- Opening Bell

- January 6, 2025

- 4 min read

Upcoming ISM Services Data and EUR Inflation Estimates

Last week, we examined the ISM Manufacturing Data, which exceeded the forecast of 48.2 by 1.1 points at a reading of 49.3 – reflecting growth in the US manufacturing sector and economic resilience. Overall, a bullish sign for USD and an increased likelihood of USD/JPY reaching 162 once again.

This week, we’ll examine the ISM Services Data, alongside several interesting data points which may affect the trajectory of EUR/USD. Starting off the week, we have several datapoints to examine:

- German Prelim CPI m/m — Monday

- Core CPI Flash Estimate y/y — Tuesday

- Core Flash Estimate y/y — Tuesday

- ISM Services PMI — Tuesday

- JOLTs Job Openings — Tuesday

What to Expect: Forecast Breakdown

Each of these data releases have their own forecasted values, which help paint a picture of the sentiment around USD and Euro. However, if the actual data varies, expect market volatility as major participants may switch up their trade positions rapidly.

| Data Point | Forecast | Previous | How to Interpret |

| German Prelim CPI m/m | 0.3% | -0.2% | If higher than forecasted, bullish for EUR |

| Core CPI Flash Estimate y/y | 2.7% | 2.7% | If higher than forecasted, bullish for EUR |

| Core Flash Estimate y/y | 2.4% | 2.2% | If higher than forecasted, bullish for EUR |

| ISM Services PMI | 53.2 | 52.1 | If higher than forecasted, bullish for USD |

| JOLTS Job Openings | 7.77M | 7.74M | If higher than forecasted, bullish for USD |

Bullish Narrative on USD: ISM Data, JOLTSs Job Openings

The ISM Services PMI forecast is 53.2, which is both over the 50 midpoint and the previous reading of 52.1. Whenever the ISM data is over 50, this suggests a positive growth environment for the measured sector. Although the manufacturing sector is lagging behind , the ISM Manufacturing Data has shown growth over the last 3 readings, growing from 46.5 to 49.3.

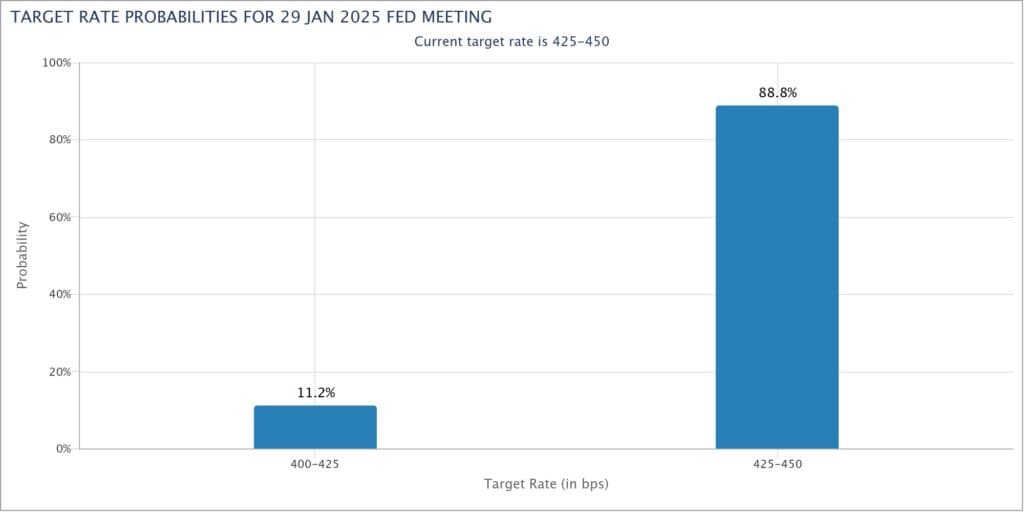

Overall, there is a stronger bullish narrative on USD as we head into January with a lowered expectation of a Fed rate cut. The Federal Reserve does not have enough reason to issue rate cuts when the economy is showing resilience, especially if they want to stick to their inflation target of 2.0%.

The JOLTS Jobs Opening is forecasted to come in higher as well, increasing the market expectations for a rate hold rather than a cut. Unless the data points come in lower than forecasted tomorrow, this bullish sentiment should continue on USD – pressuring the EUR/USD Forex Pair.

Slightly Bullish Narrative on Euro: Supported by Technicals

While USD data paints a strong bullish picture, the Euro is showing some resilience, supported by both inflation figures and technical levels. The Core CPI Flash Estimate at 2.4% (up from 2.2%) highlights persistent inflation pressures, which could keep the ECB cautious on rate cuts. If inflation remains sticky, the ECB may delay easing monetary policy, potentially lending strength to the Euro.

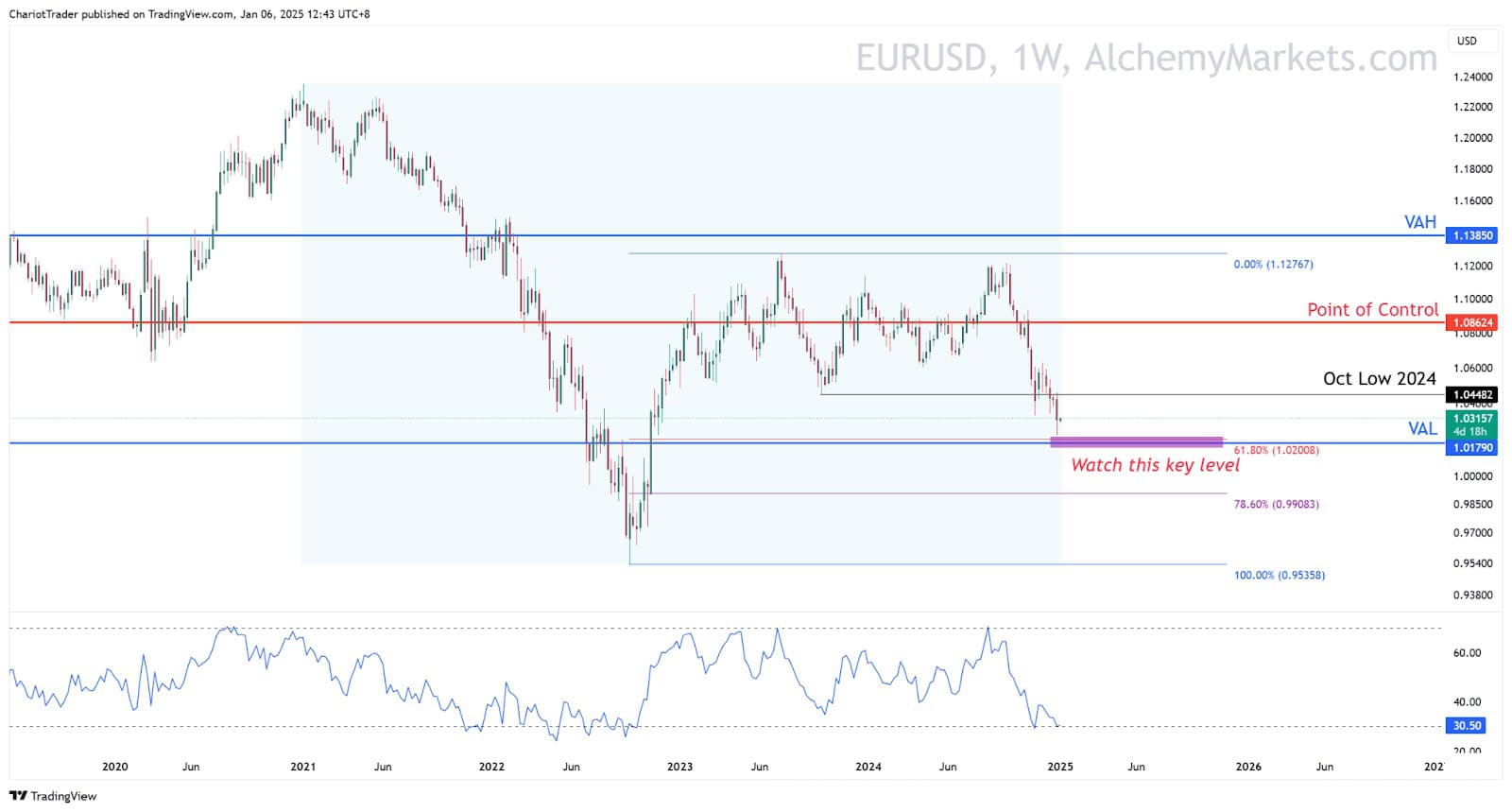

From a technical standpoint, the EUR/USD pair is trading near a key support zone, as shown in the chart at $1.01790 to $1.02008. The weekly RSI is also bottoming out at 30.50, but is not yet under 30, which technically puts EUR/USD into oversold territory.

The Rundown: The Value Area Low (VAL) of the entire range from January 2021 is at $1.01790, which coincides with the 61.8% Fibonacci retracement level around $1.02008. This confluence of critical technical levels creates a strong possibility for a potential bounce. A break above the October 2024 low at 1.04482 could open the door for a retracement toward the Point of Control ($1.08624).

Alternate Scenario: However, failure to hold this support could trigger a continuation toward the 78.6% Fibonacci retracement level at 0.99083, which provides an alternate bounce point. By then, the VAL would flip into resistance.

In summary, while economic fundamentals favour the USD, technical support zones and inflation data provide some reasons for EUR bulls to watch for a short-term rebound.

You may also be interested in: