- Elliott Wave

- May 21, 2024

- 3min read

Bitcoin Elliott Wave: Favorable News From Regulators Lift BTC

Executive Summary

- Bitcoin rallied 7% late in the day on May 20

- Bitcoin appears to be in wave ((5)) of 3.

- This rally could carry up to 85-100k over the next few weeks

Why Did Bitcoin Rally Today?

Earlier today, industry insiders noted the SEC (the regulatory body for ETFs) reached out to ETF applicants seeking additional information. Though not guaranteed, this is viewed as a positive development towards Ethereum ETF approval.

An approval of an ETF towards crypto would open the door to inflows from big money investors. Clearly, Ether would be the big winner as it has rallied nearly 20% today. Other cryptos, like bitcoin, stand to benefit as well as the approval would be viewed as a positive development towards crypto from a regulatory perspective.

Please keep in mind, this news simply suggests the SEC has reached out for more information. This does not mean that the SEC has approved or will approve the ETH ETF.

Bitcoin already has ETF approval under its belt from January 2024.

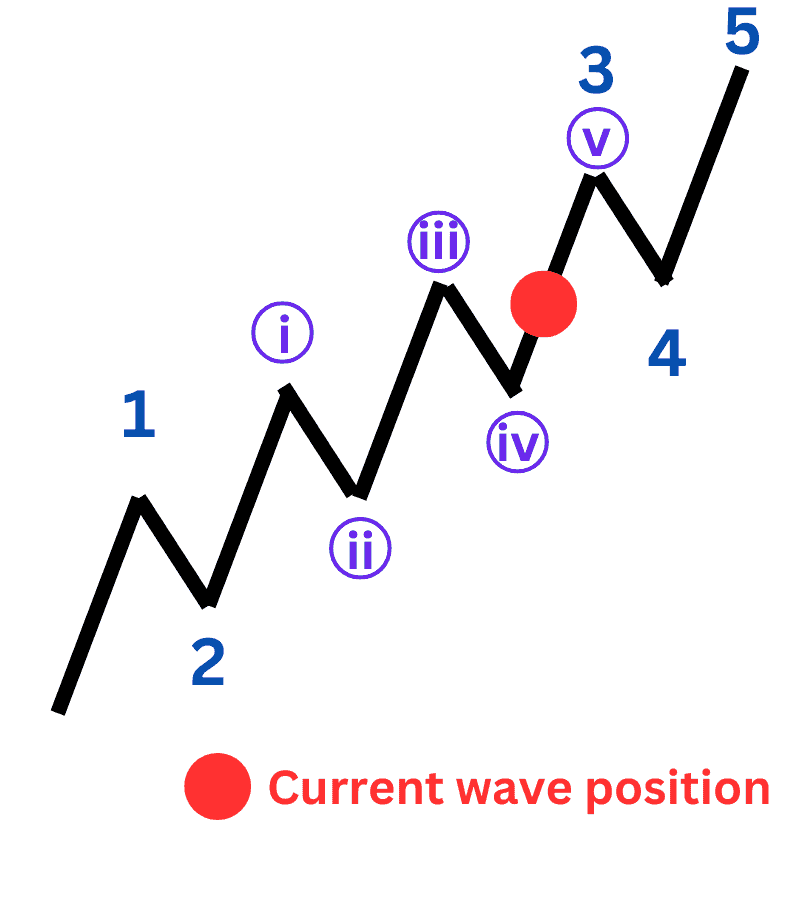

Current Bitcoin Elliott Wave Count

The current bitcoin Elliott wave count is wave ((v)) of 3, a bullish rally.

The low in May is best counted as wave ((iv)). This next rally is wave ((v)) of a larger Elliott wave sequence that could carry up to $85-100k.

The larger degree of trend is wave 3 and it began at the September 2023 low so this could end up as a 3x or 4x price rally from the low.

Once wave 3 has finished, then we anticipate a 20-40% correction that may carry the bitcoin price back to $55-80k.

Under the current Elliott wave count noted above, there is a cap of the rally up to $110k. We call it a cap, because if bitcoin rallied above $110k, that means our wave labeling is incorrect as wave ((iii)) would be the shortest of waves ((i)), ((iii)), and ((v)).

The Size of Price Corrections

Since the larger wave sequence began in November 2022, the corrections have all measured about the same distance at about 20%.

This can often be the case when you have an extended wave to the upside. It can become difficult to determine which waves belong to the larger degree of trend and which waves are with the smaller degree of trend.

Either way, the rally from September 2023 and from November 2022 are incomplete to the upside. The rally that began November 2022 still need a couple more punches higher.

If bitcoin prices are successful in pushing up to $85-100k, then the next correction will be a larger degree wave ‘4’. We can glean a forecast for wave ‘4’ based on the shape and depth of wave ‘2’. Wave ‘2’ was a sideways flat pattern. Wave ‘4’ could alternate and become a sharp and deep correction relative to wave ‘2’. Therefore, I would anticipate wave 4 to correct about 20-40% of the price high at wave ‘3’.

Bottom Line

Bitcoin appears to be rallying in wave ((iii)) of 5. This rally is forecasted to carry up to 85-100k.

If Bitcoin rallies higher than $110k or if it fails to make a new high above $73,757, then we’ll need to reassess the wave count.

Read More: Ethereum Price Searches for Support