- Weekly Outlook

- December 13, 2024

- 5 min read

Fed’s December Rate Cut: A Slower, Steadier Course Ahead

The Federal Reserve is poised to adjust its monetary policy with a significant 25 basis points (bp) rate cut on 18th December 2024. This move aligns with the Fed’s broader effort to transition from restrictive monetary policy toward a neutral stance. However, the path ahead appears more measured, reflecting sticky inflation and evolving economic dynamics under President-elect Trump’s pro-growth agenda. Below, we explore the expected rate cuts, policy signals for 2025, and their implications for the broader economy.

Expected December Rate Cut: A Step Toward Neutrality

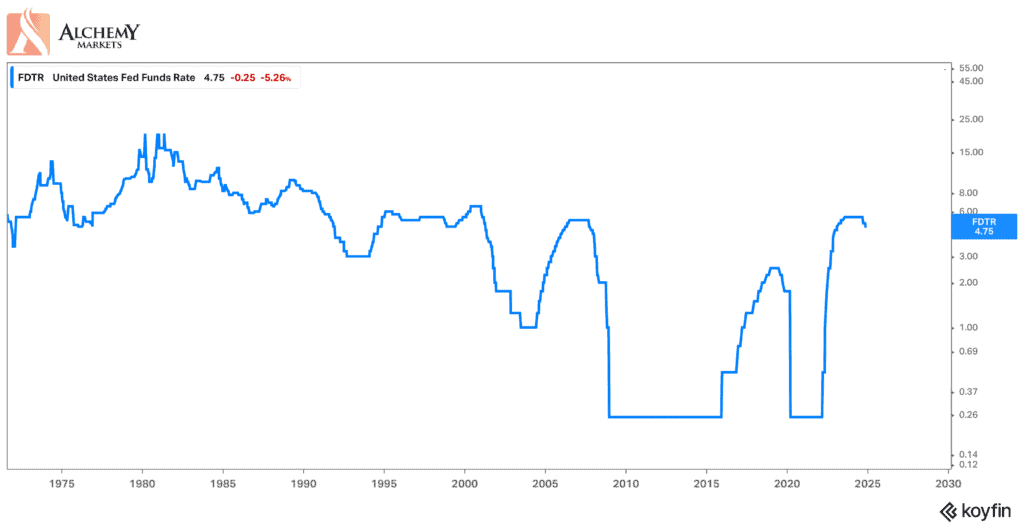

Over the last two Federal Open Market Committee (FOMC) meetings, the Fed has implemented 75bp in rate cuts. A further 25bp cut this December would lower the ceiling rate from its current 4.75% closer to the projected long-run neutral rate of 3%. This adjustment reflects the Fed’s dual mandate to balance inflation and employment while preparing for anticipated changes in the economic landscape under the incoming administration.

Key Economic Indicators Influencing Policy

Inflation Trends

Inflation has not made significant progress toward the Fed’s 2% target. Persistent monthly inflationary spikes of 0.3% remain concerning. However, the Fed’s preferred measure, the core Personal Consumer Expenditure (PCE) deflator, hints at a modest improvement, with an encouraging 0.2% month-over-month rise expected in December.

Employment Dynamics

The labour market shows signs of cooling, with slower payroll growth, declining full-time employment, and a slight uptick in unemployment. These trends provide the Fed with justification to move closer to a neutral policy stance.

2025 Policy Projections: A Slower Easing Cycle

Fewer Rate Cuts Expected

While the Fed initially projected four rate cuts for 2025, evolving economic conditions suggest a reduction to three 25bp cuts. These adjustments reflect expectations of stronger near-term growth spurred by pro-business policies, low taxes, and regulatory reform under President Trump, coupled with inflationary risks from tariffs and immigration controls.

Growth and Inflation Revisions

Economic forecasts are likely to undergo modest upward revisions for growth and inflation in late 2024. Despite these adjustments, substantial changes to 2025 projections are unlikely until the March FOMC meeting when the Fed has greater clarity on Trump’s fiscal and trade policies.

Terminal Rate Expectations

The Fed’s expected terminal rate for 2025 is approximately 3.75%, with cuts distributed evenly across the year. These decisions balance the need to support economic growth without exacerbating inflationary pressures.

Technical Adjustments in the Fed’s Reverse Repo Rate

Adjusting the Reverse Repo Mechanism

The Fed is considering a technical adjustment to its reverse repo rate, which currently stands at 4.55%. A proposed 5bp reduction would align the reverse repo rate with the Fed funds floor, effectively cutting the reverse repo rate by 30bp to 4.25%. These adjustments aim to manage the effective Fed funds rate, which is expected to decline to 4.33%.

Implications for Quantitative Tightening

Reducing the reverse repo rate is part of the Fed’s strategy to gradually phase out its reverse repo facility, potentially paving the way for an eventual halt to quantitative tightening. This process is unlikely to impact bank reserves significantly until mid-2025.

Impact on the US Dollar and Global Markets

Resilience of the Dollar

Rate differentials have driven the dollar’s strength since October, and the December FOMC meeting is unlikely to disrupt this trend. With limited changes anticipated in the Fed’s easing cycle, the dollar’s bullish momentum is expected to persist.

Tariff and Trade Policy Risks

Market sentiment is closely tied to President Trump’s impending inauguration and potential early moves on tariffs. These policies could bolster the dollar further, as tariffs often create inflationary pressures that support higher rates.

EUR/USD Outlook

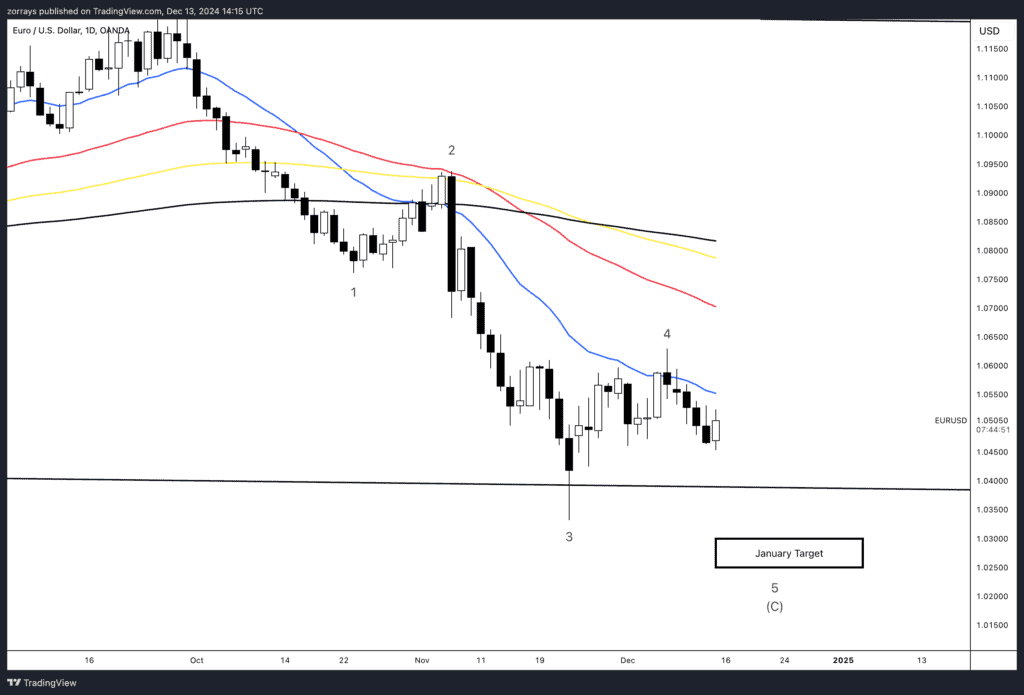

The euro remains firmly under pressure, with the EUR/USD pair trading below a cluster of key moving averages, signaling persistent bearish momentum. As shown in the chart, this setup aligns with the Elliott Wave analysis, which points toward a Wave 5 move targeting new lows near the 1.025/03 range by early January 2025. The Federal Reserve’s policy decisions, emphasizing a cautious yet steady easing path, reinforce this downward trajectory. With a firm dollar trend supported by rate differentials and pro-growth U.S. policies, the EUR/USD pair is likely to continue its descent into the projected target zone.

Conclusion: A Measured Approach to Monetary Policy

The Federal Reserve’s December rate cut and cautious outlook for 2025 reflect a deliberate effort to navigate a complex economic environment. Sticky inflation, labor market shifts, and anticipated fiscal policies under President Trump all contribute to a slower easing path. While these moves aim to balance growth and inflation, the Fed’s technical adjustments and market dynamics signal a strategic recalibration of monetary policy in the year ahead.

Frequently Asked Questions (FAQs)

- Why is the Fed cutting rates in December 2024?

The Fed is cutting rates to transition from restrictive monetary policy toward a neutral stance, reflecting cooling employment trends and modest improvements in inflation. - What does the December rate cut mean for 2025 policy?

The Fed is signaling fewer rate cuts in 2025, with an anticipated three 25bp reductions due to near-term growth prospects and inflation risks. - How does the reverse repo rate adjustment impact monetary policy?

Adjustments to the reverse repo rate align it with the Fed funds floor, supporting a gradual decline in the use of the reverse repo facility and facilitating a smoother transition to neutral policy. - What is the expected terminal rate for 2025?

The Fed’s terminal rate for 2025 is projected to be around 3.75%, reflecting three 25bp cuts over the year. - Will the dollar remain strong after the December FOMC meeting?

Yes, rate differentials and limited changes in the Fed’s easing cycle are expected to maintain the dollar’s bullish trend. - How might Trump’s policies influence the Fed’s decisions?

Trump’s pro-business agenda could lift near-term growth, but trade protectionism and immigration controls may introduce inflationary pressures that shape the Fed’s policy path.