- Chart of the Day

- August 7, 2024

- 2 min read

The Dollar and Equities Market Post-Panic

Japanese equities experienced a continued rebound this morning, and futures indicate a positive opening for US and European equities. Notably, European markets have been slower to recover. Despite this optimism, there is a sense of caution around substantial risk-on rallies ahead of the crucial US CPI data release next Wednesday. The recent market stabilisation following significant corrections should allow most FX pairs to realign with rate spreads and underlying fundamentals.

Safe-haven currencies such as the Japanese yen and Swiss franc remain somewhat vulnerable in the near term. It is widely believed that most speculative shorts on the yen have been reduced, possibly bringing the net positioning in USD/JPY close to flat. This positions the yen to trade more in response to rates and global risk sentiment. Additionally, Bank of Japan Deputy Governor Shinichi Uchida’s commitment to avoid rate hikes if markets are unstable could lead to further yen weakness. There is a possibility that USD/JPY could test the 150 mark before the release of next week’s US CPI data.

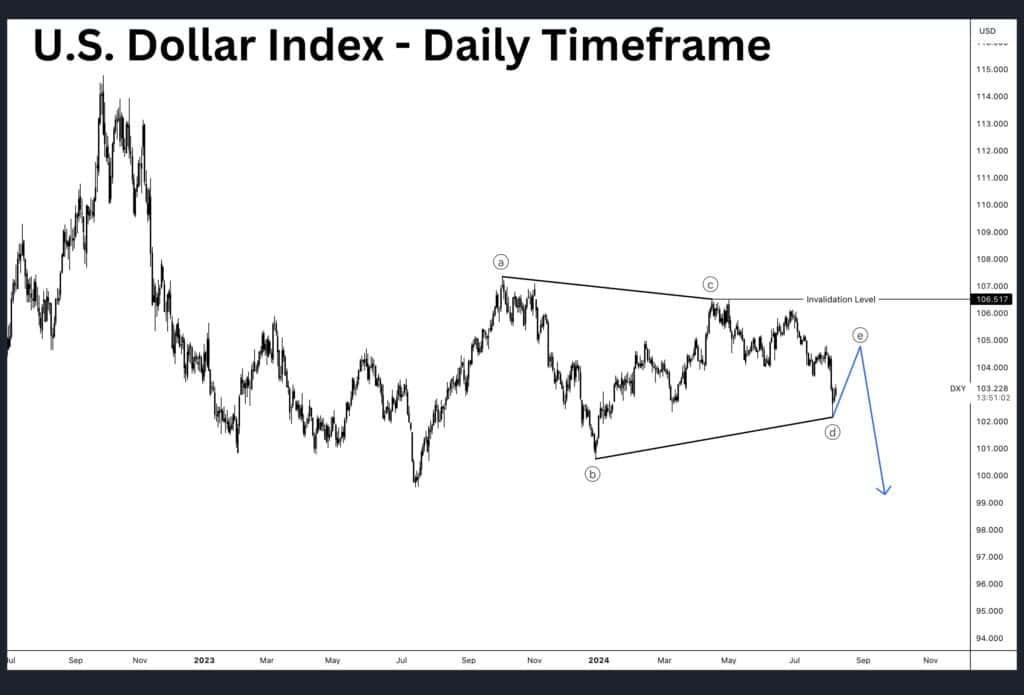

Dollar Index – Elliott suggests a downward trend

The overall trend for the U.S. Dollar Index is downwards, but in the short term, we can expect a pullback into wave E. The invalidation level is at the extreme of wave C. Once wave E completes, this triangle pattern will be triggered by a break below wave D, resuming the downward trend.

USD/JPY – Time for a rebound?

The USD/JPY is slowly retracing back into the golden zone of the 38.2% to 61.8% Fibonacci region. We will see how the price corrects in this area, which most likely signals a continuation to the downside, but time will tell.