- Chart of the Day

- August 29, 2024

- 5 min read

NVIDIA’s Growth Story: What’s Next for the AI Giant?

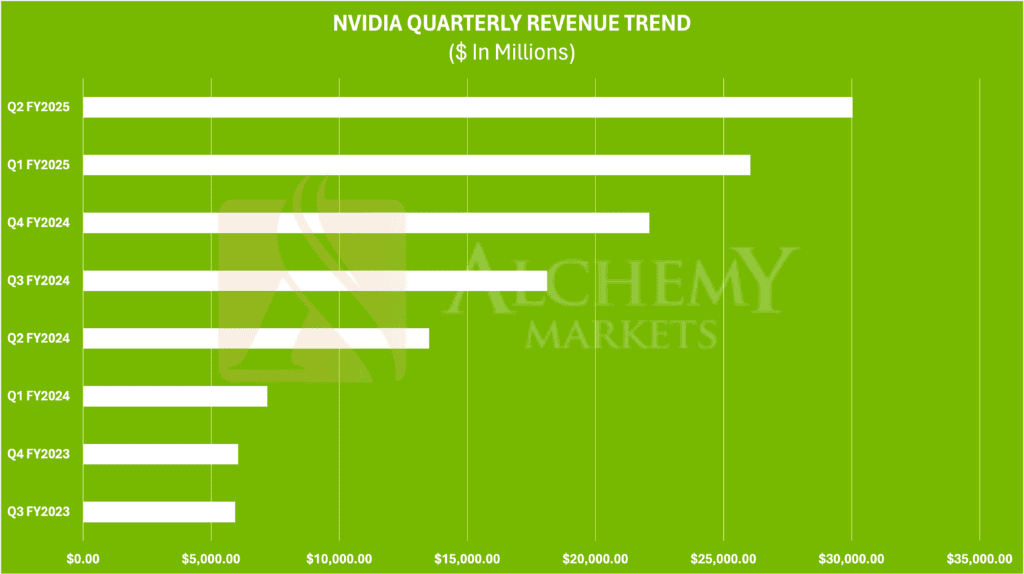

NVIDIA has been the darling of the tech world, riding the wave of AI and data centre demand to achieve record-breaking revenues. In its recent Q2 FY2025 earnings, NVIDIA reported an impressive $30.0 billion in revenue, a staggering 122% increase from the previous year. But as the dust settles, investors are beginning to ask: What’s next for this tech titan?

NVIDIA’s Recent Performance: A Closer Look

Data source: NVIDIA

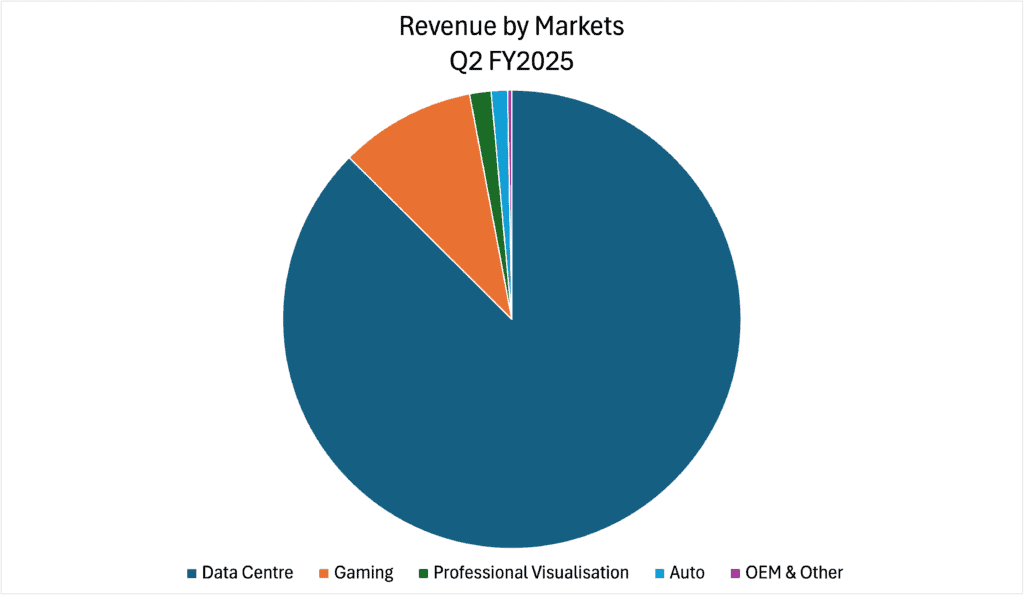

NVIDIA’s Q2 FY2025 results were nothing short of spectacular. The company’s data centre segment was the star of the show, bringing in $26.3 billion—a 16% increase from the previous quarter. This growth is fuelled by NVIDIA’s dominance in AI and accelerated computing, which are becoming increasingly vital across various industries.

The gaming segment also held its own, with $2.9 billion in revenue, reflecting a 9% sequential increase. Meanwhile, NVIDIA’s automotive division, though smaller, showed promise with a 37% year-over-year growth, generating $346 million as it pushes further into autonomous driving technology.

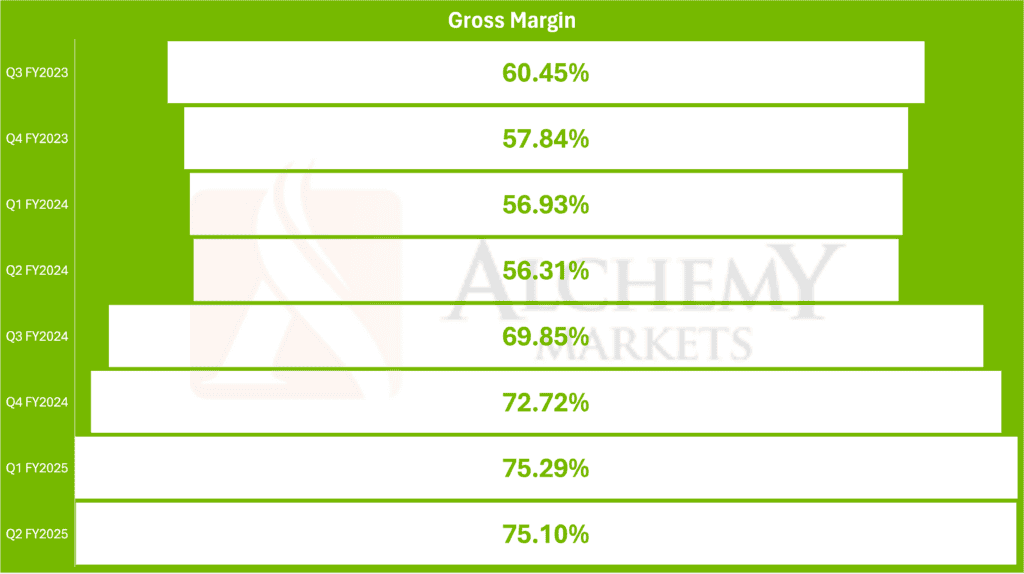

Data source: NVIDIA

However, it wasn’t all smooth sailing. NVIDIA’s gross margin, a critical measure of profitability, dipped slightly from 78.4% in Q1 FY2025 to 75.1% in Q2. While this decline isn’t drastic, it hints at rising costs—possibly from increased material expenses—that could impact future profitability if not managed carefully.

The Road Ahead: What to Expect in Q3 and Beyond

Data source: NVIDIA

Looking forward, NVIDIA has projected revenue of approximately $32.5 billion for Q3 FY2025. While this indicates continued growth, the pace appears to be slowing. After the explosive revenue increases we’ve seen, this more modest projection suggests that NVIDIA might be transitioning to a phase where maintaining rapid growth becomes more challenging.

The company expects its gross margins to stabilise around 74.4%-75.0% in the upcoming quarter. This stabilisation is crucial, as consistent profitability will be key to justifying NVIDIA’s high valuation.

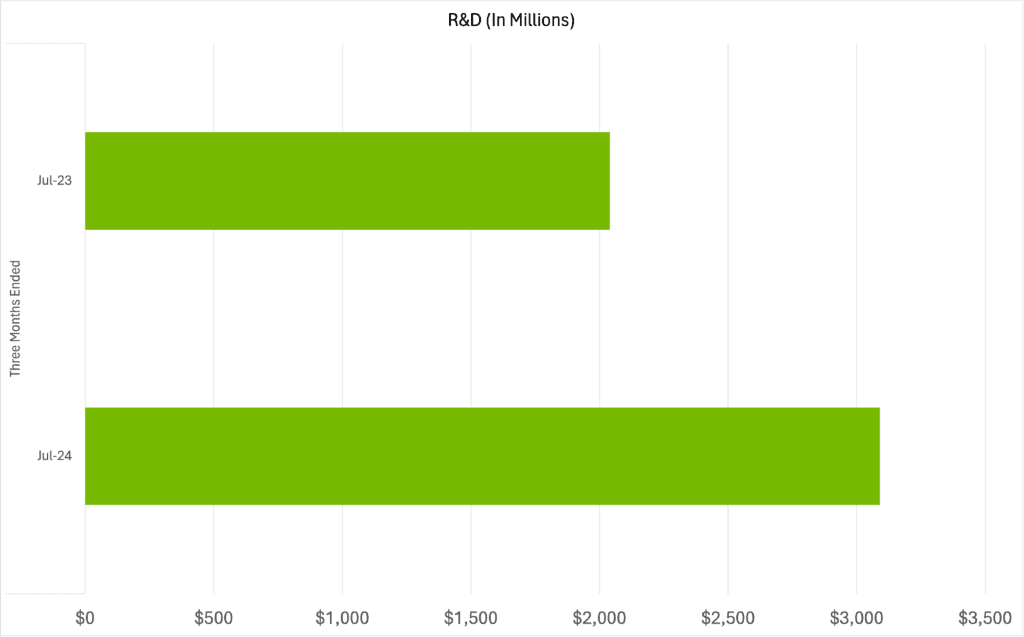

Despite these concerns, NVIDIA remains confident in its future. CEO Jensen Huang emphasized the company’s leadership in AI and data centers, which he believes will continue to drive innovation and growth. NVIDIA is also making significant investments in R&D, spending over $3 billion in Q2 alone, ensuring it stays ahead of the curve in these rapidly evolving markets.

Potential Challenges on the Horizon

As NVIDIA continues to dominate in AI and data centers, the big question is: Can it keep up this momentum? The company’s future growth will likely depend on several factors:

- Managing Costs: The slight dip in gross margin raises questions about how well NVIDIA can manage rising costs, particularly in a competitive and cost-sensitive industry.

- Maintaining Innovation: To sustain its leadership, NVIDIA must continue to innovate, particularly as competition in AI and data centers intensifies.

- Expanding into New Markets: While data centres are booming, NVIDIA will need to explore new markets and technologies, like autonomous driving and robotics, to maintain its growth trajectory.

Market Sentiment and Investor Expectations

NVIDIA’s rapid ascent in the tech world has been driven by strong investor enthusiasm, which often propels stock prices beyond just the company’s current performance, reflecting optimistic future growth expectations. As the company consistently delivers impressive results, the market’s expectations grow even higher, creating a feedback loop where strong financials fuel rising stock prices and vice versa. However, when signs of slowing growth emerge—such as a slight dip in gross margins or a more modest revenue projection—investors might start to question whether the high valuation is still justified, leading to potential volatility as the market adjusts its outlook.

Navigating this environment requires NVIDIA to not only continue its technological innovations but also to manage investor expectations effectively. If the company can sustain its growth while convincing the market of new opportunities, it may maintain its leadership position and justify its high valuation. However, any perceived slowdown could trigger a re-evaluation, leading to shifts in market sentiment and price fluctuations as the stock seeks a new equilibrium.

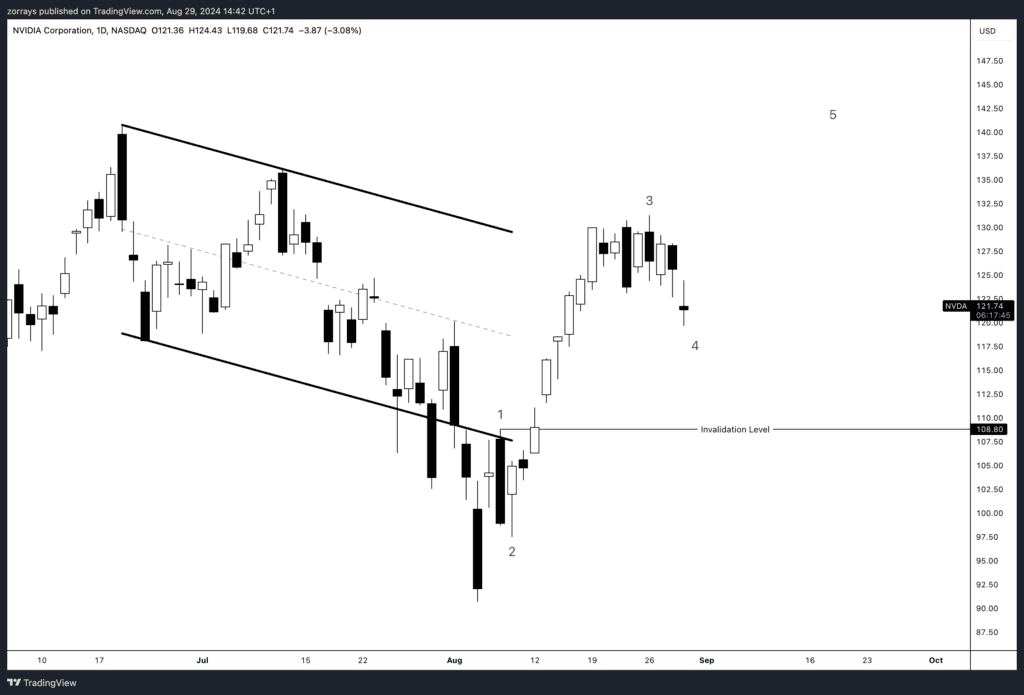

Technical Analysis: NVDA’s Bullish Continuation with Caution

The current chart for NVIDIA (NVDA) suggests that the stock is still in a bullish phase, despite the recent pullback. We appear to be in the midst of a corrective wave, likely Wave 4, within a broader five-wave Elliott Wave structure. The invalidation level for this bullish scenario is at $108.80. As long as the price stays above this level, the bullish outlook remains intact.

The stock is likely gearing up for a Wave 5 move to the upside, which could take NVDA to new highs. However, traders should be cautious once Wave 5 completes, as this would potentially set the stage for a larger correction, corresponding to a Wave 2 on a higher degree. This suggests that while the short-term outlook remains bullish, a more significant pullback may be on the horizon after the next leg up.

Final Thoughts

NVIDIA’s growth story is far from over, but the next chapter might look different from the rapid ascent we’ve seen so far. With revenue growth expected to slow slightly, the company is at a crucial juncture where maintaining its leadership will require smart strategies and continued innovation.

As NVIDIA navigates these challenges, it’s poised to remain a key player in the tech industry. However, investors should watch closely for how the company manages costs and adapts to a market where rapid growth might be harder to come by.