- Chart of the Day

- November 12, 2024

- 3 min read

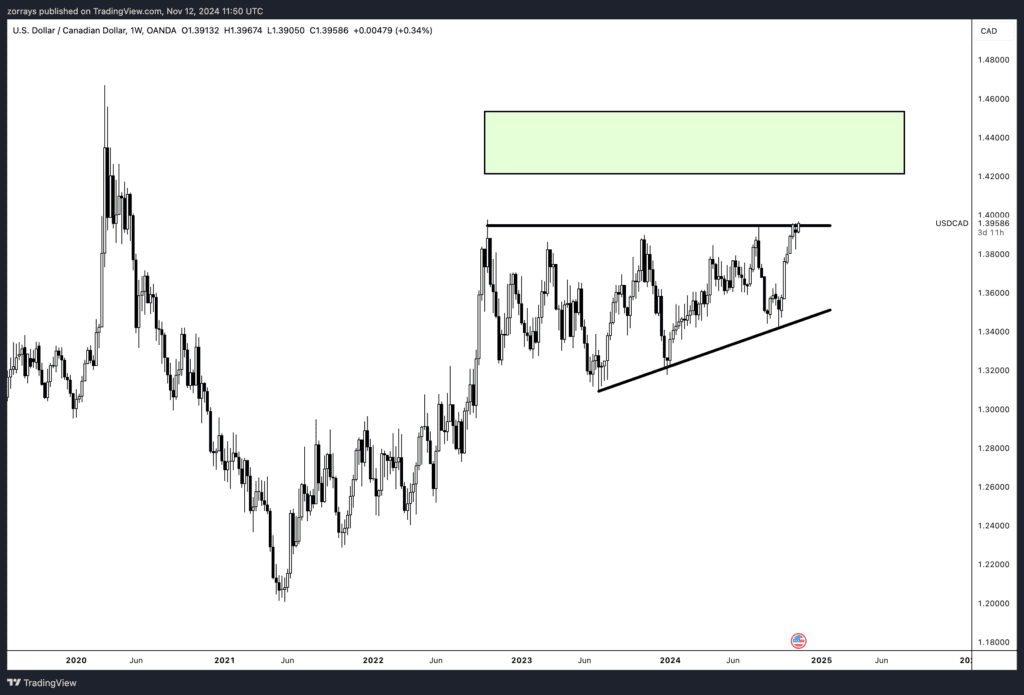

USD/CAD Breaks Out of Ascending Triangle – Eyes on 1.4350 Target

USD/CAD has officially broken out of an ascending triangle pattern, setting the stage for a potential rally towards the 1.4350 level. The recent technical breakout aligns well with the macroeconomic backdrop, as both technical and fundamental forces converge to support USD strength against a weakening CAD. Let’s take a closer look at why this setup could have staying power.

Technical Setup: Ascending Triangle Breakout

The weekly chart shows USD/CAD forming an ascending triangle since early 2022, with a steady pattern of higher lows. This classic bullish pattern often indicates a continuation of an upward trend. The breakout above the triangle’s resistance level at around 1.3950 is a significant move, suggesting strong upward momentum for USD/CAD. With no immediate resistance overhead, the next technical target lies around the 1.4350 zone, which also aligns with historical levels from early 2020.

Fundamentals Favoring USD Strength Over CAD

Several key factors are bolstering USD while pressuring CAD, particularly through the oil market:

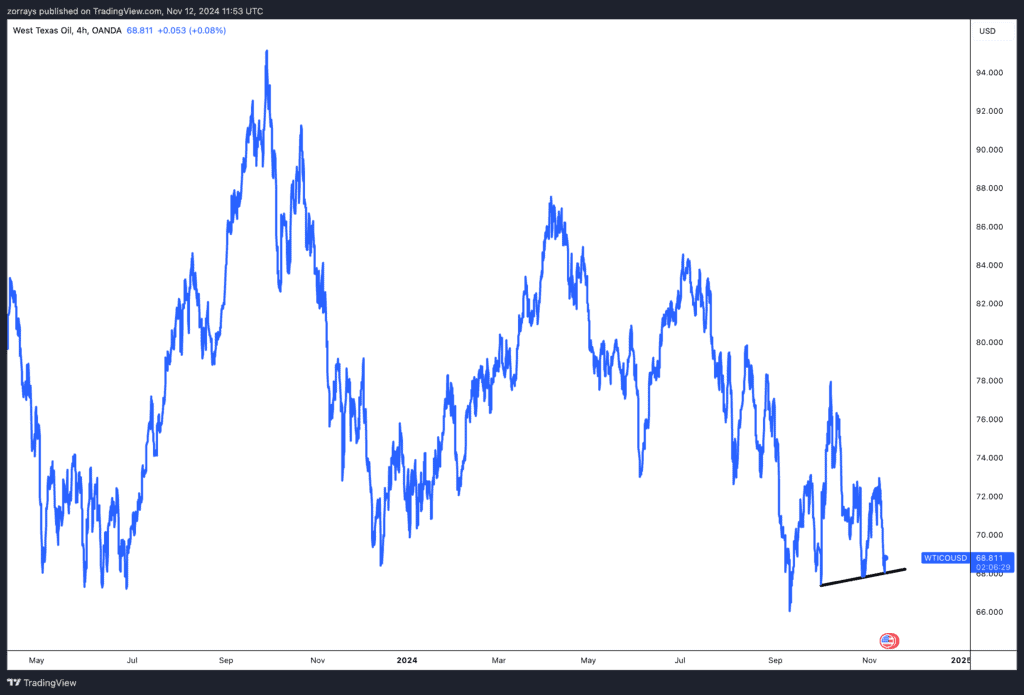

- Oil Price Weakness: Oil, Canada’s main export, continues to face downward pressure. ICE Brent prices dropped by 2.8%, closing below $72/bbl yesterday. This decline is driven by signs of oversupply, as prompt time spreads for Brent and WTI have shifted towards contango – a condition that indicates a well-supplied market. With OPEC+ expected to ease production cuts, the global oil balance looks increasingly tilted towards a surplus through 2025. For CAD, falling oil prices reduce demand, putting additional downward pressure on the currency.

- Emerging USD Bull Trend: The U.S. dollar has gained momentum, bolstered by optimism surrounding a potentially business-friendly Republican-led government. The FX options market is starting to show signs of increased volatility as traders position for a stronger dollar. Additionally, U.S. equity markets are pushing higher, which could signal renewed confidence in the U.S. economic outlook.

- Market Expectations of Demand Revisions from OPEC: Today’s release of OPEC’s monthly oil market report could bring further downward revisions to oil demand forecasts. OPEC recently cut demand growth expectations by 110k b/d for 2024 and 100k b/d for 2025. With other analysts expecting slower demand growth, OPEC’s figures may eventually align closer to consensus, potentially placing even more pressure on oil prices and, by extension, the Canadian dollar.

Long-Term Target: 1.4350

With both technical and fundamental factors aligning, the breakout appears robust, and the 1.4350 level seems within reach. USD/CAD is likely to continue benefiting from USD strength and CAD weakness, particularly if oil prices remain soft and market confidence in the U.S. economy stays high.

In summary, the breakout from this ascending triangle pattern, coupled with bearish oil fundamentals and USD strength, provides a compelling case for further upside in USD/CAD.