- Chart of the Day

- August 19, 2024

- 2 min read

Tasman Sea Tussle: AUD/NZD’s Potential to Shine

The AUD/NZD pair is currently presenting an interesting opportunity for traders, particularly those eyeing carry trade strategies. As the Reserve Bank of New Zealand (RBNZ) adopts a dovish stance, focusing on economic stability rather than aggressively fighting inflation, the Reserve Bank of Australia (RBA) is still actively working to control inflation. This divergence in monetary policy strategies makes AUD/NZD a potentially lucrative trade in the medium term.

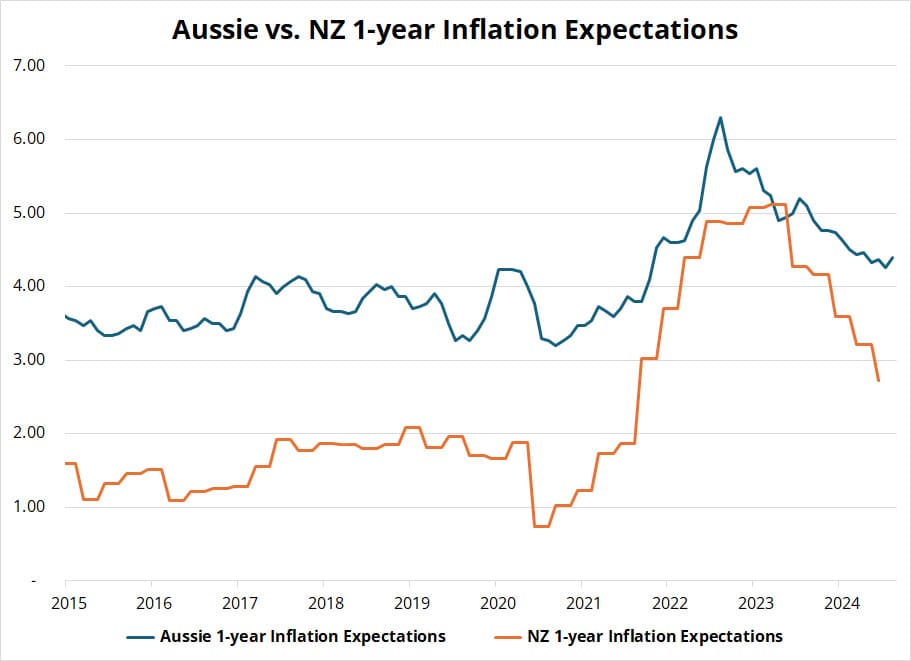

Inflation Expectations and Central Bank Policies

Looking at the inflation expectations chart, it’s clear that New Zealand’s inflation expectations have been on a significant downward trend, reflecting the RBNZ’s more relaxed approach. The RBA, on the other hand, continues to wrestle with higher inflation, indicating that the bank might be more inclined to keep rates higher for longer.

This difference in inflation targets and deadlines means that while Australia’s interest rate is currently lower than New Zealand’s, the market, which is forward-looking, could start pricing in Australia’s future rate hikes more aggressively. This shift in market sentiment can make the AUD more attractive, especially as traders anticipate a narrowing of the interest rate differential.

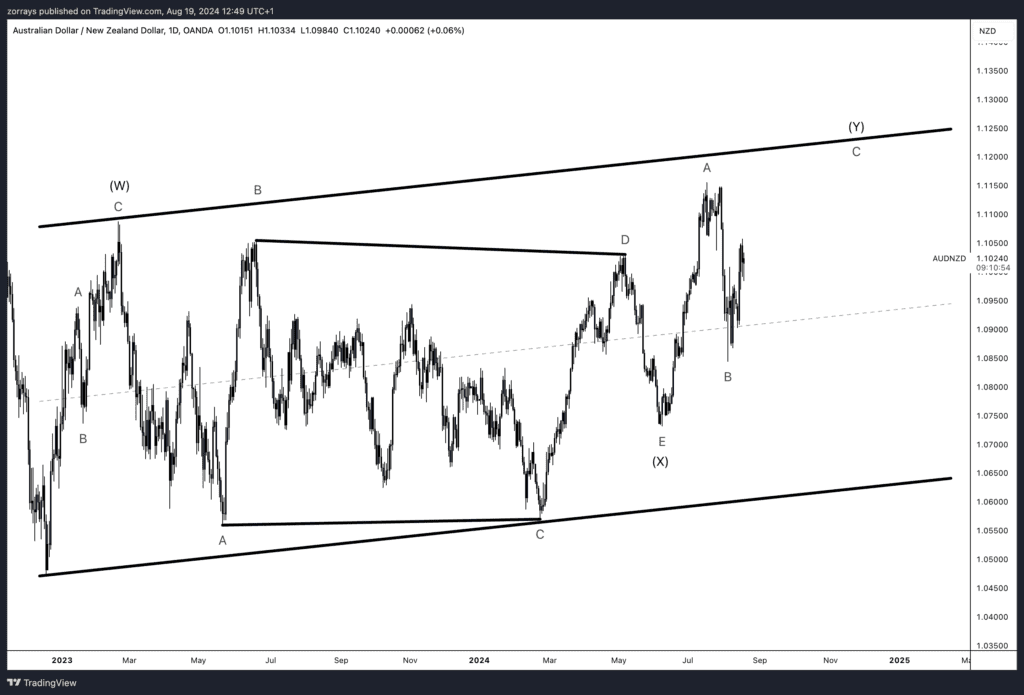

Technical Analysis: Elliott Wave and Channel Dynamics

Turning to the technical side, the AUD/NZD pair is currently forming an Elliott Wave double zig-zag pattern. In this context, Wave X is playing out as a triangle, which often serves as a continuation pattern.

The pair is approaching key resistance around the 1.1150 level, a significant point that coincides with the upper boundary of an ascending channel. Should AUD/NZD break through this resistance, it could propel the pair into the upper regions of this channel, suggesting further upside potential.

Conclusion: A Promising Setup for the Medium Term

Given the fundamental backdrop of diverging central bank policies and the technical indicators, AUD/NZD appears to be a promising carry trade candidate. The RBA’s continued focus on inflation control may well translate into a stronger AUD in the medium term, despite the current lower interest rates compared to the RBNZ. Coupled with the potential technical breakout, this setup warrants close attention from traders looking to capitalize on medium-term trends.