- Elliott Wave

- March 31, 2025

- 2 min read

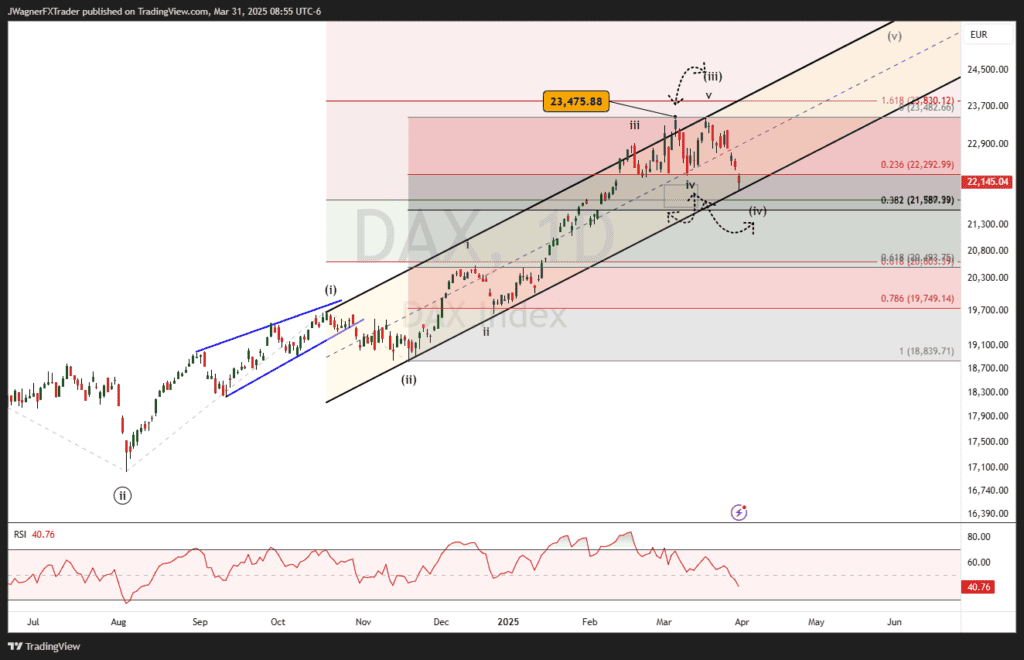

DAX Elliott Wave: In a Temporary Correction

Executive Summary

- Bullish Continuation: The DAX is in the latter stages of wave (iv) of 3.

- Key Support Levels: The bullish trend remains in place so long as prices remain above 21,000.

- Near-Term Outlook: A minor correction (wave iv) is nearing its completion but would lead to wave (v) up to new highs.

Current Elliott Wave Analysis

The DAX continues its relative outperformance when compared against its US counterparts. Though DAX has declined recently, this decline is viewed as part of Elliott wave (iv) of 3 of a five wave rally.

Therefore, this rally appears incomplete and the decline should prove to be temporary, if our analysis is correct.

The current wave (iv) decline may falter down to 21,500-21,600. It doesn’t have to, but the 38.2% Fibonacci retracement of wave (iii) sits in this zone. Please, a previous fourth wave at smaller degree of trend arrives in a similar area.

Lastly, the parallel of the wave (i)-(iii) highs crosses near current pricing. It is common for a fourth wave to touch and slightly overshoot this parallel.

As a result, the price extreme for wave (iv) of 3 may find a bottom within the next couple of days.

In the unanticipated event of a strong decline through 21,000, then we’ll need to reconsider the bullish wave count by sliding the ends of waves (iii) and (iv) one swing to the left. Also, a decline through 21,000 will force us to reconsider other wave counts that may bring a more immediate bearish forecast.

Bottom Line

The DAX uptrend remains intact, with the Elliott Wave structure pointing towards further upside. The current wave (iv) decline may find support near 21,500 – 21,600 leading to wave (v) up to new highs. The bullish bias remains valid as long as the index holds above 21,000.

You Might Be Interested In: