- Chart of the Day

- June 16, 2025

- 2 min read

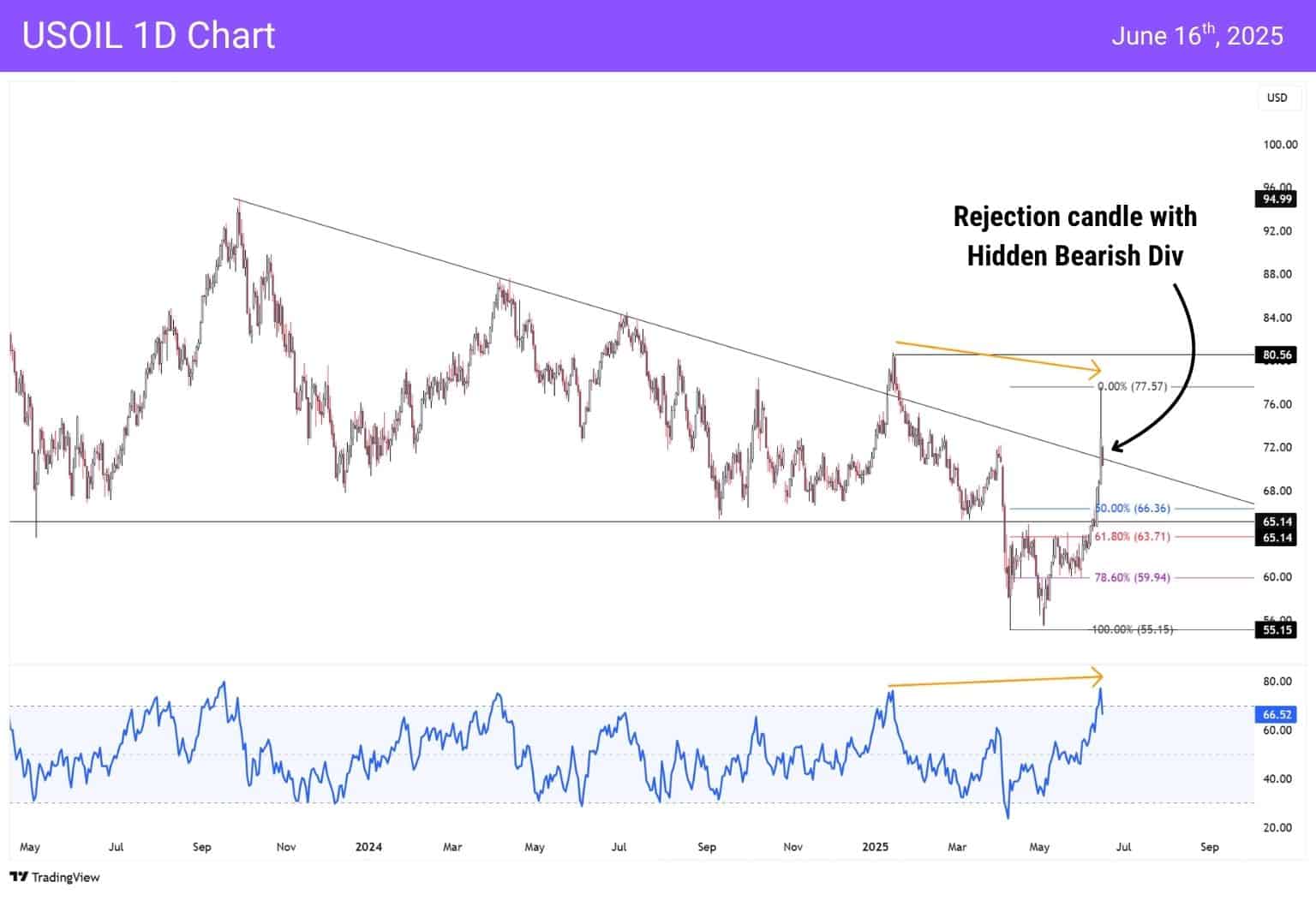

Surge Over For Now? Oil Find Resistance at Descending Trendline

Crude oil’s rally may have hit a ceiling — at least for now. After surging past $77, USOIL tagged a long-term descending trendline, printed a sharp rejection candle, and showed hidden bearish divergence on the RSI. Technically, this signals a potential pullback, especially with price stalling at the 78.6% Fibonacci retracement and a prior swing high.

This reaction suggests that much of the geopolitical risk — particularly around Iran and the Strait of Hormuz — may already be priced in. However, with Middle East tensions still simmering, traders should be prepared for an alternative scenario: any fresh escalation could quickly flip this setup back into a bullish continuation.

🔍 Base Case: Technical Rejection in Play

- Hidden Bearish Divergence: While price made a lower high, RSI formed a higher high — a classic setup suggesting weakening momentum.

- Trendline Resistance: The descending resistance from the 2022 high capped this move cleanly, reinforcing the downtrend’s grip.

If bears remain in control, downside targets include:

- $73.80 (structure support)

- $66.36 (50% retracement)

- $63.71 (Golden Pocket)

⚠️ Alternative Scenario: Geopolitics Take the Wheel

Despite the rejection, oil markets remain fragile.

- The Strait of Hormuz is reportedly closed off, cutting off a crucial artery for 20%+ of the world’s crude flows. If confirmed, this could add severe supply-side pressure.

- Iran–Israel tensions remain unresolved. Any attack on energy infrastructure or tanker routes could trigger another leg higher, especially with inventories tight and OPEC+ supply cuts still in play.

Should this narrative take over, bulls could retarget:

- $80.00 (closest previous high)

- $84.00 – $86.00 (previous highs)

- $94.99 (2023 high)

🧭 Final Word

Technicals suggest the surge may be over, at least short-term. But with geopolitics in flux and the Strait of Hormuz at risk, this market remains highly reactive. Traders should stay nimble — price may be rejecting now, but any flare-up could send oil soaring again.

You may also be interested: