- Opening Bell

- Oktober 10, 2024

- 2 Min. Lesezeit

Sticky US CPI Keeps the Dollar Firm

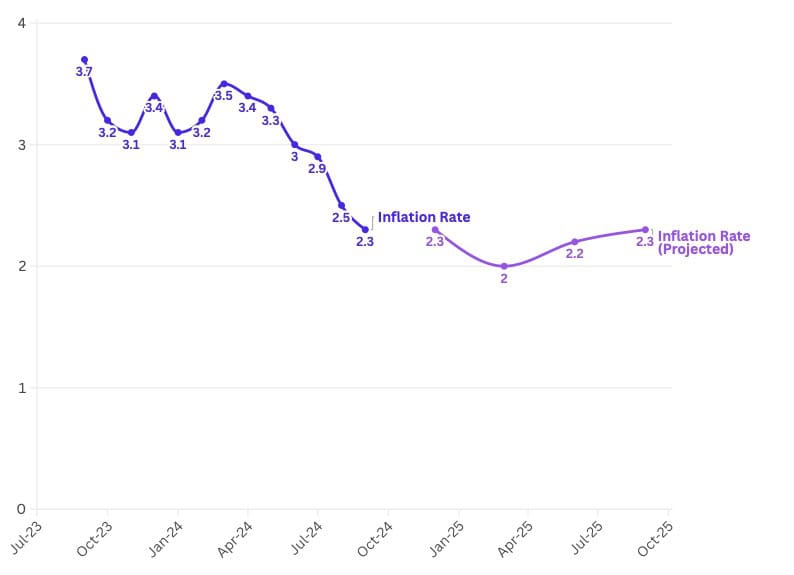

Data Source: Trading Economics

Markets are gearing up for a critical US CPI report today, with consensus expecting a slight drop in the year-over-year core inflation figure to 2.3% from 2.5%. The Federal Reserve’s September FOMC minutes revealed no rush to lower interest rates despite a recent 50bp cut. Instead, the focus was on recalibrating restrictive monetary policy as inflation pressures ease and unemployment trends higher. Today’s CPI data, if it surprises to the upside at 0.3% MoM, could reinforce the Fed’s cautious approach and keep the dollar supported.

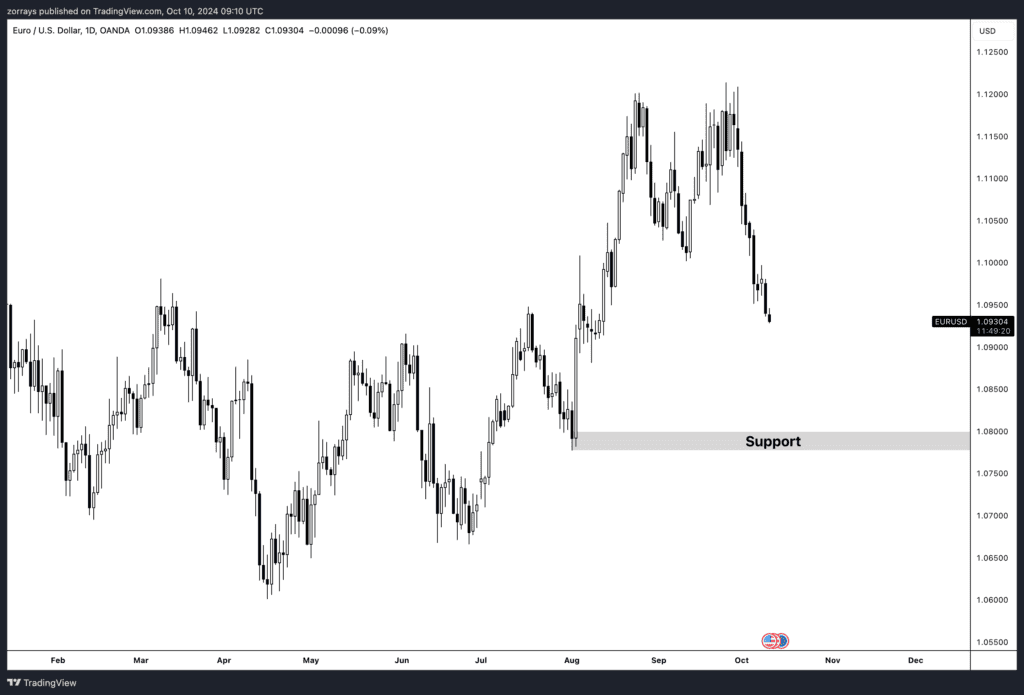

The dollar index (DXY) continues to benefit from widening short-term rate differentials, particularly against the euro. Since late September, US two-year yields have surged, helping EUR/USD drop toward 1.09. Adding to the pressure on the euro, markets are now fully pricing in further rate cuts from the ECB, with growing risks to growth and inflation.

Technicals: EUR/USD Under Pressure as Rate Differentials Widen

EUR/USD

EUR/USD continues to struggle as widening rate differentials between the U.S. and Eurozone weigh on the pair. Over the past few weeks, the two-year EUR/USD swap spread has widened significantly, from 85bp to 130bp, reflecting the market’s pricing of a more hawkish U.S. Federal Reserve stance compared to a more dovish European Central Bank (ECB). This divergence has driven the euro lower, pushing EUR/USD towards the 1.09 level.

Technically, EUR/USD looks poised to break lower, with immediate support around the 1.0850 area and a potential move down to the 1.0800 level. This bearish outlook is driven by a combination of the widening rate differentials and growing concerns about economic slowdown in the Eurozone. Weak PMI data from September has only increased expectations for an ECB rate cut in the coming months, likely adding further downside pressure.

Key Levels to Watch:

- Support: 1.0850, followed by 1.0800

- Resistance: 1.0950, followed by 1.1000

Should U.S. inflation data today come in above expectations, EUR/USD could break through key support levels, with 1.0800 being a crucial downside target. Conversely, if inflation data surprises to the downside, the pair could see some relief, though upside momentum would likely be capped near 1.0950, given the current economic divergence between the U.S. and Eurozone.