- Chart of the Day

- Januar 23, 2025

- 2 Min. Lesezeit

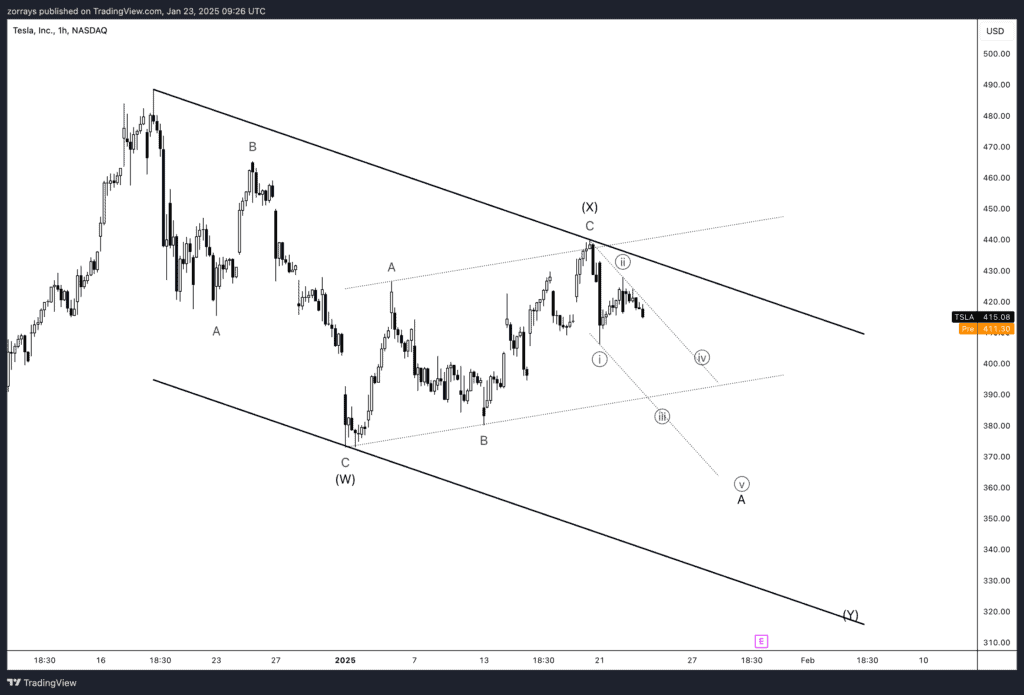

Tesla (TSLA) Faces Key Hurdles Amid Broader Market Gains: Is Another Decline Ahead?

Since reaching an all-time high of $488.54 on 18th December, 2024, Tesla’s (TSLA) stock has experienced a decline, aligning with the broader market trends.

As of 23rd January 2025, TSLA is trading at $415.11, reflecting a decrease of approximately 15% from its peak.

In contrast, the S&P 500 (SPX) has been climbing impulsively near its all-time highs, indicating a divergence between Tesla’s performance and the broader market. This disparity raises questions about the factors contributing to Tesla’s slower growth.

Factors Influencing Tesla’s Stock Performance

Several elements have contributed to Tesla’s recent stock performance:

- Sales Decline: In 2024, Tesla reported its first-ever annual sales decline, with vehicle deliveries decreasing by 1% year-over-year. This downturn has raised concerns among investors about the company’s growth trajectory.

- Competitive Pressure: The electric vehicle (EV) market is becoming increasingly competitive, particularly from Chinese manufacturers like BYD. BYD increased its sales by 12% in 2024, surpassing Tesla in quarterly sales. This intensifying competition is challenging Tesla’s market share and pricing power.

- Regulatory Environment: The new administration under President Trump has initiated policies that could impact the EV industry, including the potential repeal of federal purchase tax credits. Such changes may affect consumer incentives and Tesla’s sales in the U.S. market.

Technical Analysis and Future Outlook

From a technical perspective, Tesla’s stock appears to be forming another leg down into wave (Y) of a double zigzag pattern, potentially within sub-wave ((iii)). This pattern suggests the possibility of further declines in the near term.

Alternatively, Tesla’s stock may move sideways leading up to its upcoming earnings report. The results of this report could serve as a catalyst, determining the stock’s near-term direction. Positive earnings could bolster investor confidence, while disappointing results might exacerbate the current downtrend.

In summary, Tesla’s recent stock performance reflects a combination of internal challenges and external pressures. Investors should closely monitor the company’s earnings and broader market developments to gauge future movements.