- May 26, 2025

- 23 min read

10 CFD Trading Strategies (Tips Included)

What are Contracts for Difference (CFDs)?

Contracts for Difference, or CFDs, are financial derivatives that allow market participants (i.e., retail and institutional traders) to bet on a financial asset’s future price movements without directly buying or owning the underlying asset. As a type of derivative, the value of CFDs is based on or “derived” from a specific financial asset. CFDs are a popular alternative to for active traders that may not be concerned about long-term ownership of the asset.

How do Contracts for Difference work?

From its name, CFDs are called “Contracts for Difference” because when you trade them—you are effectively entering into a contract with your broker to settle the difference between the asset’s current price and its price in the future. Hence, if you are bullish on the specific asset on which the CFD is based and go “long,” you will profit if the asset’s price increases from the time you open your position. Conversely, if you are bearish and go “short,” you will profit if the asset’s price declines from the time you open your position. Note, therefore, that losses occur if the price moves against your position in either case.

For example, if you go long on a CFD based on Apple Inc. (NASDAQ: AAPL), expecting its price to go up, you will make a profit if the stock price is higher when you close your position compared to the price at which you opened it. In contrast, if AAPL’s price goes down, you will incur a loss.

Developing a CFD Trading Strategy

The following are the cornerstone elements (i.e., the key components) of a successful CFD trading strategy:

Importance of Risk Management

Remember that in CFD trading—just like in other financial markets—effective risk management strategies are crucial. Keep in mind that the only thing you can control in your trades is your risk exposure (i.e., how much you risk per trade). Hence, it’s a best practice to employ a set of risk management measures that you always follow regardless of the type of CFD you trade (e.g., stop loss and limit orders). This will ensure you never find yourself losing money rapidly. In fact, instead of thinking about how much money you can make from a trade, it’s more prudent to think of how much money you stand to lose. This framing shifts the focus from maximizing profits to protecting your capital first and foremost—because a successful trading career is a marathon, not a sprint.

Market Analysis for CFD Trading

Market analysis is an essential element of a profitable CFD trading strategy. Hence, in order to create a successful CFD trading strategy, you need to develop a clear market analysis approach—whether it is based on technical analysis, fundamental analysis, or both. To start, you can ask probe yourself with these three key questions:

1. Will my strategy rely solely on technical analysis, or do I also incorporate a fundamental analysis?

2. What key technical analysis techniques will I adopt?

3. What timeframe will I focus on?

Having definitive answers to these three questions will provide you with a more grounded basis for developing your own market analysis approach.

Discipline and Consistency in Trading

Being disciplined and consistent is needed for successful CFD trading. These values are demonstrated by always creating a trade plan before opening a position and sticking to it without exception. As many successful traders would always say: “Plan your trade and trade your plan.” This is because a trading plan ensures that you approach each trade as objectively as possible—with no room for emotions to take over. Aiming to have a successful trading strategy while failing to follow your own trading plan (i.e., not being disciplined and consistent) is a disaster waiting to happen.

Here are three key non-negotiables to have in each of your trade plans:

1. Your risk management (stop loss point, position size, and the risk-to-reward ratio)

2. Your entry

3. Your take profit price

CFD Trading Strategies for Beginners

Here are three of the best CFD trading strategies we recommend for beginners, with entry and exit points:

1. Day Trading

Timeframe: Intraday

First, as the name suggests, day trading involves opening and closing positions within the same trading day—often multiple times. Compared to other strategies, this approach requires active daily monitoring and screening for potential trades. Consequently, it typically demands the most time, given its fast-paced nature.

Day Trading Example

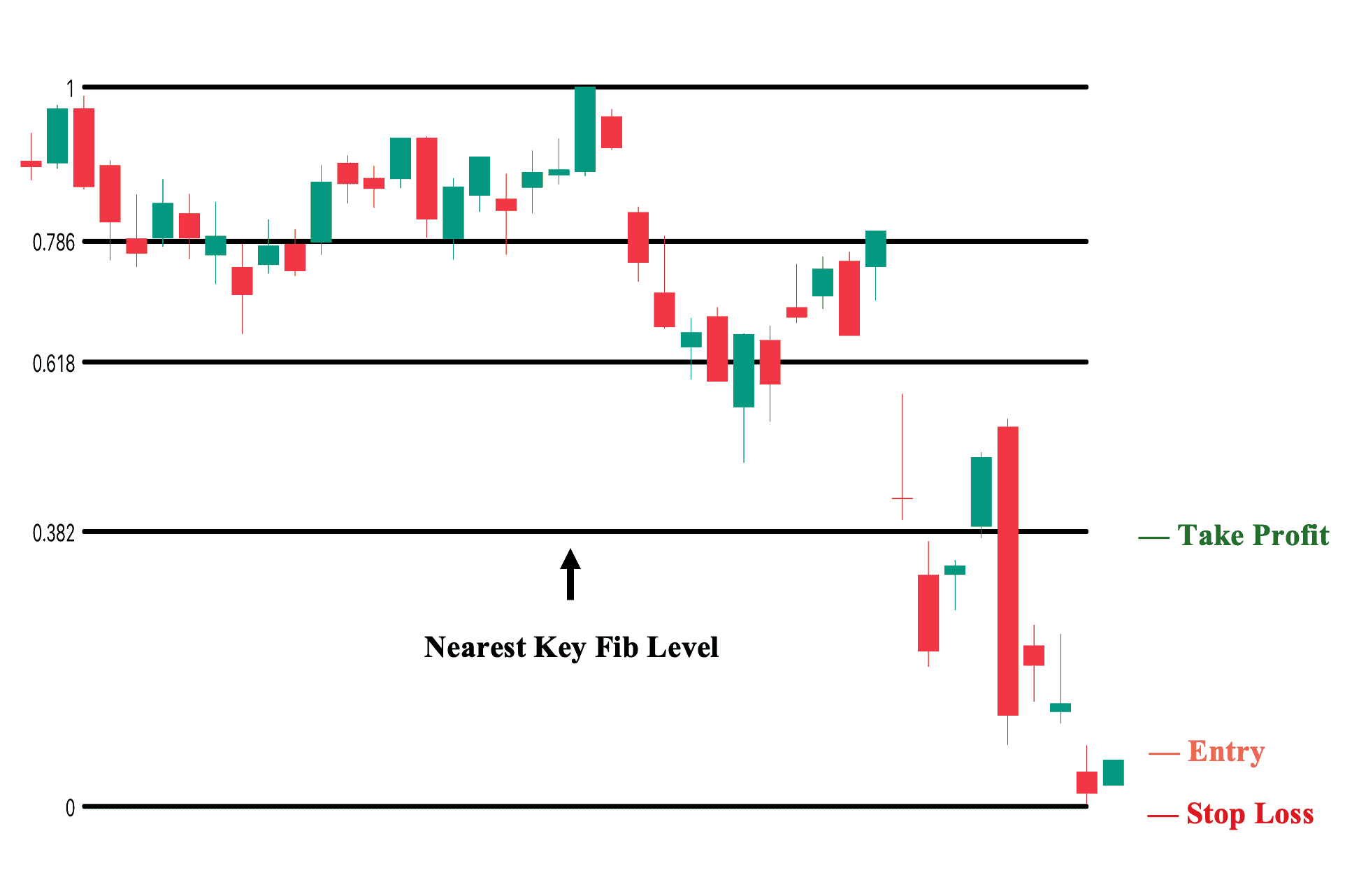

Shown here is the 15-minute price action of a CFD position with key Fibonacci retracement levels to serve as possible short-term bounce points for the price movements—giving us potential scalping opportunities.

In this example, we observe a bearish candle making a noticeable gap-down, which is followed by a bullish candle closing above 50% of the bearish candle’s range. If we take this as a bullish signal for a potential pause in the ongoing price decline, we can use the nearest Fibonacci level to estimate the potential upside if the price moves as anticipated.

1. Entry: You can place your entry on the next bullish candle following the last bearish candle in anticipation of a potential bounce.

2. Stop Loss: Set your stop loss below the low of the last bearish candle.

2. Swing Trading

Timeframe: A few days to a few weeks

Second, swing-based trading strategies are among the most popular CFD trading strategies out there. When compared to other strategies—swing trading focuses on capitalizing on the short to medium-term “swings” in price movements within an existing trend. Depending on your preference, you may focus on possible bounce or look for potential trend reversals.

Swing Trading Example

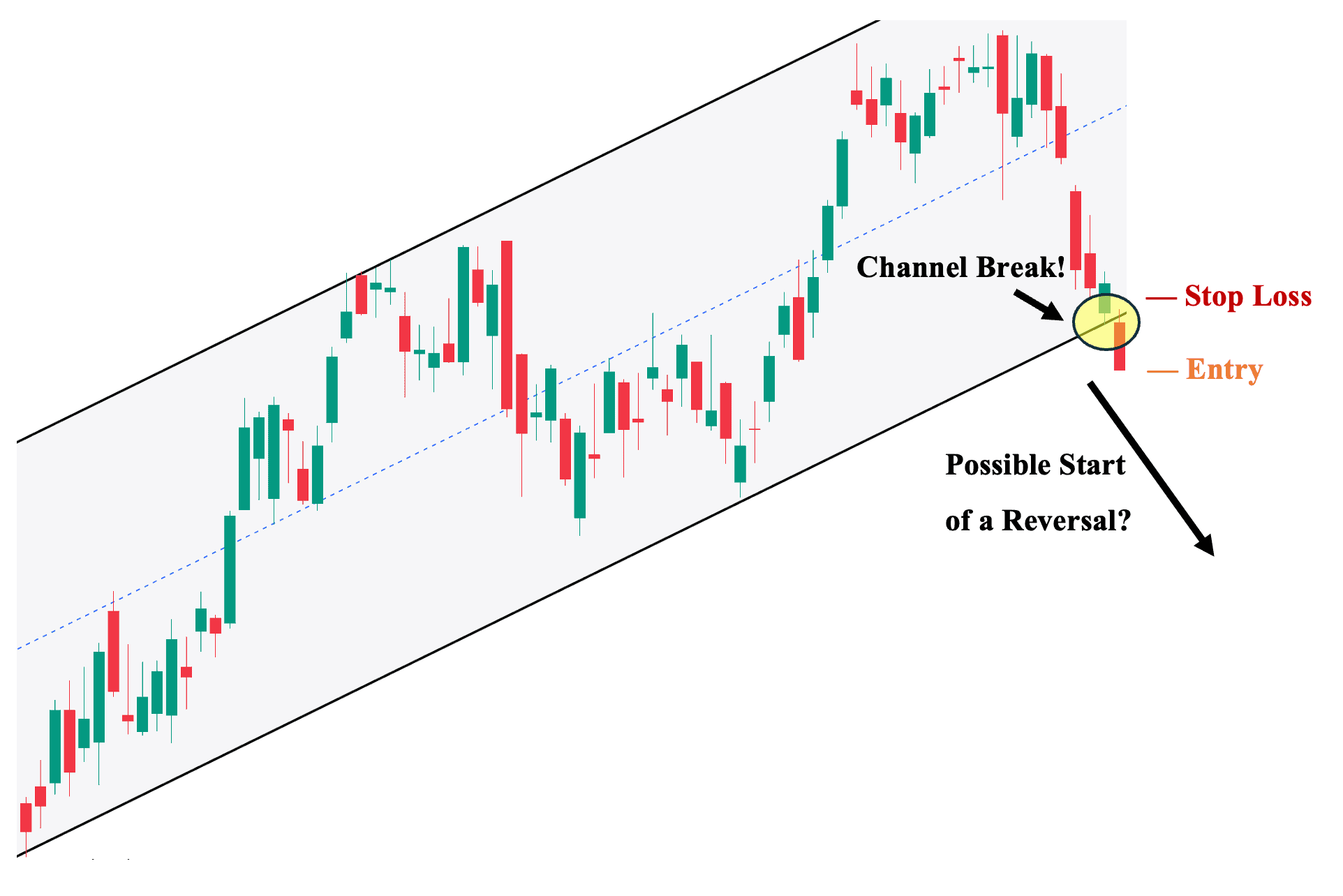

As shown, we can see a prevailing uptrend moving inside an upward channel. We can observe how the price “swings” upon hitting either the upper or lower channel lines, subsequently serving as the trend’s ceiling (key resistance) and flooring (key support) levels. Hence, when a bearish candle decisively closes below the lower channel line (which is supposed to be a key support level), it signals a potential shift against the prevailing uptrend and a possible significant swing to the downside.

1. Entry: You can place your short position on the candle that breaks the upward channel, anticipating the potential start of a reversal.

2. Stop Loss: Set your stop loss just above the lower channel line, as closing back inside the channel could indicate a resumption of the upward move, thereby invalidating the reversal signal.

3. Position Trading

Timeframe: A few weeks to a few months

Third, compared to both day trading and swing trading, a position trading strategy is inherently medium to long-term focused. As the name implies, position trading aims to take a “position” on an established uptrend, preferably one that has remained unbroken for at least six months. This is because, unlike day and swing traders, position traders are typically less active in the market and do not participate in many short-term market trends that can also shift quickly.

Instead, position traders prefer longer-term trends that have remained resilient. Hence, a staple of position trading is the trend-following strategy, which involves trading in the direction of the general trend rather than against it. This is also one of the CFD trading strategies where fundamental analysis can be integrated to enhance the reliability of the trend, as longer-term trends are often supported by a fundamentally sound basis.

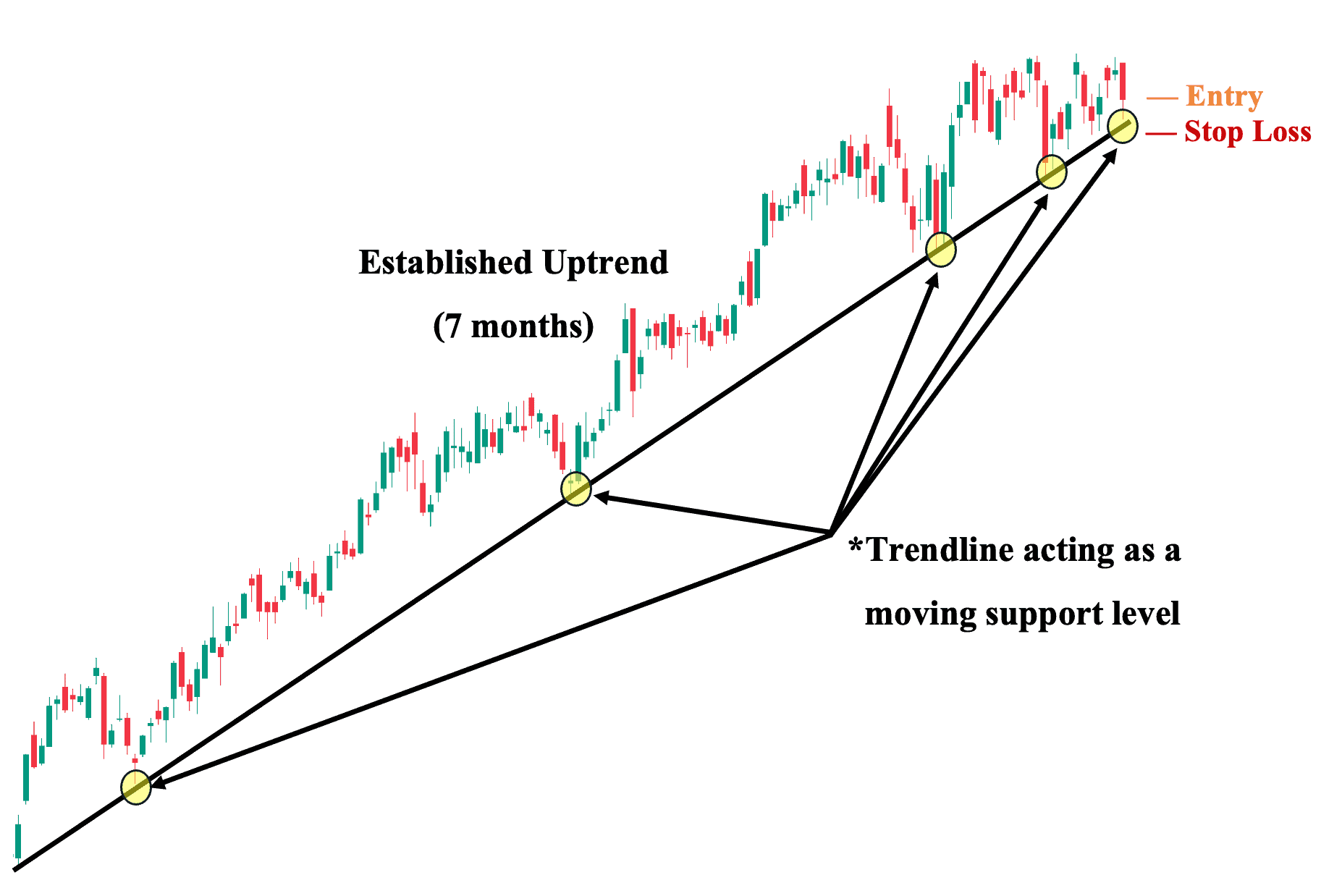

Position Trading Example

As shown, we have an established uptrend that has remained unbroken for the past seven months—making it a strong candidate for a medium-term CFD position. We can see the strength of the trend by looking at how the upward trendline has supported price movements. In fact, the price has not closed below this trendline even momentarily, demonstrating the trend’s resilience. Based on this observation, we can infer that the trend is likely to continue higher unless a strong bearish catalyst emerges—making a long position a strongly viable choice.

1. Entry: You can enter at the closing price of the last candle.

2. Stop Loss: Set your stop loss below the trendline—but ideally wider (more than a few ticks), as price movement can be erratic over the short term and may prematurely force you out of the trade if your stop loss point is too near the trendline.

4. Trading with Technical Analysis

Fourth, trading with technical analysis encompasses all trading strategies that use price charts to evaluate potential trades. It focuses on analyzing historical data to identify price patterns, trends, and the overall behavior of market price movements. In addition, it also employs technical indicators (e.g., moving averages, RSI, etc.) to help with the analysis and interpretation of specific market movements. Unlike fundamental analysis, which looks at the broader macroeconomic and company/asset-specific fundamentals, technical analysis mainly focuses on price and volume.

5. Pullback or Retracement Strategy

Timeframe: A few days to a few weeks

Lastly, a pullback or retracement strategy takes advantage of the short-term countermoves in a trend (whether an uptrend or a downtrend). This is because a healthy trend does not constantly move up (in an uptrend) or move down (in a downtrend). Instead, it usually involves short-term price declines during an uptrend and short-term price increases during a downtrend. These pullbacks are easy to spot in price charts—making it an accessible trading strategy even if you are just starting out.

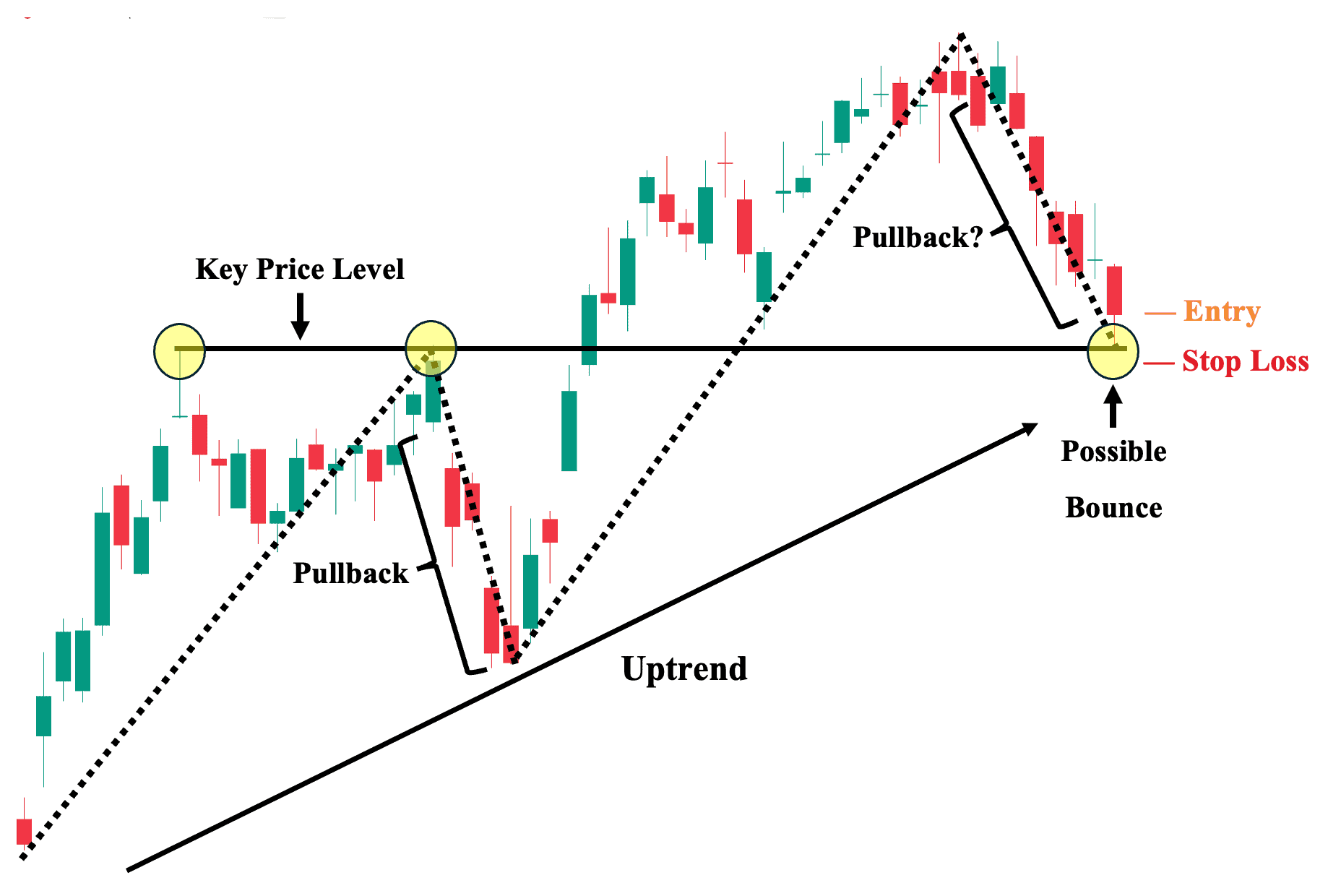

Pullback Trading Example

As shown, we can observe an existing uptrend with two noticeable downward price movements. Looking closely, we can see that the first pullback happened after hitting a key price level. Nevertheless, this first pullback essentially propelled the price even higher—ultimately leading to the creation of a new high before the price began to make a sustained downward move once again.

That said, while this new downward price move can be seen as a potential bearish reversal, it could also just be a much steeper pullback—as we can see that the last candle did not close below the trend’s established key price level, which now serves as the nearest key support level. From a bullish perspective, this creates a potential bounce point for a potential continuation of the uptrend.

1. Entry: You can enter at the closing price of the last candle. For a more conservative entry, you can wait for either a retest of the key price level or a bullish next candle to confirm the possible bounce.

2. Stop Loss: Set your stop loss a few ticks just below this key price level (nearest support area).

Advanced CFD Trading Strategies

Here are the three advanced CFD trading strategies that we believe experienced traders can utilize effectively:

1. Range Trading

Timeframe: Flexible

First, one of the more advanced approaches we recommend for trading CFDs is range trading. Essentially, range trading takes advantage of clearly defined support and resistance levels in which you can place your entry and exit points. This simplicity in technical analysis allows you to focus on identifying viable entries with optimal risk-reward, turning this approach’s simplicity into its greatest strength.

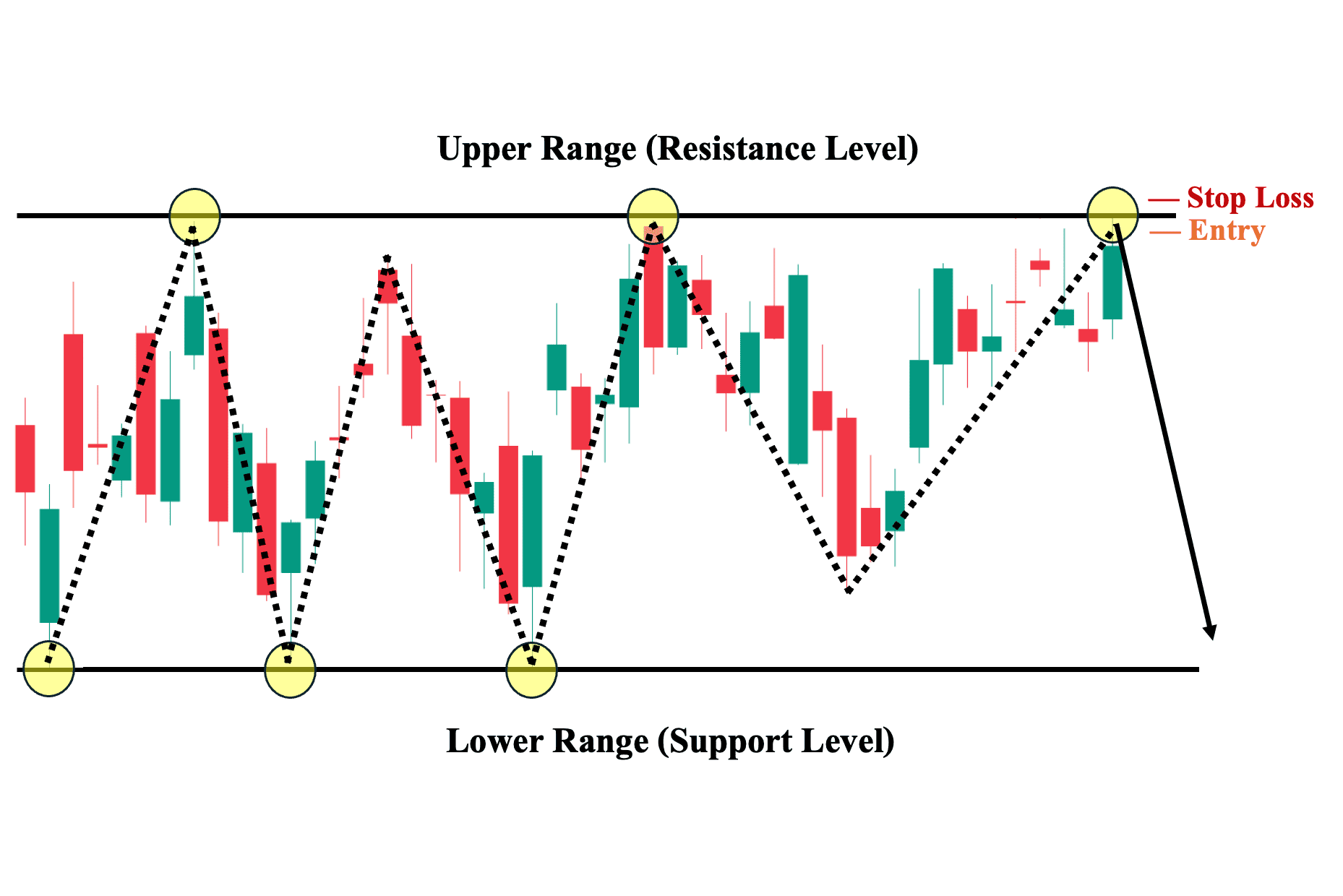

Range Trading Example

In this example, we can clearly see that price is moving sideways with a structurally defined upper range (resistance level) and lower range (support level). Unlike our previous price charts with clearly trending market trends—range trading thrives in non-trending market environments where volatility is relatively low, and the price movement is much more predictable. Here, we can clearly define our stop loss—just outside either range—and our entry point, which is simply located near the range.

1. Entry: Place your entry order a few ticks below the upper range. Preferably, you put the order in advance in anticipation of the price reaching this point before bouncing back down. This is because intraday prices move quickly—especially in seconds and minutes chart intervals.

2. Stop Loss: Set your stop loss just a few ticks above the upper range level.

2. Support and Resistance Trading

Timeframe: Flexible

Second, support and resistance is one of the most popular CFD trading strategies. “Support” refers to a price level where buying pressure outweighs selling pressure (i.e., there are more buyers than sellers), making the price more likely to stop declining and move upward. Conversely, “resistance” refers to a price level with significant selling pressure, causing the price to stop advancing and potentially start declining. To identify these key price levels, you can use price structure or complementary technical indicators, notably a moving average.

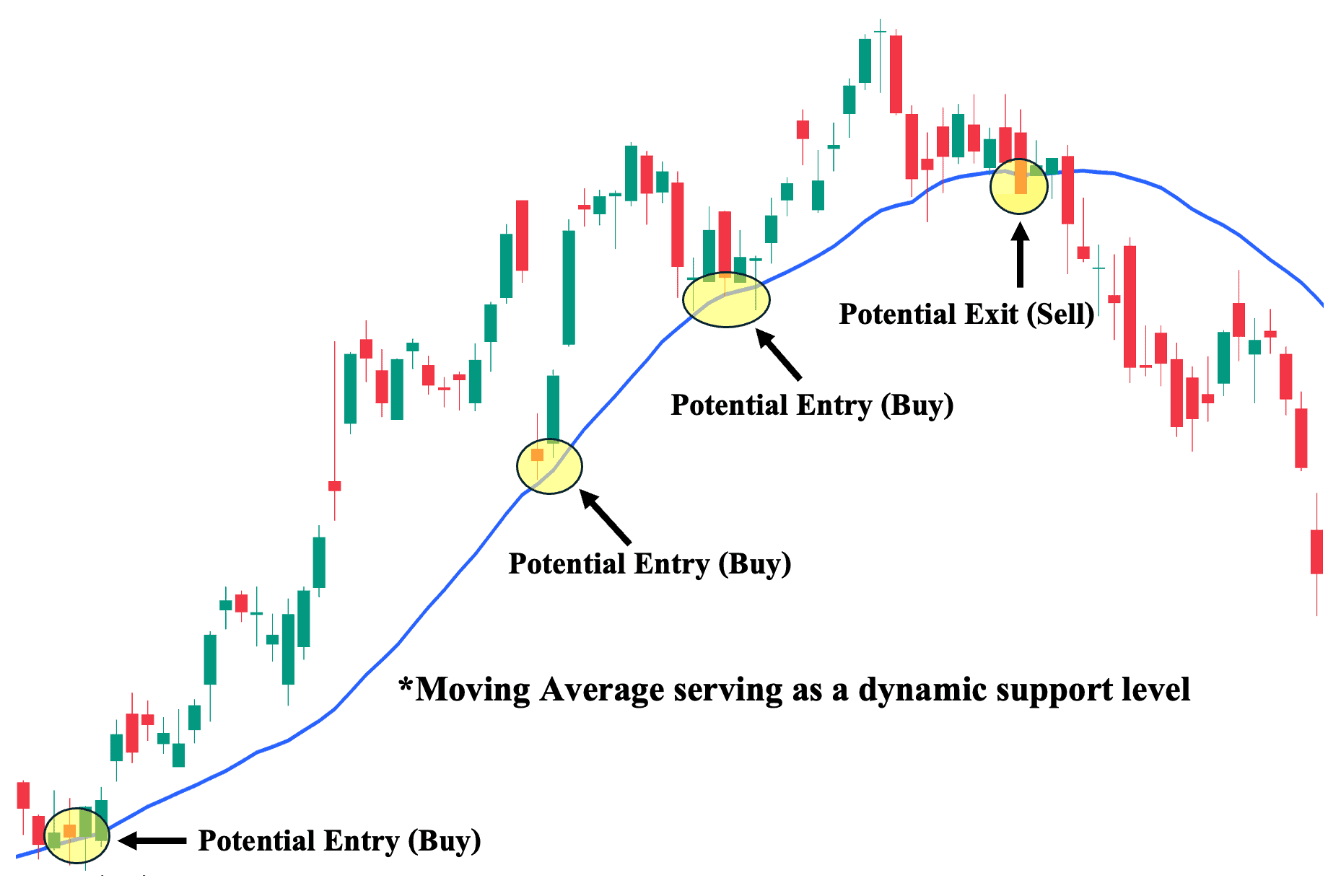

Support and Resistance Trading Example

In this example, we use a 50-day simple moving average to serve as our dynamic support (and eventually a resistance) level. During the uptrend phase, the moving average actively supported the price, with the price bouncing off the MA line to form higher highs. However, when the price closed (broke) below the MA, it signaled a shift to a downtrend, as the price now remains below the MA line. As a result, the MA now serves as a resistance level that price needs to overcome.

1. Entry: Place your entry close to the moving average in anticipation of a possible bounce.

2. Stop Loss: Set your stop loss just below the moving average line.

3. Breakout Trading

Timeframe: A few days to a few weeks

Third, breakout trading looks for positions with ongoing consolidation (the price is moving sideways with a definitive resistance level preventing it from advancing). Traders anticipate that when the price eventually breaks above this resistance level with significant momentum (i.e., volume), it signals the start of a momentum-filled upward move. In contrast, if the price breaks below a key support level during consolidation, it may indicate the beginning of a downward trend and is called a “breakdown.”

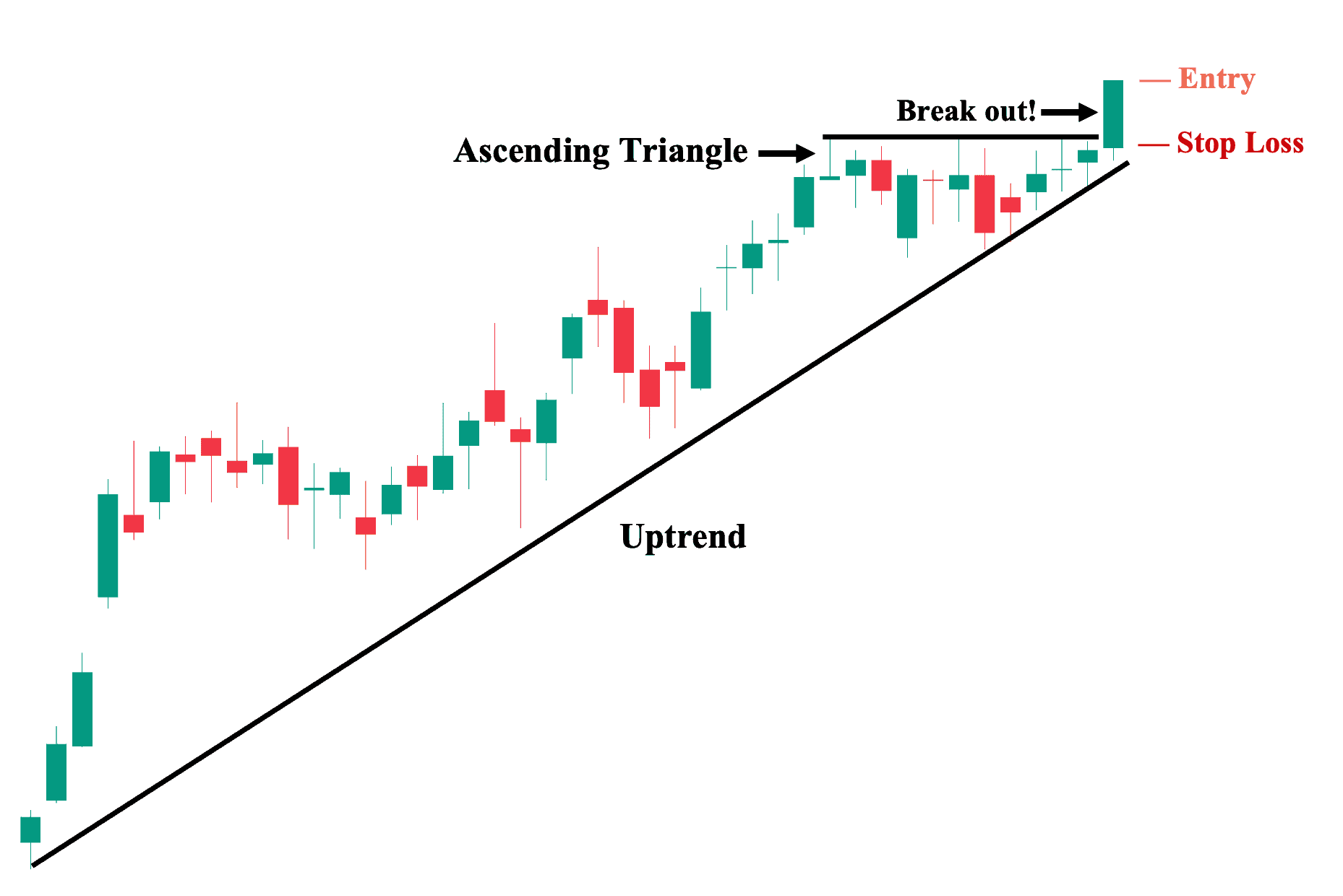

Breakout Trading Example

As shown, we can observe an existing short-term uptrend—with considerable upward price movement leading to a consolidation happening at the top of the trend, as characterized by short-ranged candles with nearly identical highs. Despite this consolidation, we can observe the growing momentum as an ascending triangle develops, hinting at a potential breakout—which did happen. This breakout likely generates added momentum for further upward moves, which we can take advantage of.

1. Entry: You can enter at the closing price of the breakout candle. For a more conservative entry, you can wait for a potential “golden pullback” where the price momentarily touches the previous resistance. However, if the breakout candle has generated enough upward momentum, it will likely lead to a sustained upward move.

2. Stop Loss: Set your stop loss a few ticks below the previous resistance (the high of the ascending triangle).

4. News Trading – Events Driven Strategy

Timeframe: Intraday to a few days

Fourth, another advanced CFD strategy that we believe is highly appropriate for trading CFDs is news trading. This is due to the fact that CFDs are incredibly short-term in nature, and the current sentiment around the market conditions dictates the direction of CFDs, especially in the short term. News trading, as the name implies, is essentially basing your trading decisions on the news as well as the latest events that could affect the sentiment on your current holdings. This is a sharp contrast to many CFD trading strategies, including what we have covered so far, because this type of trading does not rely on technical analysis.

Why it is advanced: While news trading is a well-known strategy, we do not recommend it as a starting point for beginners, as we believe it is better suited for experienced traders. This is because news trading is incredibly subjective and heavily relies on the trader’s intuition. For example, if you give both traders the same set of news or information, it is not surprising that they act completely differently.

In addition, advanced traders usually have access to premium data providers, such as Bloomberg Terminal and Capital IQ, and can interpret the information better due to their sheer experience in the market. In contrast, many beginner traders lack the solid financial and economic knowledge needed to act swiftly on recently released relevant information.

News Trading Example

Here are the three common ways advanced traders evaluate a potential CFD position:

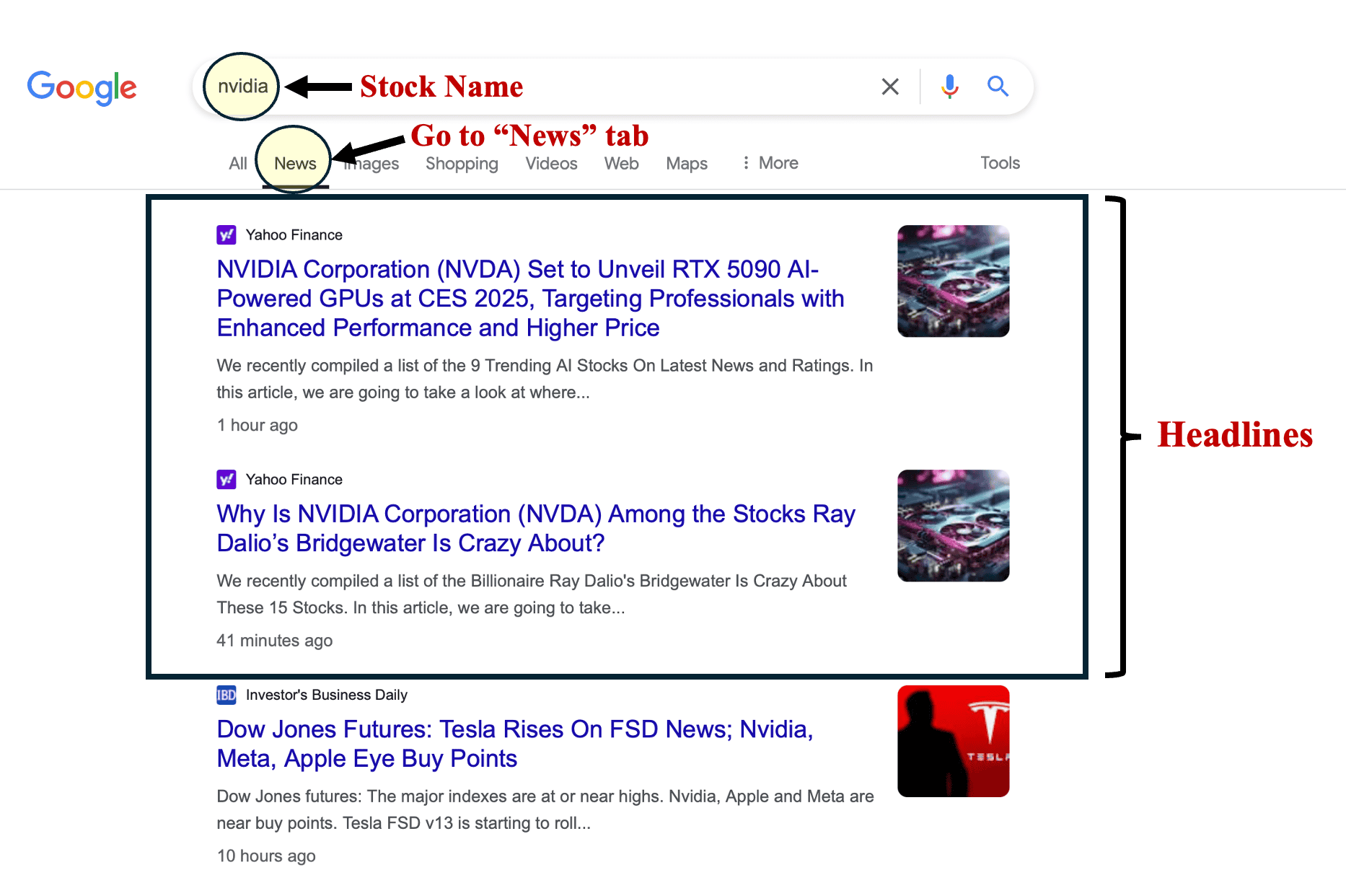

First, and the most basic approach—you need to identify the underlying asset you wish to trade with CFD and look up the most recent information available. For this example, suppose you are looking to take a position on a CFD based on NVIDIA Corporation (NASDAQ: NVDA). The first step you can do is to simply search for the company on Google and click the “News” tab to find if there is any recent information. In this example, we can see recently published information regarding the company. That said, you now have to evaluate whether these pieces of information are relevant to the movement of stock. This is the first challenge that beginners encounter—they do not know for sure if these pieces of information are relevant at all.

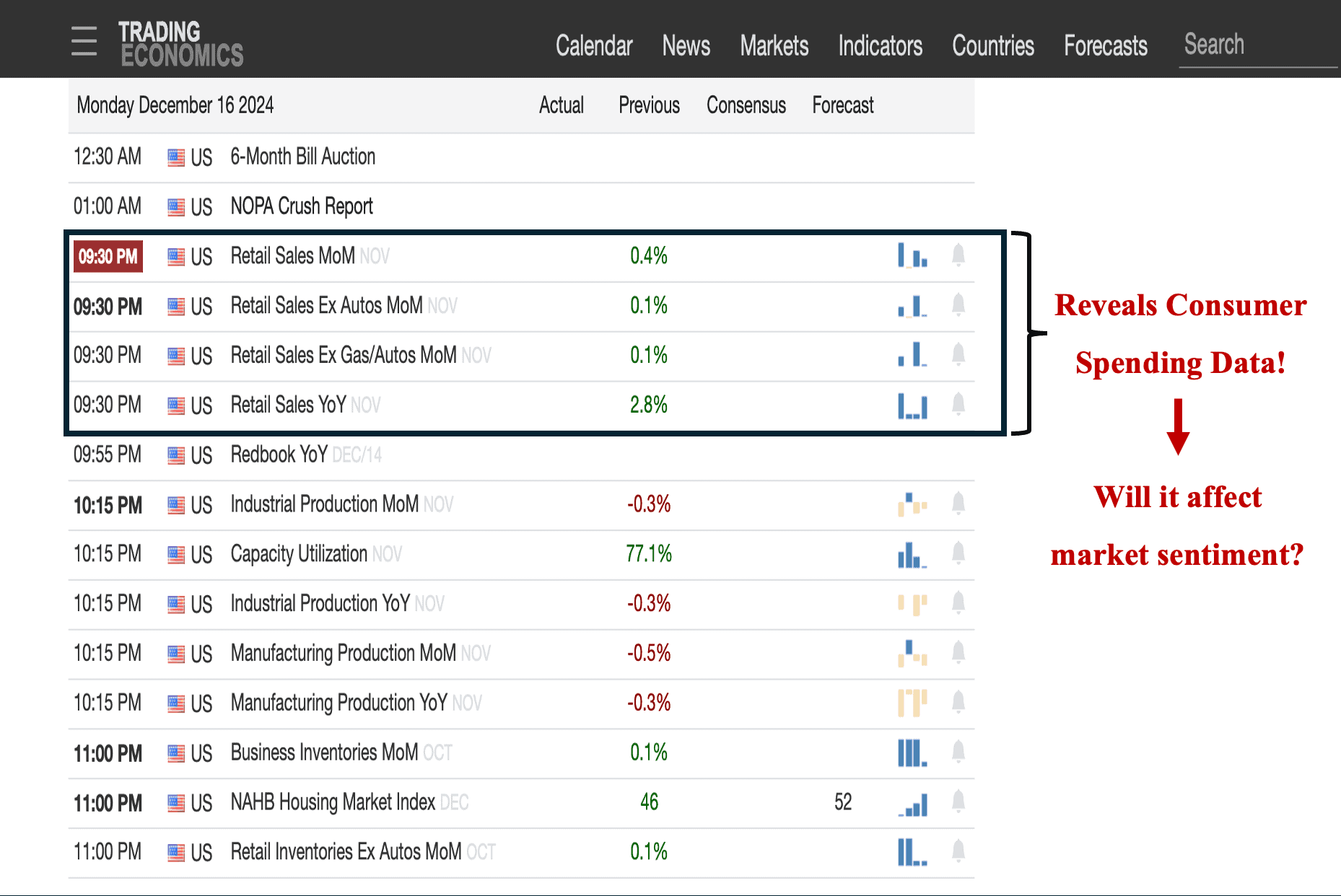

Second, advanced traders also look for possible “catalysts” that can affect the short-term market sentiment of NVDA. One of the ways to do this is by checking relevant economic data that will be published soon. As shown, Retail Sales data in the US will be announced on the 16th of December. Retail Sales essentially reveal the total consumer spending for a given period. For consumer-focused technology companies, a positive retail sales trend is often bullish, as it signals stronger consumer spending. While NVIDIA’s core business in gaming and AI are less directly tied to retail sales, such data can still influence overall market sentiment. The question is, will the retail sales’ result ultimately affect sentiment around NVDA?

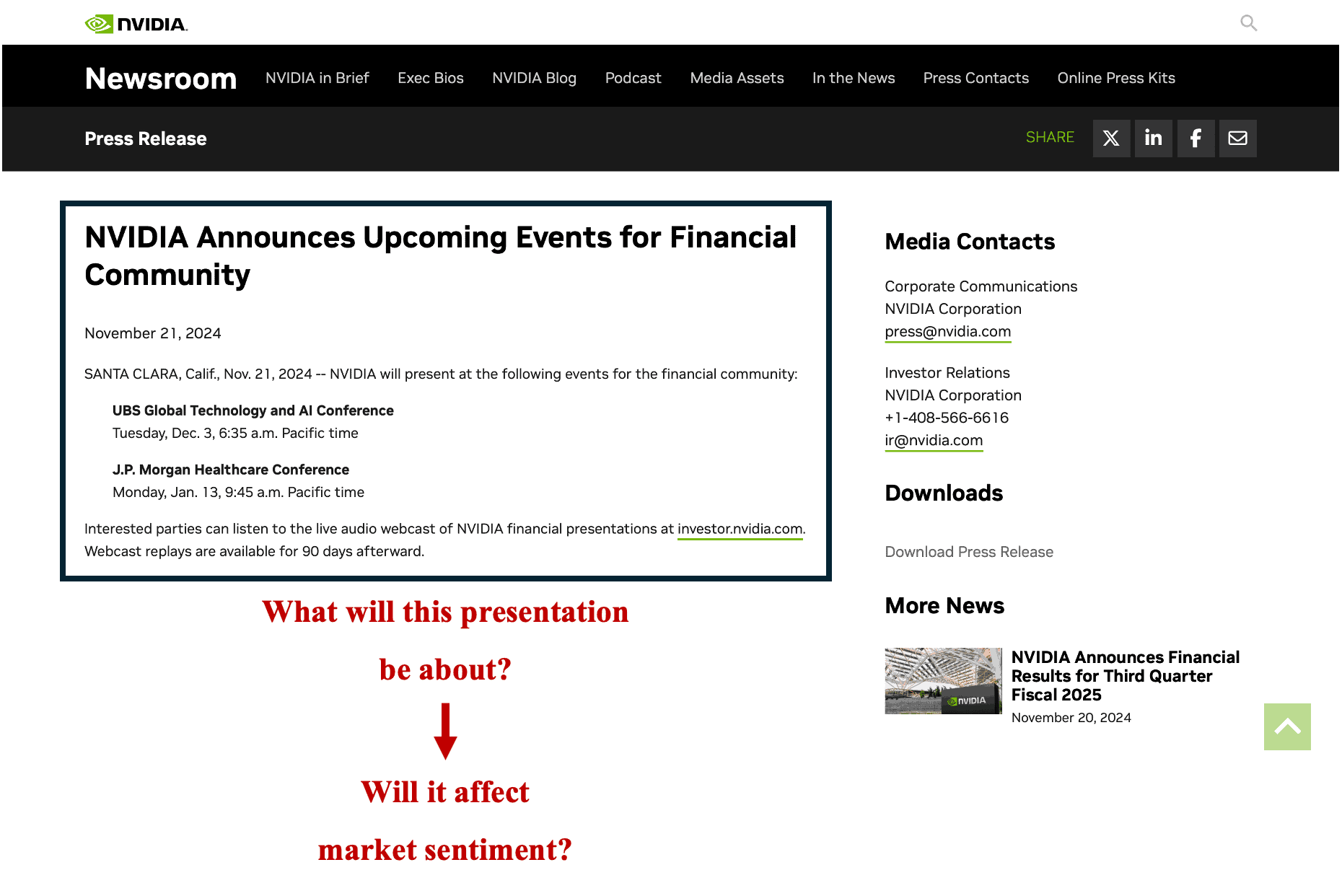

Finally, another source for upcoming events and announcements is the company’s investor relations website. As shown, NVIDIA is planning an event for its financial community (i.e., existing and potential investors). What will this presentation be about? Will it ultimately affect market sentiment? Overall, if you are trading on news, the most important question that you need to answer is whether such information will affect the CFD position you are looking at. The thing is, not all information is relevant to your trades. Hence, it’s essential to distinguish what genuinely matters from what is merely “noise.”

5. Hedging Strategy

Timeframe: Short to Medium Term (a few days to a few months)

Finally, the last advanced CFD strategy we want to highlight is Hedging. This strategy is done by taking an opposite position in the same asset (or a closely related one) or by buying an inversely correlated asset. Similar to news trading, hedging is also not reliant on technical analysis or even price charts. That said, unlike news trading, trading CFDs under a hedging strategy is inherently defensive in nature. In fact, this approach prioritizes reducing the potential downside of your overall portfolio rather than seeking additional profit.

Why it is advanced: Hedging is seen as more of a risk management strategy than a trading strategy. Frankly, for beginners and even many experienced traders, this strategy is not applicable at all—particularly those without substantial investments in a specific underlying asset to begin with. That said, for advanced retail traders and many institutional traders, hedging is a staple strategy for managing risk and ensuring a level of protection against sudden market shifts.

Hedging Illustration

Suppose you hold a sizable investment in Apple, Inc. (NASDAQ: AAPL) in your portfolio. This exposure makes your portfolio vulnerable to substantial losses if AAPL’s price abruptly declines as a result of bearish sentiment in the short to medium term. Hence, to mitigate this potential downside without needing to sell your AAPL holdings, you could open a short position in a CFD tracking the stock.

This strategy allows you to offset losses in your investment portfolio by profiting from the potential downward movement in AAPL’s price—effectively mitigating a portion of the losses while maintaining your long-term position in the asset. By doing so, you avoid the costs and potential tax implications associated with selling a portion of your AAPL investment while retaining the benefits of being a shareholder—like receiving dividends and retaining all of your voting rights.

Effective Trading Strategy Tips

Here are five essential tips to enhance your trading strategy and overall approach:

1. Start Small (or with a demo account)

First, and perhaps one of the most important CFD trading tips when you’re just starting out, is to always start small. In fact, you can start with a demo account using virtual funds to get a “feel” for how CFD trading works and explore the various features offered by CFD brokers before committing to a real account with the broker that best suits your needs.

In addition, by starting with a demo account and using virtual funds—you also get to see how your trading strategy can work without risking real money. When you’re ready, be sure to review the fee structure of your chosen CFD broker for its retail investor accounts. This will help you strategize on saving fees and ensure you are aware of all charges you may incur with each trade.

2. Avoid Overcomplicating

A crucial piece of advice to keep in mind is to avoid glorifying a complicated trading strategy. A lot of times, many beginner traders resort to making their CFD trading strategies more complicated than they need to be.

This can look like using too many technical indicators that end up giving mixed signals or having too many trading strategies you employ simultaneously in different financial markets. The danger of overcomplicating your trading approach is that you end up with a subpar trading system, as you miss out on the key issues by hyperfocusing on the small things.

3. Never Add to a Losing Trade

A quick way to find yourself losing money rapidly in CFD trading is by adding to a losing trade position. This concept of “averaging down” has its roots in long-term investing, where you view the further decline in price as a “discount” and buy more of it.

However, trading CFDs is unlike long-term investing, and adding to a losing position compromises your risk management. At the same time, it likely reflects a clear violation of your trade plan as you allow your emotions to take control.

4. Constantly Refine Your Strategy

Ensure that you continually refine your CFD trading strategy moving forward to adapt to different market conditions. The thing is, even if you have a fully working trading strategy that works on different financial markets—a sudden shift in market condition (e.g., from bullish to bearish) can dramatically reduce the effectiveness as well as the upside potential of your strategy.

Hence, the best practice is to continually optimize your trading strategy tailored to the particular market/asset class the CFD is tied to.

6. Journal Your Trades

Finally, one of the most crucial CFD trading tips is to keep a detailed journal of all your trades—both successful and unsuccessful—including the profits from winning trades and the losses from failed ones. As a CFD trader, a successful trading track record means achieving net positive results in both rising and falling markets.

More than that, a trading journal records your journey—including both struggles and improvements. We also recommend adding a small note to each trade entry about what went well and what can be improved. This practice reinforces positive habits and serves as an inspiration to keep improving your craft.

Automating CFD Strategies with Algorithmic Trading: Benefits and Challenges

Algorithmic trading, or algo trading, is an advanced method that allows CFD traders to automate their strategies using predefined rules and algorithms. This approach leverages software to execute trades based on set conditions, such as price movements, technical indicators, or market trends.

Benefits of Algo Trading for CFD Traders

- Efficiency: Algorithms can analyze vast amounts of data and execute trades faster than any human, ensuring you never miss market opportunities.

- Emotion-Free Trading: By eliminating human emotions, algo trading helps maintain discipline and stick to a predetermined strategy, reducing impulsive decisions.

- Backtesting: Traders can simulate strategies on historical data to refine their approach and assess potential profitability before risking real capital.

- 24/7 Market Monitoring: Algorithms can continuously monitor global financial markets, executing trades even while you’re offline or asleep.

Challenges to Consider

- Complexity: Developing an effective algorithm requires a strong understanding of programming and financial markets, which can be a barrier for beginners.

- Over-Optimization: Excessive fine-tuning of algorithms based on historical data might lead to poor performance in live markets, a phenomenon known as “curve fitting.”

- Technical Risks: Algo trading depends on robust technology. System glitches, software bugs, or connectivity issues can result in missed trades or unintended losses.

- Initial Costs: Building or purchasing algorithmic trading software can be costly, and ongoing expenses for data feeds or platforms may add up.

Incorporating algorithmic trading into your CFD strategy can significantly enhance your efficiency and accuracy. However, it’s important to weigh the benefits against the challenges and start with thorough research and testing before fully automating your approach.

Frequently Asked Questions (FAQs)

Are CFDs good for the long term?

Generally speaking, CFDs are not suitable for long-term trading due to their inherent short-term nature. Many CFDs incur overnight financing fees, which can compound and eat up your profits over time. These fees are usually applied daily to leveraged positions and are calculated based on the total value of the trade—making them significantly more costly for potential long-term positions than simply owning the underlying asset they are based on.

How long can you hold a CFD position?

The length for which you can hold a CFD position depends entirely on the specific CFD broker as well as the terms of the trading contracts. Due to its nature, CFD is typically used for short-term trading purposes, with many only lasting for a few weeks to a couple of months at most.

What costs will I incur holding a CFD in the long term?

Holding a long-term CFD trade can incur several costs, including overnight financing fees charged by your CFD broker for maintaining the position beyond a day. Again, these fees can eat into your overall profitability—so make sure to review your broker’s fee structure to be aware of all potential costs.

Is CFD trading taxed?

Yes, CFD trades are usually subject to capital gains tax in many countries. This is because profits from a CFD trade are often considered and treated as capital gains. That said, the exact tax treatment depends on your country’s tax laws.

Is there a Single Best CFD Trading Strategy?

No, the best trading strategy depends on the individual CFD trader. As with any other financial instrument, there is no single “holy grail” strategy that always works or guarantees the most profit. Instead, to ensure long-term profitability, the strategy that you choose must align with your trading style and goals.

Can I use multiple CFD trading strategies at once?

Yes, you can use multiple CFD trading strategies simultaneously. For instance, you might use a momentum-based strategy for trading individual CFD stocks in the stock market and a swing-based strategy for derivative trading in commodities or forex. It ultimately depends on you and what aligns best with your trading objectives and goals.

How much money do I need to start trading with CFDs?

The amount needed to start trading with CFDs depends on the specific trading platform as well as the CFD provider you choose. There are retail investor accounts that allow you to open positions for as little as $50.