Trade The World,

Grow Your Portfolio

Access institutional liquidity and trade our wide range of CFD products with tight spreads, zero commissions*, and 100% STP execution**.

Invest in Forex, Stocks, Indices, Metals, Crypto, and more with confidence and ease.

0%

Commission

10

Years of reliability

0.2

Pip Spreads

Invest

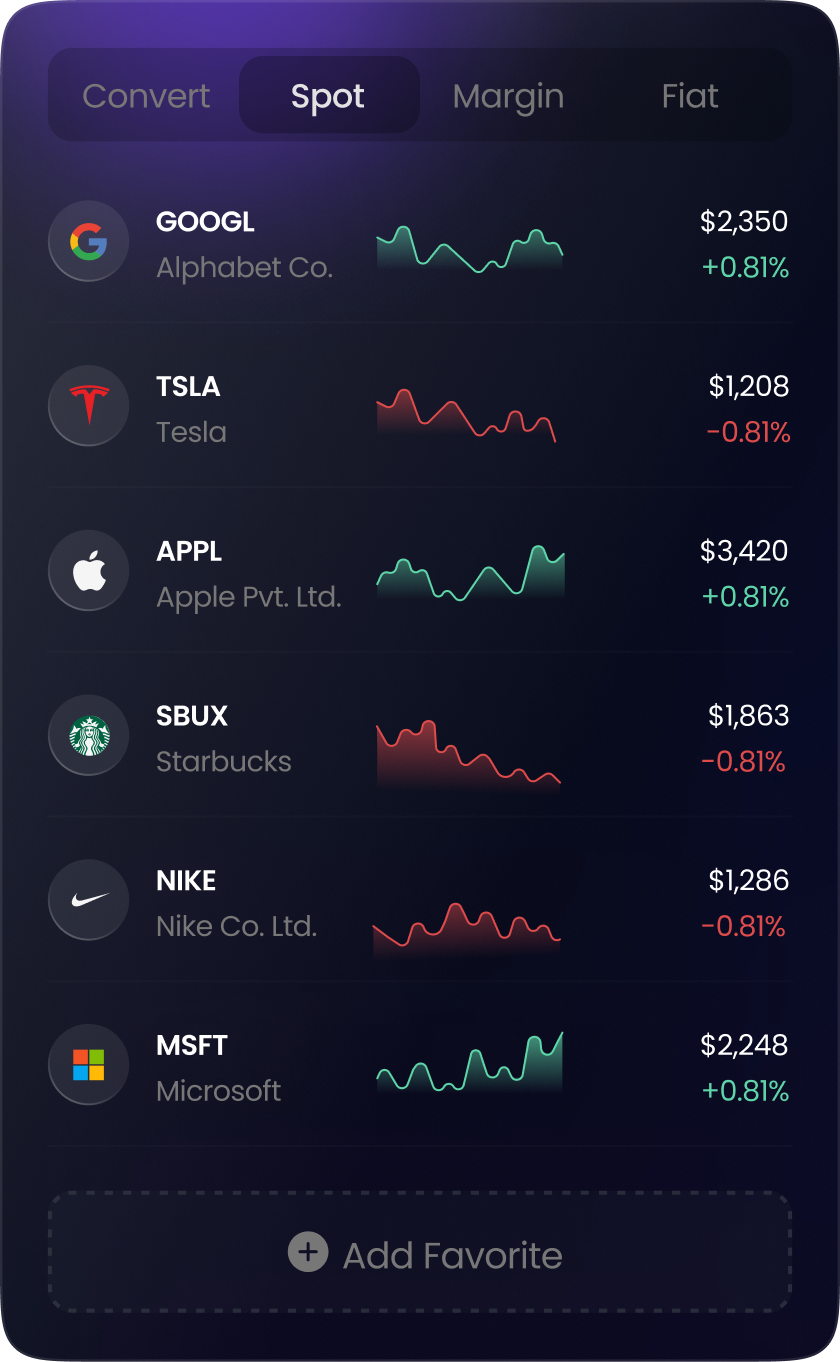

Extensive Choice of Markets

Trade across 10+ asset classes, including Forex, Stocks, Indices, and more.

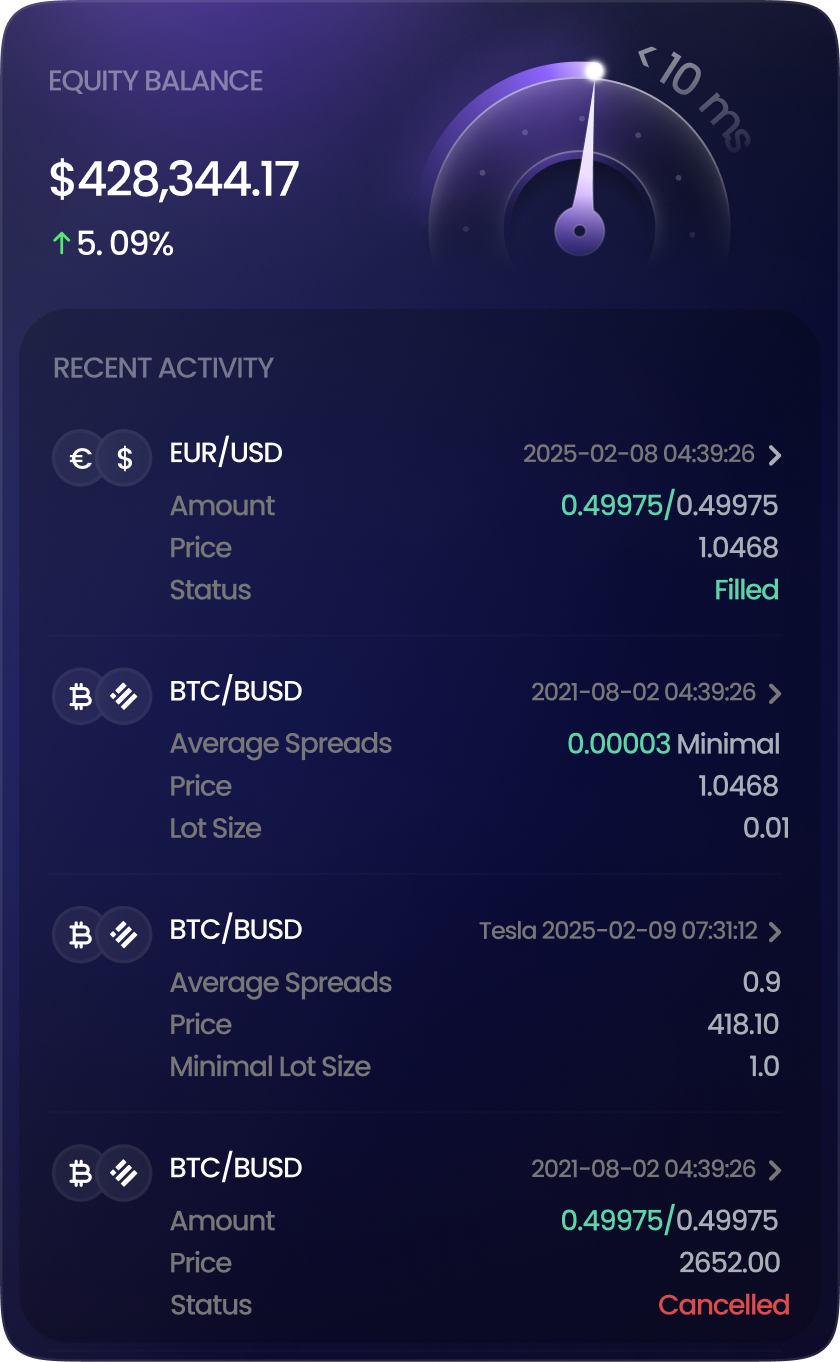

Maximize

Lightning-fast Execution

Never miss an opportunity again with execution speeds of <10ms on all your trades.

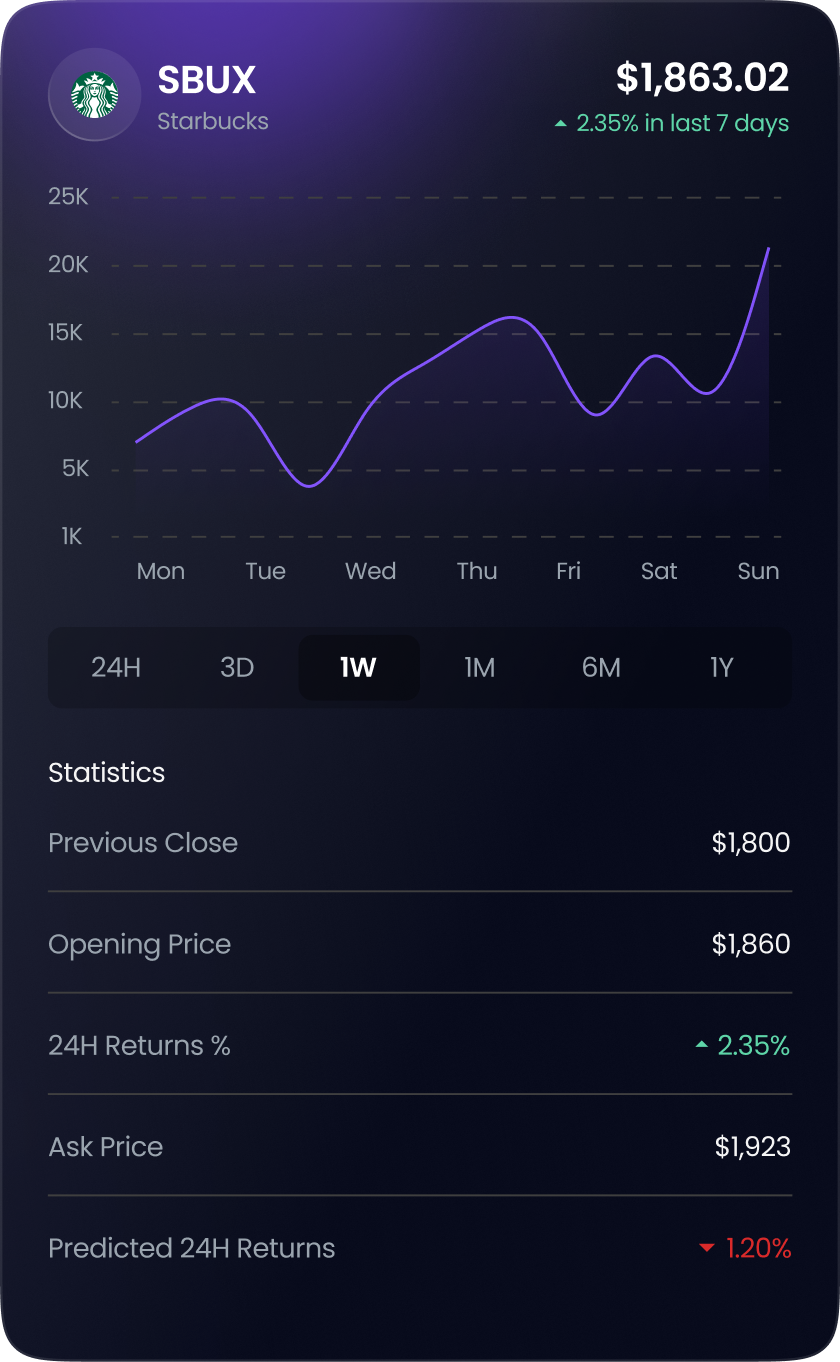

Choose

Market-leading Pricing

Tight spreads, zero commissions* & no hidden fees with customised pricing available upon request.

Tradable Assets

Diverse Tradable Assets

Three steps to start investing

Registration

Verification

Start Trading