The U.S. dollar index (DXY) found solid support in the 104.0-104.50 range following stronger-than-expected U.S. PMIs yesterday, which helped cushion recent declines. The data reaffirmed a growing divergence between a struggling manufacturing sector and a resilient services industry, adding to the uncertainty around the U.S. economic outlook. However, the Conference Board (CB) Consumer Confidence report, which was released earlier today, came in worse than expected, reinforcing concerns about weakening consumer sentiment and further fueling short-term dollar downside risks.

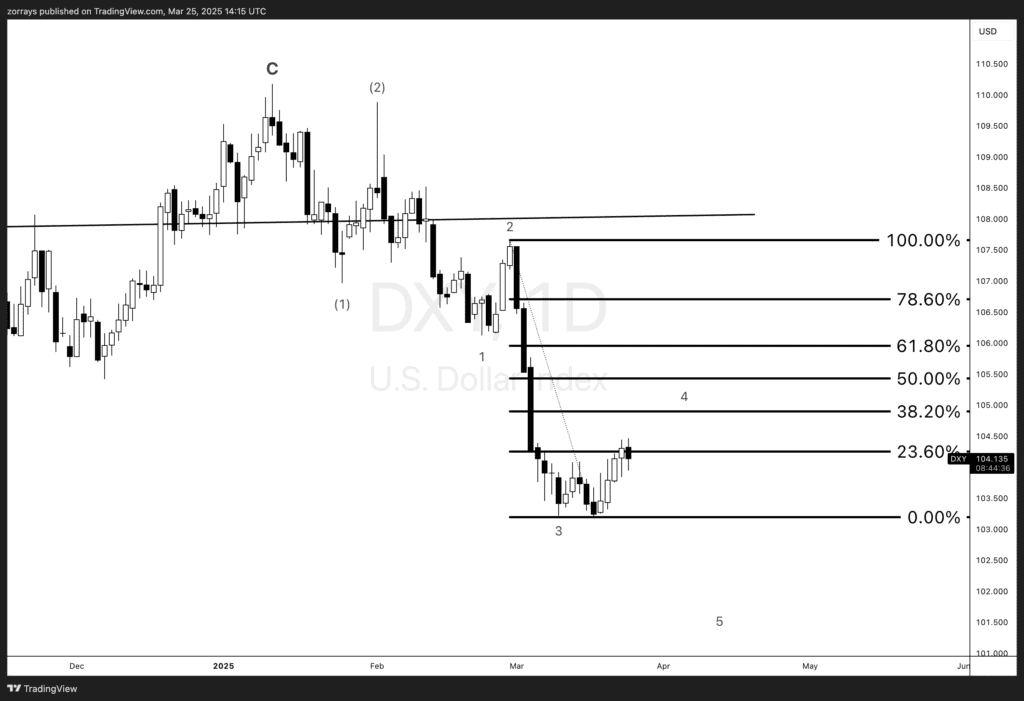

Despite this softer macro picture, technicals suggest the DXY is currently in a Wave 4 correction, with upside potential toward the 38.2% Fibonacci retracement level at 105.000 before resuming a broader downtrend.

Consumer Confidence Miss Confirms Fragile U.S. Outlook

The CB Consumer Confidence report was widely seen as the most important release of the week for FX markets, given its implications for U.S. growth expectations and Federal Reserve policy. Markets had already been on edge following the 14.5-point drop in the index between November and February, which played a key role in shifting investor flows from U.S. to European equities and fueling the EUR/USD rally.

Expectations heading into today’s release were broadly centered around a further decline from 98.3 to 94.0, with some estimates even lower at 93.0. The worse-than-expected outcome confirms that consumer sentiment remains fragile, raising concerns about household spending and broader economic activity. Given that much of the market’s pessimism toward the U.S. economy stems from soft consumer data, today’s report does little to inspire confidence in the dollar’s near-term strength.

DXY Technicals: Wave 4 Correction Targeting 105.000

From a technical standpoint, today’s weak confidence data confirms that the DXY is currently in a Wave 4 correction, following its recent downward impulse move. The 23.6% Fibonacci retracement level around 104.100 has provided initial resistance, but further upside potential remains toward the 38.2% retracement level at 105.000.

This suggests the dollar could see some consolidation in the coming sessions before resuming a broader downtrend. While short-term risks still tilt to the downside, the second half of the week may present a more favorable environment for the dollar, particularly with upcoming trade policy announcements and key inflation data.

Key Catalysts Ahead: Tariffs and Core PCE Inflation

Looking ahead, there are several key events that could shape the dollar’s trajectory for the rest of the week:

- Trade Policy Uncertainty (April 2 Tariff Deadline):

- The Biden administration is set to announce new tariff details this week, including potential car tariffs. Any escalation in trade tensions could have ripple effects on risk sentiment and the dollar’s positioning.

- Core PCE Inflation (Friday):

- The Fed’s preferred inflation measure is expected to come in at 0.3% MoM, which may cap dovish Fed expectations and lend some support to the dollar heading into the weekend.

Other U.S. Data in Focus: New Home Sales & Richmond Fed Index

In addition to today’s CB Consumer Confidence report, markets will also be watching:

- New Home Sales (February):

- Expectations are for strong demand, given tight housing supply and resilient mortgage applications. Any upside surprise here could provide a temporary boost to USD sentiment.

- Richmond Fed Manufacturing Index:

- Given the recent PMI trends, this regional survey may fall back into negative territory, further confirming the ongoing weakness in U.S. manufacturing.

Final Thoughts: Short-Term Dollar Weakness, But Upside Risks Remain

While today’s weak consumer confidence data confirms ongoing headwinds for the U.S. economy, the dollar remains supported by broader macro themes, including tariff risks and sticky inflation. In the near term, technical factors point toward a potential move to 105.000, marking a Wave 4 correction before a renewed downtrend.

Markets will closely watch trade policy updates and the PCE inflation print later this week for further clues on the Fed’s policy path and the dollar’s next major move.