- Chart of the Day

- December 11, 2024

- 3 min read

Bitcoin Flushout: Drop Before Further Run to Upside

On Monday and Tuesday, Bitcoin dropped significantly by approximately 7%, resulting in a liquidation of over $1.6 Billion across crypto exchanges. This event comes with a light at the end of the tunnel, though: Bitcoin may be primed to move higher once again.

Several key reasons for this:

- Bitcoin is at technical support levels.

- Hidden bullish divergence is spotted on the 4H timeframe.

- Funding rate has been reset.

Technical Support on Bitcoin and Hidden Bullish Divergence Spotted

Bitcoin’s decline brought it to the Daily EMA-20 level, a reliable support zone over the past week. Additionally, the price has tapped into a key 61.8% Fibonacci retracement level at $95,660.45, further increasing the likelihood of a rebound.

On the 4-hour chart, a hidden bullish divergence has formed following this recent price drop. Hidden bullish divergences are signals of potential bullish continuation, which support the case for Bitcoin to make a price recovery even after this recent sharp decline.

If Bitcoin resumes its upward momentum, it could potentially retest its previous all-time high of $104,009, or even aim for new highs. According to our Bitcoin Cup and Handle Target, prices could reach approximately $120,391 by the end of December.

What if it’s a Bearish Case Scenario:

If Bitcoin breaks below the Daily EMA-20 at $95,660, it may revisit the $90,000 region, which acts as a psychological support and the site of a recent strong bounce.

Alternatively, the Bitcoin price could face rejection at around $98,900, where a bearish 61.80% Fibonacci Retracement level lies.

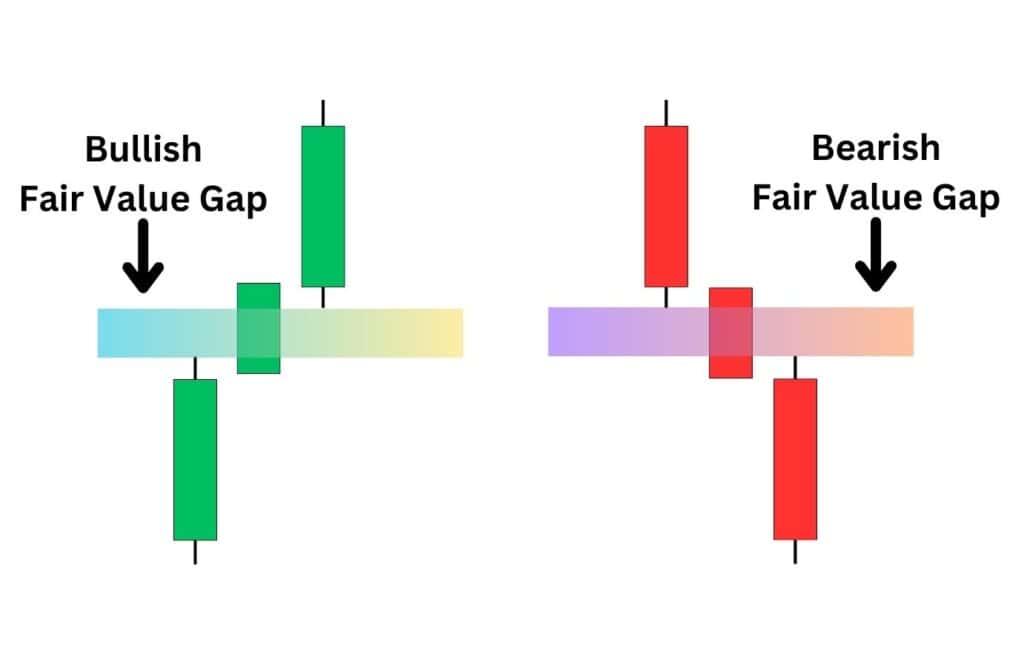

There is also a bearish Fair Value Gap from $98,340 to $98,800 which could act as resistance.

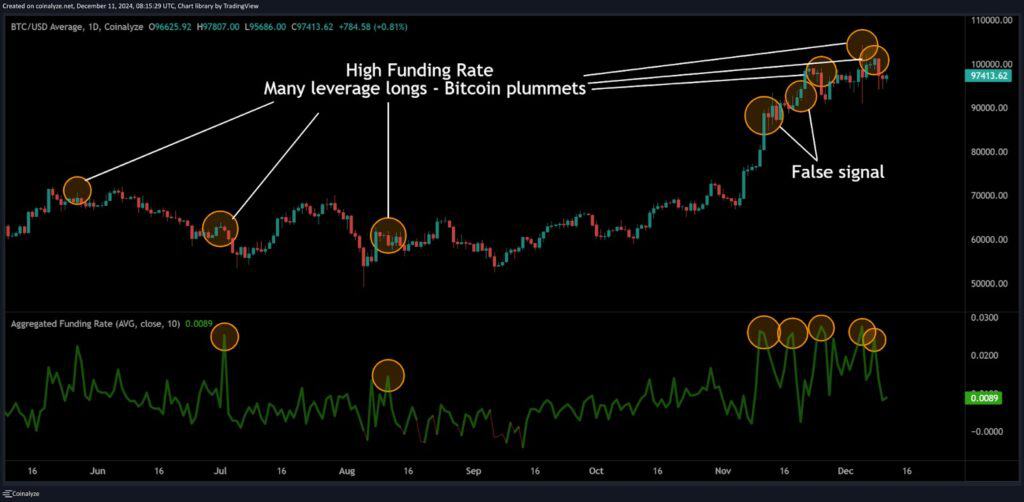

Funding Rate Reset: What Happens When It’s High or Low?

Funding rates are periodic payments on cryptocurrency exchanges, designed to align perpetual futures prices with the spot market.

- Positive funding rates: Indicate that the majority of traders are in leveraged long positions, meaning long traders pay funding fees to short traders.

- Negative funding rates: Suggest most traders are in leveraged short positions, with short traders paying fees to long traders.

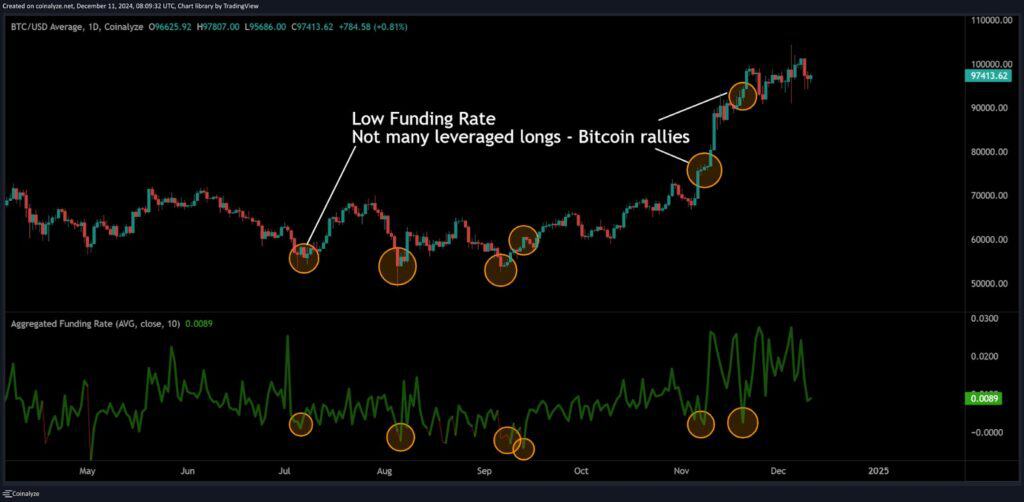

Looking at Coinalyze’s Bitcoin funding rate chart, a pattern emerges:

- Extreme positive funding rates often precede sharp Bitcoin declines.

- Extremely low funding rates are typically followed by rallies.

Currently, Bitcoin’s funding rate has hit a potential extreme low, which could signal the start of an upside move. This reset mirrors previous patterns, where low funding rates provided the foundation for significant rallies.

High Funding Rate:

Low Funding Rate:

What are Fair Value Gaps?

A Fair Value Gap (FVG) is an “Air pocket” between 3 candlesticks. It represents an area which the price has cut straight through – making it effectively an untested price zone. They work similarly to market gaps, in that price typically will return to the gap and test the market’s intentions.

If the price rejects from a Fair Value Gap, it signifies that buyers or sellers are interested in defending the price from going any higher or lower.

You may also be interested in: