook: The Delicate Balance

Data Source: Eurostat

- Inflation slowdown: While September CPI has cooled, inflation could rise again toward the end of 2024. Geopolitical risks, particularly related to energy prices, remain a concern for policymakers.

- Growth risks mounting: Economic activity is struggling, with the ECB increasingly worried about slower growth. Although some indicators, like the ZEW survey, show a slight improvement, the overall outlook remains fragile.

What If the ECB Holds Rates?

- Potential market shock: A decision to hold rates could be perceived as a policy mistake, especially after so much conviction for cuts. This could push short-term rates higher and flatten the yield curve.

- ECB’s credibility at stake: If the ECB doesn’t act as expected, the market may interpret this as the Bank falling behind the curve, particularly as inflation risks remain.

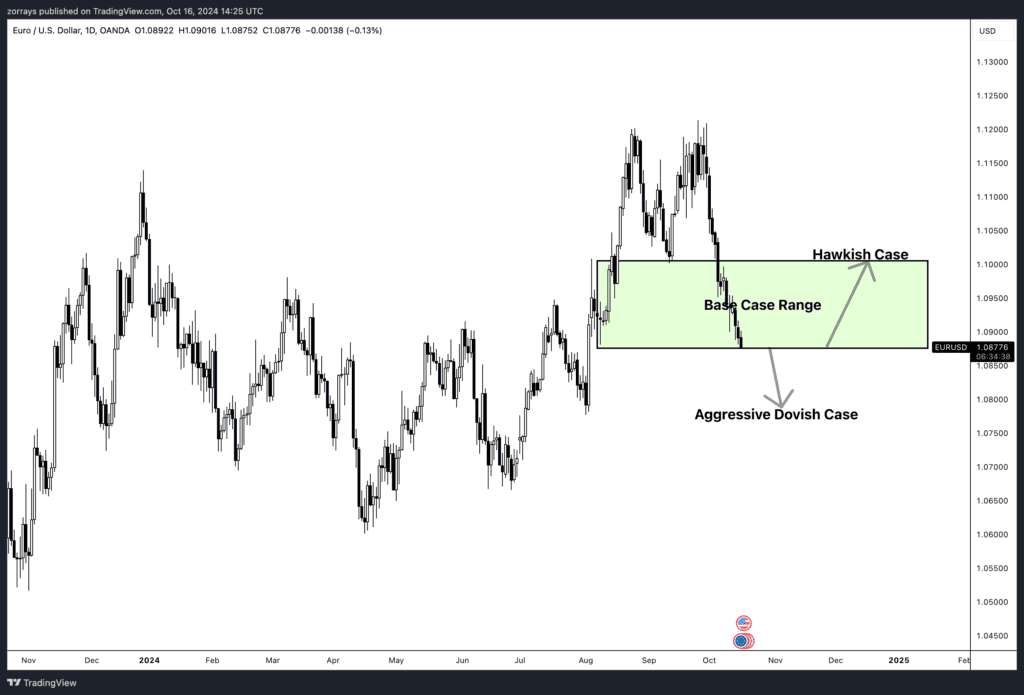

EUR/USD Outlook: What’s Driving the Pair?

- Rate differentials matter: The widening gap between EUR and USD short-term rates has been the main driver of EUR/USD’s recent decline. The USD’s relative strength, combined with expectations of fewer Fed rate cuts, is keeping pressure on the euro.

- Election risks loom: With the US presidential election approaching, USD inflows are likely, especially with the market factoring in a higher chance of a Trump victory. This could lead to further weakness in EUR/USD, especially if markets position defensively.

Scenarios to Watch Tomorrow

- 25bp Cut (Base Case): Markets will likely feel validated, reinforcing expectations of future cuts and keeping EUR/USD around current levels (1.09-1.95).

- Surprise Hold: Markets could react negatively, pushing front-end EUR rates higher and potentially sending EUR/USD toward the 1.10 – 1.105 range.

- Dovish Surprise: If the ECB hints at more aggressive easing or additional cuts, we could see further pressure on EUR/USD and send it to 1.08 range and short-term rates.

Bottom Line: Limited Impact, But Watch the Risks

- Rates already priced in: The market has largely absorbed expectations for this cut, but any deviation from the expected outcome could stir volatility.

- Downside risks remain for EUR/USD: Despite some improvement in activity data, external factors, including the US election, will likely dictate EUR/USD movements in the coming weeks. A slide toward 1.08 is not out of the question, especially if USD positioning ahead of November intensifies.

Conclusion

With a 25bp cut widely expected, the ECB’s October meeting may feel predictable, but surprises cannot be ruled out. Traders should stay alert for any unexpected signals, as a deviation from the baseline could cause significant market reactions, particularly for EUR/USD.

DISCLAIMER: For educational purposes only. Trading comes with substantial risk, leading to possible loss of your capital.

Traders are advised to do their own due diligence before investing.