- Opening Bell

- February 3, 2025

- 3min read

U.S. Tariff Surprise Shakes FX Markets, Boosts Dollar

Washington’s unexpected decision to impose full tariffs on Mexico and Canada starting tomorrow has caught FX markets off guard. Just a day prior, reports suggested that tariffs wouldn’t take effect until March 1, allowing time for negotiations. However, the Trump administration appears to be taking a “tariff first” approach, likely aiming for quicker trade deals through maximum pressure.

Market Reaction: Dollar Strength and Commodity Currency Weakness

Technical Analysis

USD/CAD (1H Chart): The U.S. Dollar is surging against the Canadian Dollar, following a strong impulsive move higher. The chart suggests an Elliott Wave count, with wave 3 reaching a peak and a potential wave 4 correction underway before further upside towards wave 5.

NZD/USD (1H Chart): The New Zealand Dollar is in a strong downtrend against the U.S. Dollar, with a clear five-wave structure forming. Wave 3 has completed with a sharp drop, and wave 4 is attempting a minor retracement before a possible continuation lower towards wave 5.

AUD/USD (4H Chart): The Australian Dollar has broken out of a rising channel, signaling a bearish shift. A five-wave decline appears to be unfolding, with wave 3 sharply lower, followed by a potential wave 4 pullback before another drop towards wave 5.

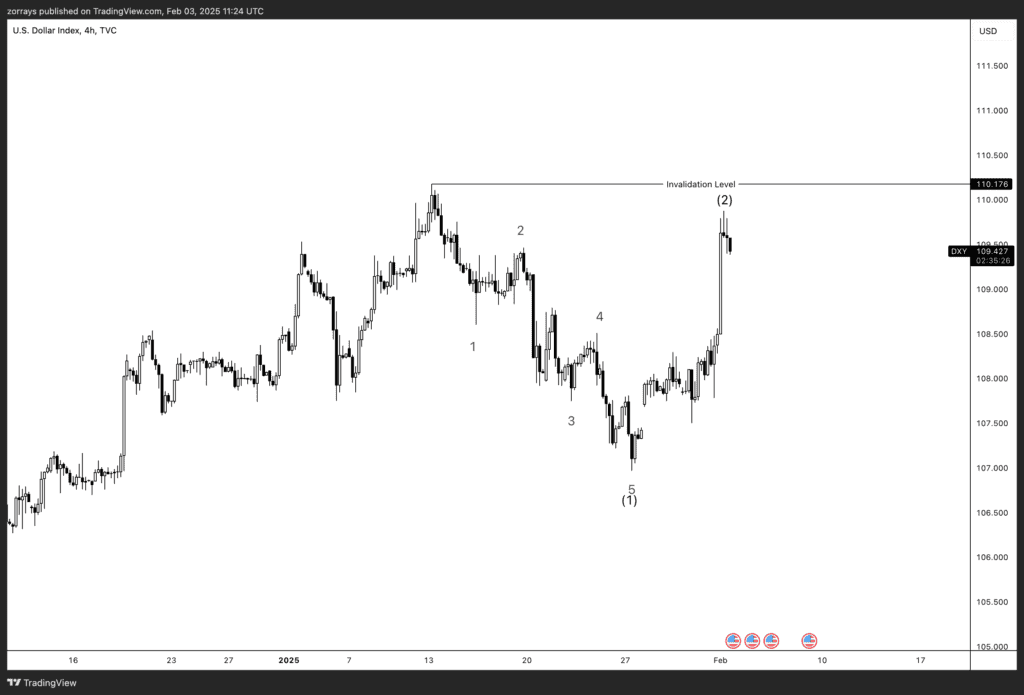

DXY (U.S. Dollar Index, 4H Chart): The U.S. Dollar Index (DXY) has rebounded strongly, invalidating a previous downtrend with a sharp rally. The Elliott Wave structure suggests a corrective wave (2) nearing completion, with a potential continuation of the larger trend depending on price action near the 110.176 resistance level.

The FX market responded with a defensive rally in the U.S. dollar, with the DXY index jumping 1%. Commodity-linked currencies, which thrive on global growth, suffered the most—New Zealand and Australian dollars fell more sharply than the Canadian dollar. Conversely, safe-haven currencies like the Japanese yen and Swiss franc outperformed.

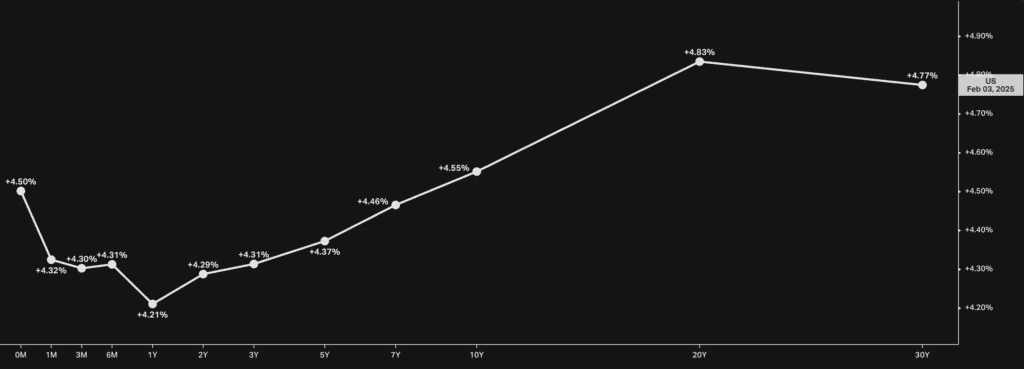

The announcement also sent S&P 500 futures down 2%, as investors worried about disrupted supply chains and weaker corporate profits. Meanwhile, the U.S. yield curve flattened, reflecting concerns over a potential recession. Investors pulled back expectations of Federal Reserve rate cuts, as tariffs are seen as inflationary.

What’s Next?

Investors are watching for any last-minute negotiations between Trump and Canadian or Mexican officials, though expectations are low. FX markets will now track U.S. equities—if stocks fall significantly, the Federal Reserve could turn more dovish, which might weaken the dollar and boost the yen further.

Beyond tariffs, key macroeconomic data this week includes today’s ISM manufacturing confidence report and Friday’s January jobs report. However, annual benchmark revisions could lower previous job creation figures, posing a downside risk for the dollar.

Unless Trump unexpectedly reverses course (which seems unlikely), expect the DXY to hold near this year’s highs. The best chance for a pullback in the dollar may come from Friday’s job data revisions.