- Chart of the Day

- February 24, 2025

- 3 min read

Bybit Gets Hacked; Cryptocurrency Takes A Plunge… What’s Next?

Following the Bybit hack on February 21, 2025, Bitcoin took a slump and is now revisiting a support zone between $94,000 to $96,000, which has been respected so far in the month of February.

The heist resulted in 401,000 Ether, worth ~1.6bn USD, being stolen from Bybit’s Ethereum Wallet. The hack is now being coined the largest crypto hack in history. Knowing this, should investors panic as we move into the month of March?

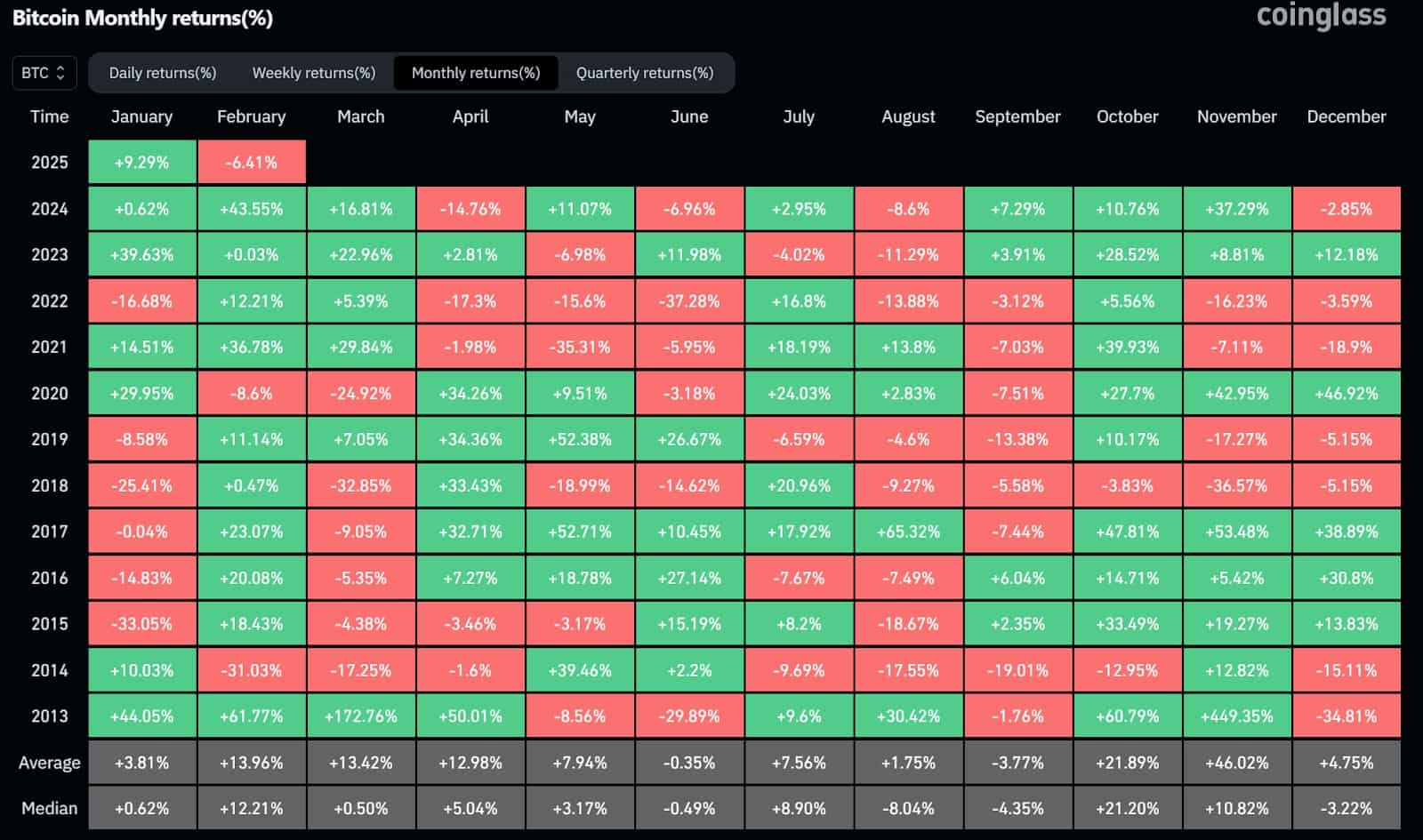

March is Largely a Neutral Month for Bitcoin

Taking a look at Bitcoin’s monthly returns (%) throughout its history, we’ll notice that March is largely a neutral month, with 50% resulting in a rise and the other 50% in a fall. The median PnL is 0.5%, if excluding the outlier data in 2013.

Based on these findings, investors and traders should approach March with a neutral mindset — however, it’s also important to consider the impacts of the Bybit hack, which could temporarily send Bitcoin’s price lower. But overall, should provide a lucrative opportunity for swing traders or investors looking to buy.

There is currently a discrepancy in the popular media narrative and the data, whereby many outlets are referring to this as the “largest crypto hack in history”—but upon closer inspection, the scale of the hack is only 0.047% of the current crypto market cap. This is by far not as critical as the Mt. Gox hack in 2014.

Narrative Discrepancy: Mount Gox Hack was larger

By comparison, the infamous Mount Gox hack in 2014 resulted in 850,000 Bitcoins being stolen, worth $473 million at the time. Though this is less in USD value in comparison to the hacked Ethereum, the market cap impact was worth ~5.84% at the time.

This narrative discrepancy in the media and data poses some interesting opportunities for investors and swing traders alike. However, it’s also important to note that in 2014, Bitcoin’s valuation decreased by 50% from the immediate drop.

In contrast, the current drop only weighs in at 4%, a far cry from the Mount Gox hack. This means that we should still remain mid and long term bullish, but cautious in the short term.

Technical Analysis for Bitcoin after Bybit Hack

Drawing a bearish Fib retracement from the All-Time-High at $109,588, to the following lowest low at $91,274.24, we can find several potential resistances.

The key zone to note is $98,270 to $100,431, which is the 38.20%—50.00% retracement. This zone has acted as a consistent point of rejection in February thus far, and also aligns perfectly with the Bybit Hack on Feb 21st.

Currently, Bitcoin is making a pitstop at the support zone between $94,000 to $96,000, which has been respected thus far in February. However, if this level fails and we see a significant close under, these would be the key supports to watch:

- Pivot Low at $93,388.09

- Support Zone at $90,820 to $92,200

If these levels break, we can expect a more bearish March, where price may move lower towards the Fair Value Gap between $81,395 to $85,160, which still remains untested.

You may also be interested in: