- Elliott Wave

- July 21, 2025

- 2 min read

Silver’s Rising Rhythm [XAGUSD Elliott Wave]

Executive Summary

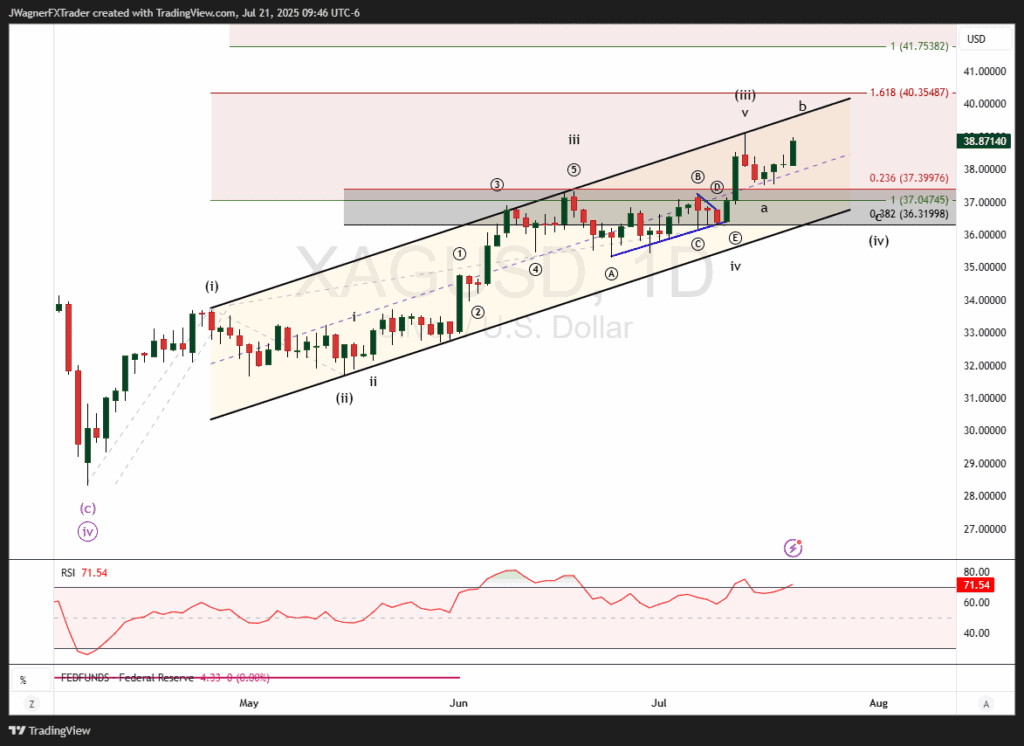

- Bullish Bias: Silver (XAGUSD) is in a clear up-trend inside a rising channel, completing wave (iii) and now correcting as wave (iv).

- Key Levels: Watch support near $36-38 (lower channel trendline) and resistance at the $40 channel ceiling.

- Correction Targets: Expect wave (iv) to finish near the lower end of the parallel price channel then break higher in wave (v).

Current Elliott Wave Analysis

On the daily chart, Silver’s rally from the April low at $28.31 marks wave ((v)) in progress. The surge from $28.31 to $39.13 has unfolded as an incomplete impulse pattern with three of the five waves in the books.

Wave (iii) was an extended wave falling short of the 1.618 Fibonacci extension.

Wave iv of (iii) was a symmetrical triangle leading to the final push higher in wave v of (iii).

Now, wave (iv) appears to be unfolding and the current rally is wave b of (iv).

I suspect that wave (iv) is still in progress and is incomplete because it was shallow in depth and short on time. No Elliott wave rules were broken, but the structure doesn’t look correct for the current rally to be wave (v).

If I needed to adopt an alternate count, one could argue wave v of (iii) was still unfolding to the upside.

If Silver materially pushes above $39.70, then we’ll consider the alternative. Until $39.70 is broken, this rally can be viewed as wave b of (iv).

Bottom Line

Silver remains bullish inside a well-defined rising channel. A corrective wave (iv) to $36–$38 is likely before wave (v) resumes. If Silver pushes above $39.70, then we’ll consider wave (v) is already unfolding. Once wave (v) begins, we are anticipating a target near $42.

You might be interested in…