- Elliott Wave

- May 27, 2025

- 2 min read

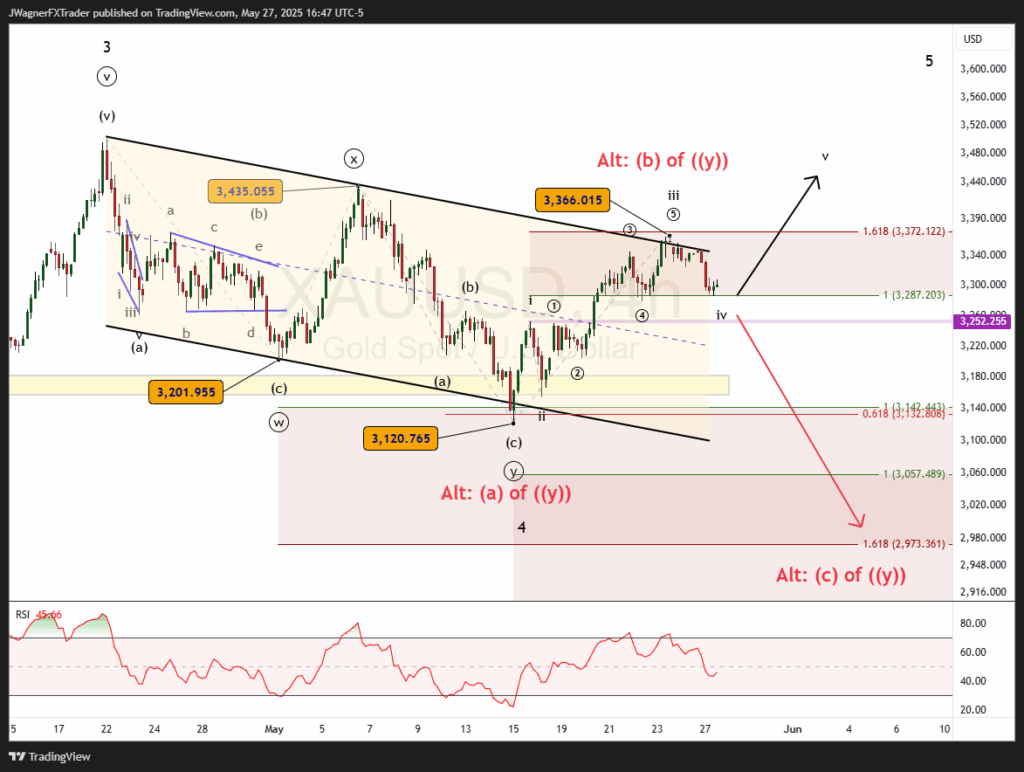

Gold’s Gleaming Glide or Grinding Gloom? [Gold Elliott Wave]

Executive Summary

- Trend Bias: Gold is climbing in an impulse wave pattern.

- Current Action: Price is within the first wave of a larger wave 5.

- Key Level: A break below the wave (4) low near $3,252 would invalidate the current bullish count.

Current Elliott Wave Analysis

The current Elliott wave chart of Gold shows an incomplete impulse rally. It appears the current Elliott wave is ‘iv’ of (i).

Today’s low in Gold might be the ending of wave ‘iv’ suggesting a rally this week in wave ‘v’ of (i) to retest the all time high.

There is a good amount of wave harmony taking place. Wave iii reached the 1.618 Fibonacci extension of wave i…a common relationship. Additionally, today’s low at $3,285 is the 38% Fibonacci retracement of wave iii…another common relationship.

Therefore, if the bulls are going to continue their run, they’ll need to step in and hold prices above $3,252 for a rally in wave ‘v’ to retest $3,500.

There is an alternative count we are considering too. Due to the inability of Gold to punch above the parallel price channel, we are keeping an eye on the red labels.

Last week’s high could have been wave (b) of ((y)). This implies this week’s decline is wave (c) of ((y)) to possibly reach down to $2,975.

Bottom Line

Gold appears to be in the early stages of a 5th wave. If this wave pattern is correct, then gold should begin rallying in wave v of (i).

A decline below $3,252 negates the bullish count while a rally above $3,366 negates the bearish count.

You might also be interested in: