- Chart of the Day

- May 29, 2025

- 3min read

U.S. Dollar Index (DXY) Analysis: Rally May Be Short-Lived Amid Legal Setback on Tariffs

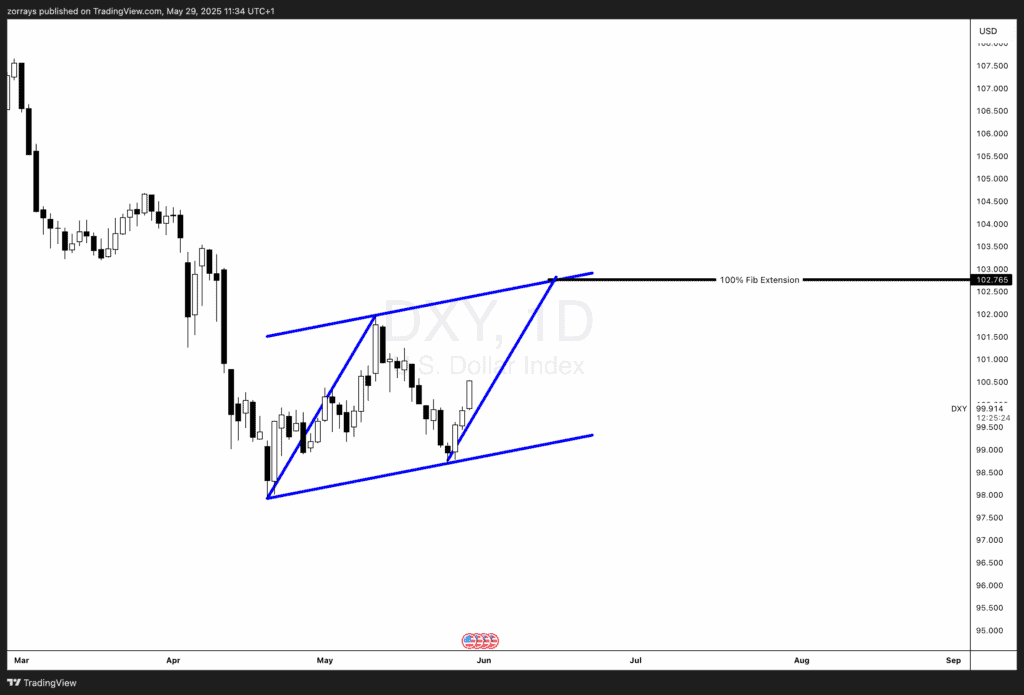

The U.S. Dollar Index (DXY) has shown an impressive rally in recent sessions, bouncing sharply from its lower channel support and currently approaching the upper boundary of a clearly defined ascending channel. While this upward movement may give the appearance of a renewed bullish trend, deeper fundamental and technical analysis suggests that this surge might be short-lived.

Legal Setback on Trump-Era Tariffs: A Dollar Headwind

Recent developments in U.S. trade policy have cast a shadow over the Dollar’s medium-term outlook. In a landmark decision, U.S. courts have moved to block several of the tariffs originally imposed during former President Donald Trump’s administration on Chinese goods. These tariffs, initially enacted to curb Chinese imports and strengthen U.S. manufacturing, have now been deemed procedurally flawed by the judiciary.

The implications of this legal decision are significant:

- Reduced Trade Tensions: A rollback or invalidation of tariffs could lower import costs and potentially ease inflationary pressures.

- Weaker Dollar Outlook: As risk sentiment improves and trade normalises, the Dollar may lose its safe-haven bid, leading to a broader depreciation.

This fundamental backdrop supports the idea that the current DXY rally may not be sustainable in the longer term.

Technical Perspective: DXY Approaches Channel Resistance

From a technical standpoint, the DXY is currently testing the upper bound of a rising channel structure that has held well throughout May. This channel has effectively defined the Dollar’s corrective rebound following months of downward pressure.

Key observations:

- Price Rejection Zone: The upper boundary of the channel is a known resistance zone, where previous attempts have failed.

- Larger Trend Remains Bearish: Despite the rally, the broader trend from March remains to the downside.

- Overextension Risk: The recent rally may be an overreaction to short-term macro data or positioning adjustments, rather than a shift in fundamental trend.

Conclusion: Dollar Surge Likely Temporary

While the DXY has surged impressively from its May lows, both legal and technical signals suggest that this move may be running out of steam. The court’s block on Trump-era tariffs undermines one of the structural supports for the Dollar, and technically, price is nearing strong resistance.

Unless the Dollar breaks above the channel with conviction and follows through with macroeconomic support, the path of least resistance may still be lower.

Traders should monitor the 103.00 level as key resistance and remain open to potential reversals if price action weakens near the top of the channel.