- Chart of the Day

- April 29, 2025

- 2min read

Palantir Leads Stock Market Recovery, Amid Weak S&P 500 Breadth

Within the last 2 weeks, AI Company Palantir (PLTR) has made a recovery of over 73% amid the SPX’s correction of only 13%, showing its incredible strength and status as the current market leader.

Currently, the Daily RSI is overbought, but there no bearish divergences, and volume shows a gradual decline suggesting slow and steady buying – but no overall weakness in PLTR.

Traders can wait for a long trade if price revisits the Value Area High at ~$99, or wait for a rejection at the All Time High at ~$125.40, or even a large volume spike to indicate a strong bearish injection, or long squeeze opportunity if a green candle forms at the highs and not at a pullback.

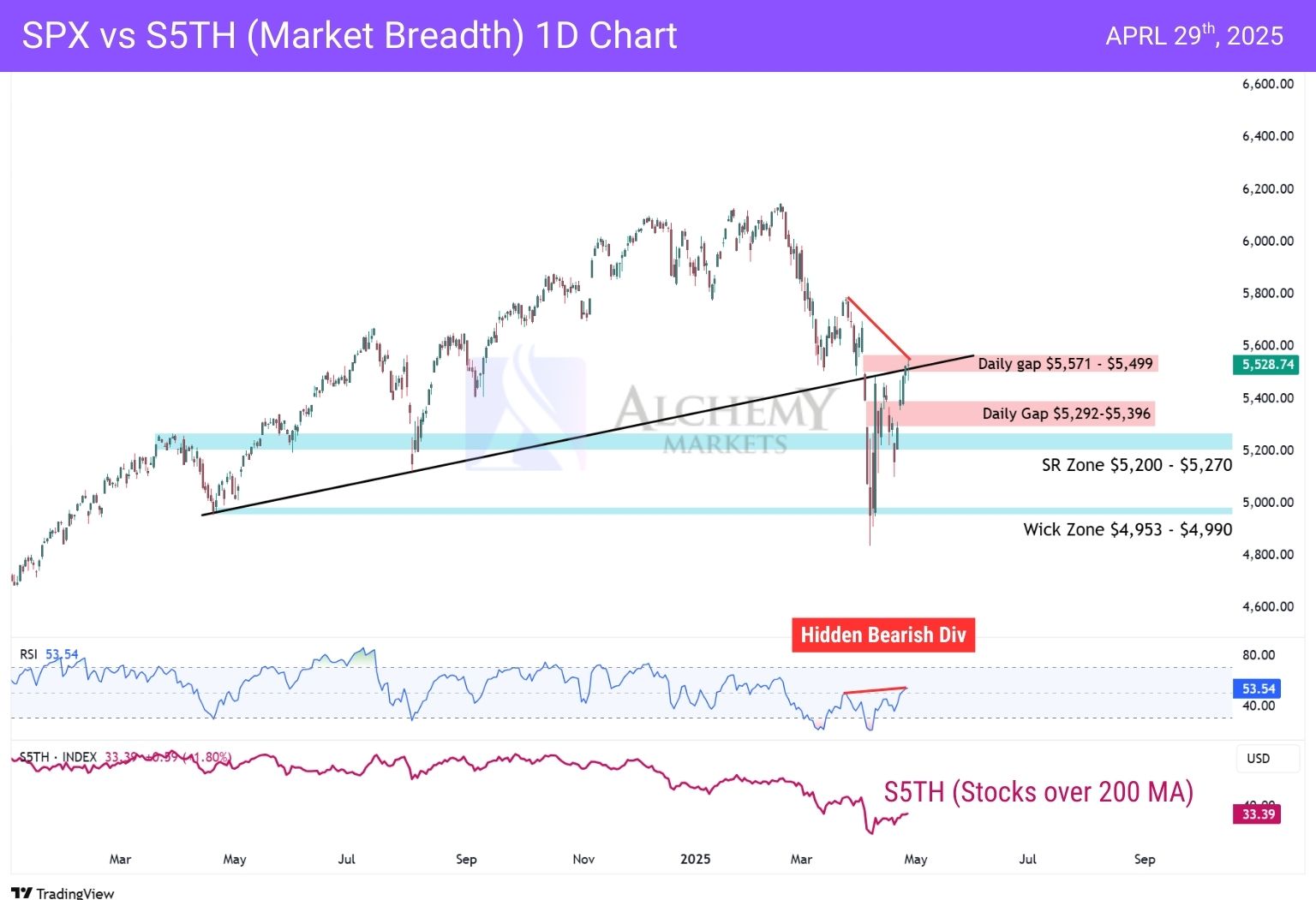

This rise comes amidst weak market breadth in the S&P 500, as indicated by the S5TH Chart (Stocks above the 200 Moving Average) seen below.

SPX itself is also at a resistance zone ($5,499-$5,571) formed by a gap down on the daily timeframe, with added pressure from a Hidden Bearish Divergence.

So, while Palantir may continue outperforming in the near term, traders should stay cautious if SPX fails to reclaim the gap resistance zone ($5,571). A sharp rejection here—especially alongside sustained weak market breadth (S5TH)—may trigger sector-wide pullbacks, including in AI stocks like PLTR.

Consider setting alerts near $125.40 and monitoring volume spikes or RSI reversals for early warning signs of exhaustion.

🧠 Pro Tip: Combine SPX’s resistance reaction with PLTR’s intraday order flow for a sharper read on whether this strength can persist—or if it’s time to lock in gains.

You may also be interested in: