- Chart of the Day

- September 4, 2024

- 2 min read

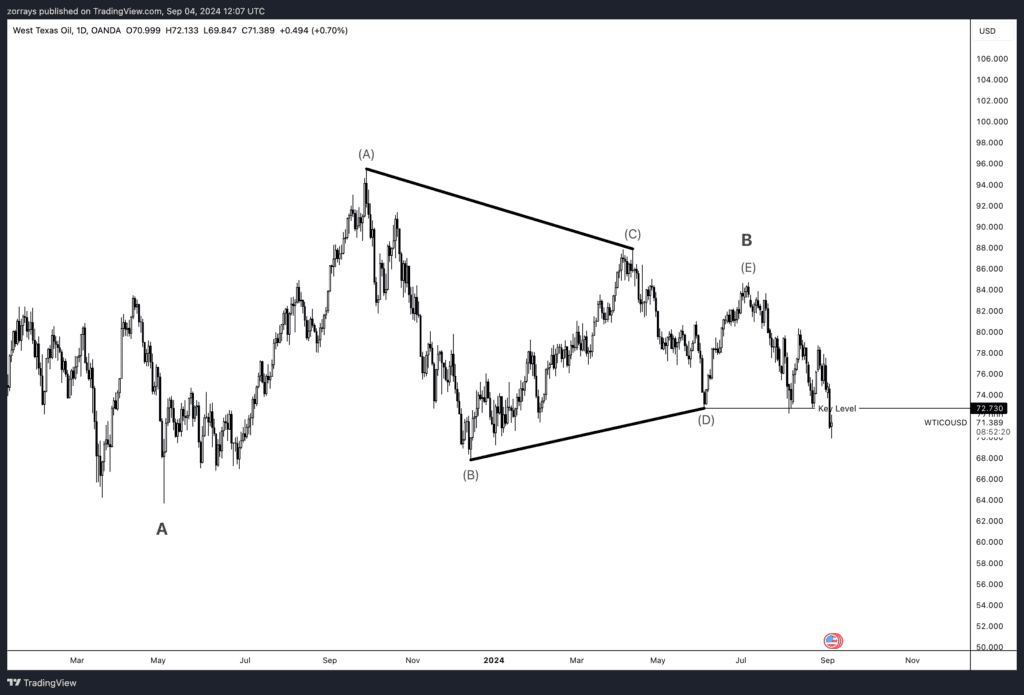

US Oil – Sell-off Due to Libyan Supply

US Oil has recently faced significant pressure, with prices experiencing a sharp decline. The primary driver behind this sell-off has been the unexpected surge in Libyan oil supply hitting the market. Libya’s National Oil Corporation announced an increase in production, which has heightened concerns of an oversupply at a time when global demand remains tepid. This development, combined with broader economic factors, has contributed to the recent downward movement in oil prices.

Technical Analysis Breakdown: Bearish Triangle in Play

On August 13th, 2024, I posted an analysis highlighting a bearish triangle formation on US Oil, warning that a potential breakdown was on the horizon. At that time, I believed the pattern would break lower, largely due to worsening economic conditions. Despite some countries like the U.S. and Canada attempting to stabilise their economies, global growth remained uncertain, amplifying the bearish outlook for oil.

Fast forward to today, and we can see the price action confirming this bearish outlook. WTI has broken through Wave D of the triangle, indicating a stronger move downwards. The price action is now moving into Wave C on a higher degree, signaling that the market is adjusting to this new supply glut from Libya, which is exacerbating the already fragile economic environment.

The bearish breakout confirms the technical structure and aligns with the recent fundamental pressures, making this a critical time for traders to watch further developments in the oil market.

Stay tuned for more updates as the global oil market continues to react to both fundamental and technical forces driving prices.