- Elliott Wave

- April 11, 2025

- 2min read

EUR/USD Elliott Wave: Nearing End of First “Five”

Executive Summary

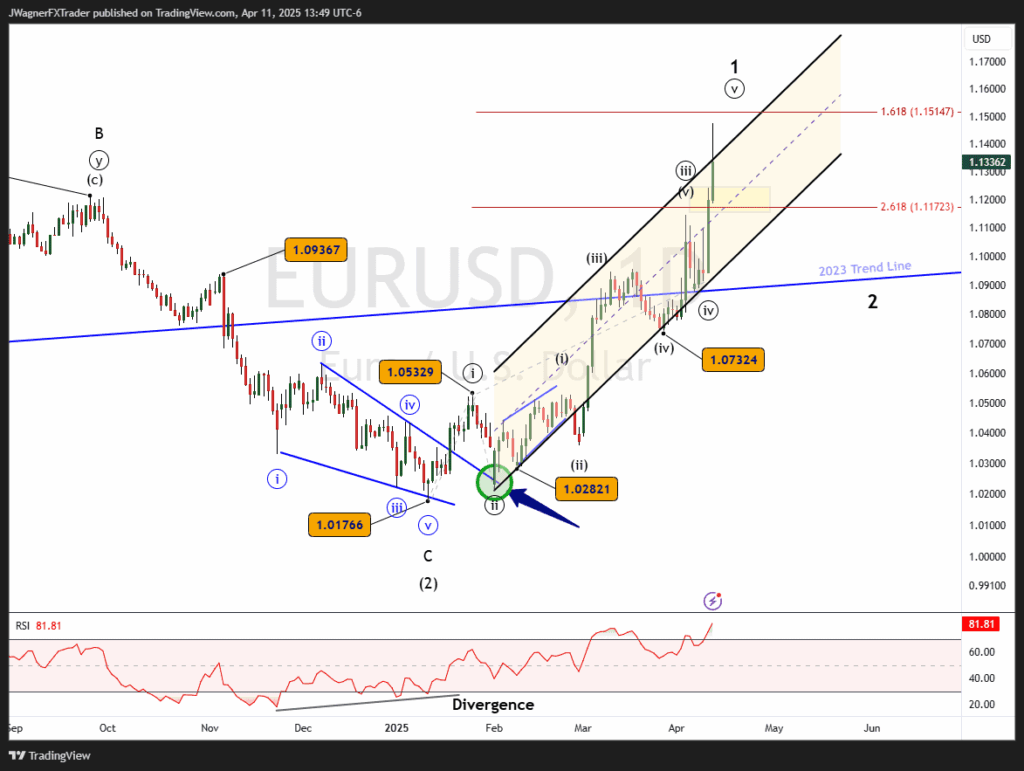

- The recent surge in EUR/USD was the latter stages of a first of a third wave advance.

- The trend remains up with a pull back offering a value trade.

- A decline to 1.07-1.11 would be considered normal, but not required.

Current Elliott Wave Analysis

Volatility wasn’t just for the equity markets. EUR/USD has been in a strong trend higher.

Our Elliott wave analysis suggests EUR/USD is in the latter stages of Minor Wave 1 of a larger third wave advance.

For those unfamiliar with Elliott wave, a third wave must subdivide as an impulse wave, in five subwaves. It appears EUR/USD is about to complete the first of those five subwaves. When this first subwave completes, then the biggest decline since January may appear.

The wave harmony has been in check during this rally.

We are counting wave ((iii)) complete with nearly a 2.618 Fibonacci Extension of wave ((i))..this is a common wave relationship.

Additionally, wave ((v)) would be 1.618 the length of wave ((i)) near 1.1515, another common extension.

It is possible that EUR/USD needs one more push to finalize wave ((v)) and wave 1. Therefore, a rally to 1.1515 would be considered normal, but may also signal a near-term top is looming.

Once the top in wave 1 is in place, then a decline down to 1.07-1.11 would be considered normal.

General Technical Analysis

We’ve been anticipating a strong and powerful rally from the lows. Our most recent writing “EURUSD Eyes the Prize” anticipated a wave ((iii)) topping near 1.12. That top appeared on April 3 at 1.1145.

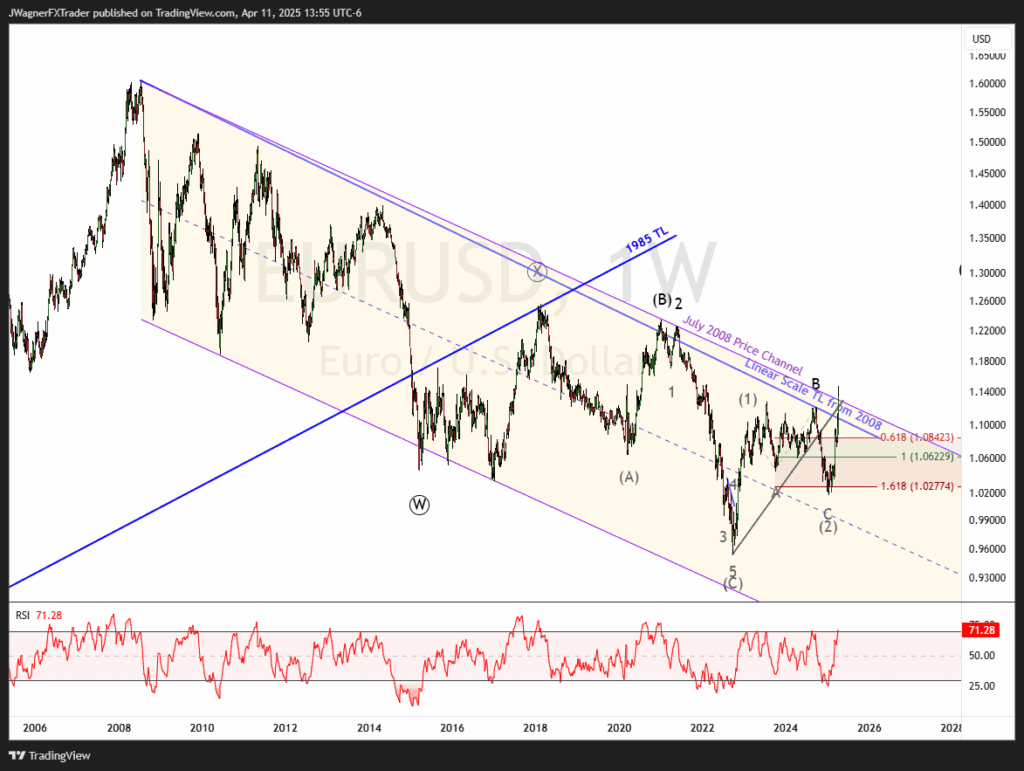

Zooming out, EURUSD is breaking long-term downtrend channels and resistance levels.

Here’s a Weekly price chart going back to 2008. There is a 17-year downward sloping price channel resistance that was broken this week. This is another major clue that the mood of the market is shifting from cyclical dollar strength to dollar weakness.

Bottom Line

The first wave of a five-wave advance is nearing its end. EUR/USD might rally a little higher to 1.1515. However, once this rally tops, then a minor wave ‘2’ decline back to 1.07-1.11 would be considered a normal pullback within a much larger uptrend.

Once wave 2 exhausts to the downside, the next wave 3 advance could carry up to 1.28-1.29.

You Might Be Interested In: