- Chart of the Day

- December 5, 2024

- 4 min read

USD/JPY Slides on BoJ Hawkish Hints; EUR/JPY Signals a Clear Bearish Break

The USD/JPY pair is slightly lower this morning as dovish Bank of Japan (BoJ) policymaker Toyoaki Nakamura hinted he’s not entirely opposed to a rate hike—a rare admission from a central bank historically wedded to ultra-loose monetary policy. This statement adds fuel to market speculation that the BoJ might tighten its monetary stance in the upcoming meeting. Expectations are building that October’s Japanese wage data, due tomorrow, could strengthen the case for a policy shift.

This comes against the backdrop of contrasting monetary policies globally, with the BoJ potentially tightening while other G10 central banks lean into easing. These dynamics have bolstered the yen, making it the standout performer in currency markets. The USD/JPY’s downside this morning reflects this sentiment, but EUR/JPY appears to be presenting a clearer bearish trend, backed by technical and fundamental factors.

Let’s dive deeper into the USD/JPY and EUR/JPY dynamics.

USD/JPY: Weighing BoJ’s Hawkish Hints and US Data Sensitivity

The USD/JPY is currently trading around the 150.10 level, reflecting mild weakness after Nakamura’s remarks. Market participants are grappling with the possibility of a rate hike from the BoJ, a scenario that has been largely unpriced in recent months. Tomorrow’s Japanese wage data could be pivotal—higher-than-expected wage growth would bolster inflation pressures, aligning with the BoJ’s desire for a sustainable inflation target above 2%.

However, the dollar’s outlook is not entirely bearish. The US Federal Reserve remains hawkish, and upcoming US Non-Farm Payrolls (NFP) data could provide a significant catalyst for the USD/JPY. A strong print would reinforce the Fed’s rate-hike bias, likely lifting the pair. On the flip side, if the NFP disappoints, the USD/JPY could see sharper weakness, given the yen’s resurgence as a safe-haven asset amidst geopolitical tensions and monetary tightening expectations in Japan.

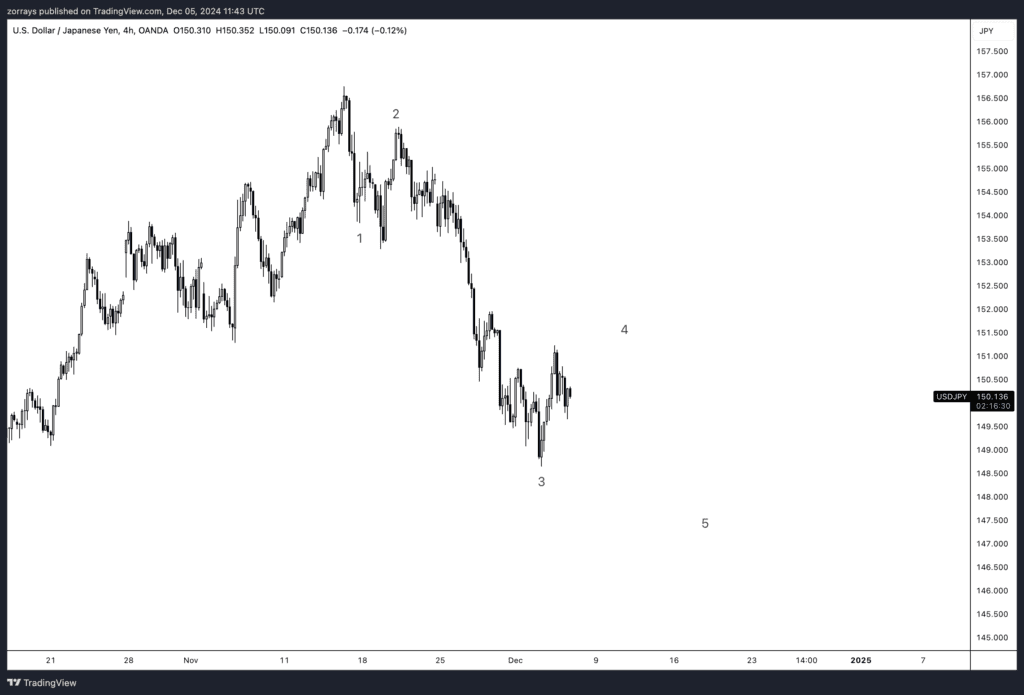

Technical Outlook for USD/JPY

The chart suggests that USD/JPY is currently in the fourth wave of a broader Elliott Wave correction, which could pave the way for a fifth wave lower toward the 148.00 region. Immediate resistance lies near the 150.50 level, while a break below 149.50 would confirm a bearish continuation.

While the medium-term outlook for the dollar remains bullish, short-term risks favor yen strength, especially with the BoJ rhetoric supporting tighter monetary policy.

EUR/JPY: Cleaner Bearish Trend Amid Divergent Policies

The EUR/JPY pair presents a clearer bearish trend compared to USD/JPY, underpinned by technical and fundamental forces. While the yen is gaining strength from hawkish BoJ speculation, the euro faces headwinds from ongoing monetary easing by the European Central Bank (ECB). This divergence sets the stage for continued downside in EUR/JPY.

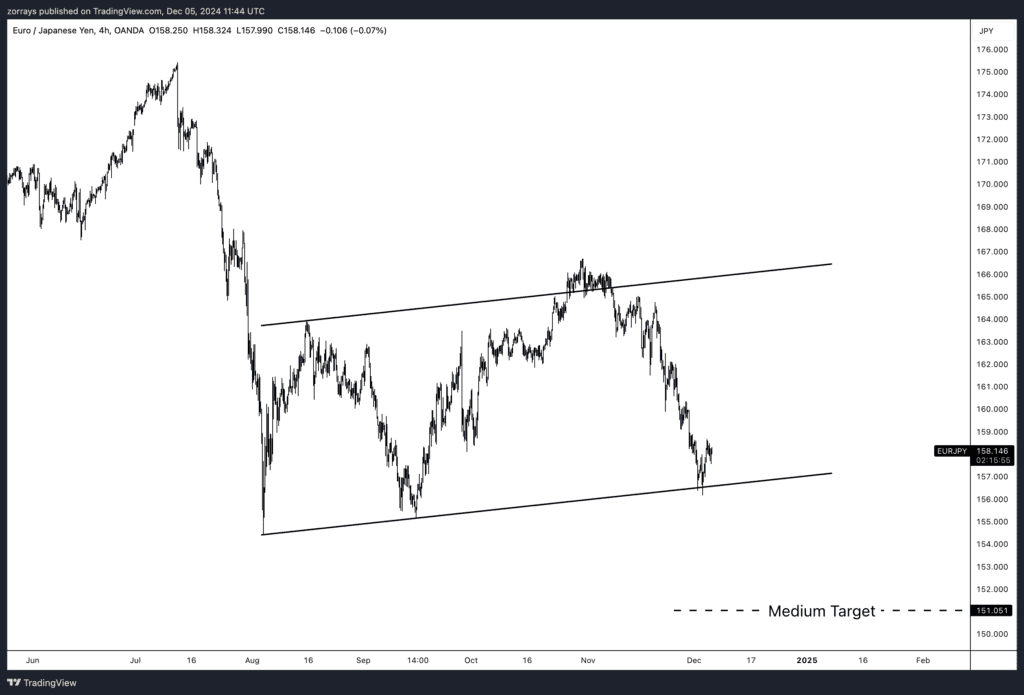

Technical Analysis for EUR/JPY

The EUR/JPY pair is trading near the 158.10 level, testing the lower boundary of a well-defined ascending channel. If the pair breaks below 157.00, it could target the medium-term support level of 151.00, as outlined in the first chart. This would confirm the bearish breakout and signal further downside momentum.

The recent decline aligns with broader market sentiment favoring the yen, as well as safe-haven flows into Japan amid geopolitical uncertainty in East Asia, including events in Korea. The medium-term target near 151.00 looks achievable if the BoJ signals a firmer commitment to tightening.

Fundamental Drivers for Yen Strength

The yen’s resurgence against both the dollar and the euro is driven by three key factors:

- BoJ Policy Shift Speculation: Toyoaki Nakamura’s remarks highlight the possibility of a policy pivot. If wage data tomorrow supports inflationary pressures, the BoJ may take a more hawkish stance, a stark contrast to the ECB’s dovish approach.

- Geopolitical Risks: Escalating tensions in East Asia, particularly on the Korean Peninsula, have added a layer of safe-haven demand for the yen. This has amplified the bearish outlook for EUR/JPY.

- Contrasting Monetary Policies Globally: With easing policies underway in Europe and potential tightening in Japan, the euro-yen trade offers a cleaner divergence, making EUR/JPY an attractive bearish play.

Conclusion: Navigating USD/JPY and EUR/JPY Trends

While we remain structurally bullish on the dollar, the short-term risks tilt in favor of yen strength. Tomorrow’s Japanese wage data and US NFP figures will be critical in shaping the USD/JPY’s trajectory. A weaker-than-expected NFP print could amplify dollar weakness against the yen, driving USD/JPY lower.

On the other hand, EUR/JPY stands out as the cleaner bearish trade. The technical setup, combined with a growing policy divergence between the BoJ and ECB, points to a potential move toward the medium-term target of 151.00.

Traders should closely watch tomorrow’s key data releases and remain nimble in positioning, as these catalysts could set the tone for yen crosses heading into 2025.