- Elliott Wave

- December 16, 2024

- 2min read

S&P 500 Elliott Wave: The Rally Continues

Executive Summary

- S&P 500 continues to rally in wave 5

- Additional highs are anticipated at $6200 and possibly $6325-6400 based on Fibonacci wave relationships

- A print below $6013 would cause us to reconsider the preferred wave count

Fed Meeting and US Interest Rates

The heavy news for this week is the FOMC meeting and concluding on Wednesday, December 18 announcing their latest interest rate maneuvers.

The street is largely expecting Fed rate cuts of 25 basis points to 4.25%-4.50%. If any surprises exist, it will be the Fed’s interest rate projections for 2025.

The SP500 has been cheering the interest rate cuts for the past four months as the cost of money reduces.

How much higher can the SP500 go?

Current Elliott Wave Count

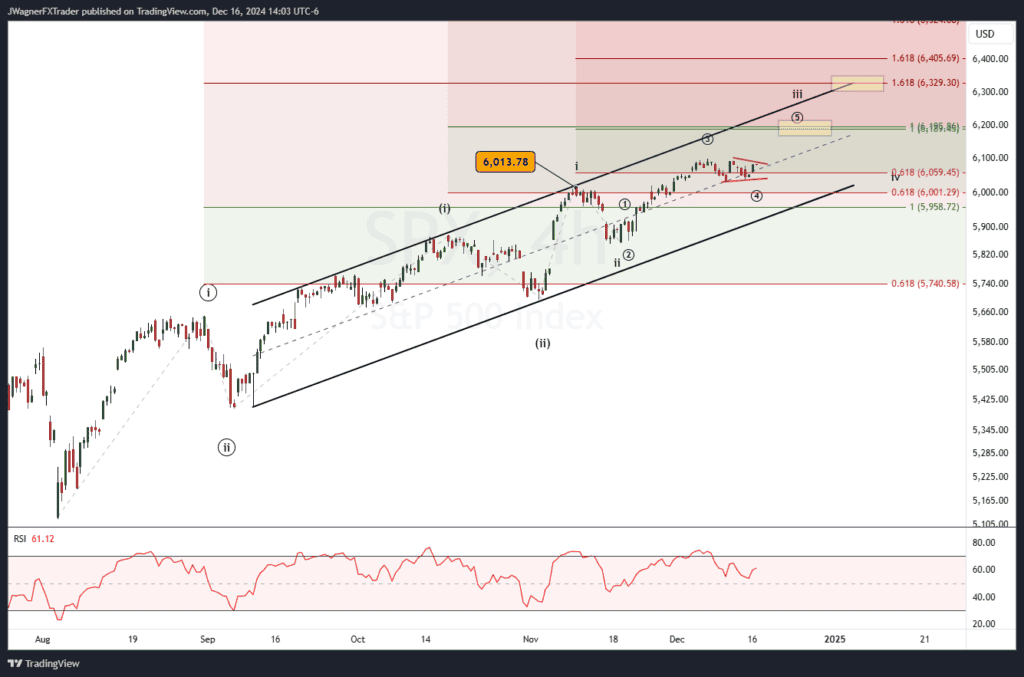

The S&P 500 has developed into a well-defined Elliott wave progression in a rising channel. Our October 3 post listed two different Elliott wave counts. We are narrowing down and focusing on just the bullish count right now.

After wave 4 bottomed in early August, SP 500 is rallying in wave 5 that appears incomplete.

Within the 5th wave, we can anticipate a motive wave to develop, an impulse or diagonal.

The current shape of the rally from August does open the door for either interpretation (impulse or diagonal).

The image above displays an ongoing impulse rally for wave 5 and the current wave appears to be (iii) of ((iii)) of 5. If this wave structure is correct, then SP 500 would be entering the meat of this fifth wave rally.

Initial topside projections based on Fibonacci extension show a soft target near $6200, then $6325-$6400.

If this wave count is correct, then even a slight dip near $6200 should remain shallow as a small degree 4th wave with even higher prices is still anticipated.

A breakdown below $6013 will be a cause for concern that another pattern, possibly a diagonal is carving.

Bottom Line

Based on the current Elliott wave count, we are anticipating SP500 to continue its uptrend to $6200 and possibly $6325-6400.

In the unexpected event of a print below $6013, then we’ll reconsider the wave count and consider a diagonal for wave 5.

You might also be interested in: