Weekly outlook

- November 29, 2024

- 4min read

NFP Showdown: Will the Jobs Report Seal the Fed’s Next Move?

The upcoming week in the financial markets is set to revolve around a critical economic data release: the November Non-Farm Payrolls (NFP) report on Friday. This report holds significant weight as market participants assess its implications on Federal Reserve policy, with a rate decision looming on December 18. Alongside the labor market update, key technical developments in the S&P 500 Index (SPX) and the US Dollar Index (DXY) will also demand close attention.

Labour Market: All Eyes on Non-Farm Payrolls

The Federal Reserve’s dual mandate, which prioritises both price stability and maximum employment, places next week’s jobs report in the spotlight, particularly as inflation continues to run hotter than expected. While the Fed remains split on whether to cut rates by 25 basis points (bps) at the December 18 meeting, Friday’s NFP data could tip the scales.

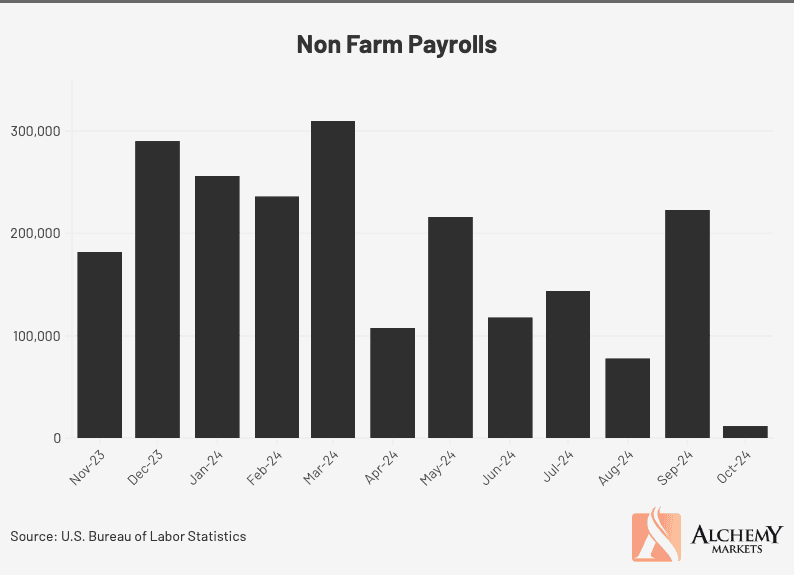

October Recap: Weather and Strikes Distorted Data

Last month’s disappointing addition of 12,000 jobs to non-farm payrolls fell well below expectations, but the outcome was influenced by one-off factors. For instance, Hurricane Milton negatively impacted Florida, where employment dropped by 38,000 relative to its six-month trend growth of 13,000 jobs. The hurricane likely depressed payrolls in Florida by around 51,000 jobs, with smaller losses observed in the Carolinas and Virginia, bringing the total hurricane-related drag to approximately 60,000–65,000 jobs.

Additionally, strike activity at Boeing slashed another 44,000 jobs from October’s payroll numbers. These temporary disruptions are expected to reverse in November, with affected workers returning to the labor force.

November Expectations: Rebound and Core Growth

The anticipated rebound from October’s distortions forms the baseline for this month’s data. Adding back the 109,000 jobs lost due to weather and strikes, we forecast headline payrolls growth of 225,000. However, this implies “true” underlying job growth of just 116,000, after stripping out the technical rebound.

The unemployment rate, which stood at 4.1% in October, is projected to edge up to 4.2%, reflecting moderate slack in the labor market. If these projections materialise, the Federal Reserve is likely to lean toward a rate cut in December to provide further economic support.

Technical Analysis: S&P 500 Index (SPX) and US Dollar Index (DXY)

While economic data will drive sentiment, technical developments in key financial instruments are also shaping market expectations.

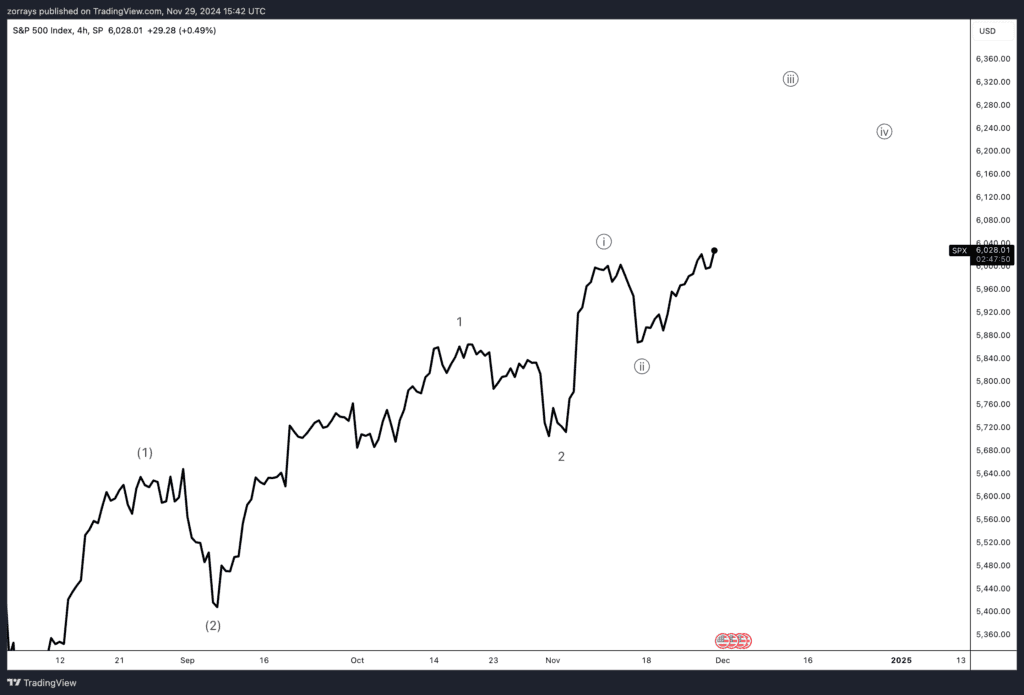

S&P 500 (SPX): Eyeing Wave 3 of 3

The S&P 500 has displayed remarkable strength recently, climbing steadily within its Elliott Wave structure. The index is playing out a third wave of the third impulsive wave, characterized by strong bullish momentum.

Looking ahead, the SPX appears poised to test the 6,300 level, aligning with its current trajectory and wave count. This level could serve as a key resistance zone, but traders will be watching for signs of exhaustion or continuation as the broader market absorbs next week’s economic data.

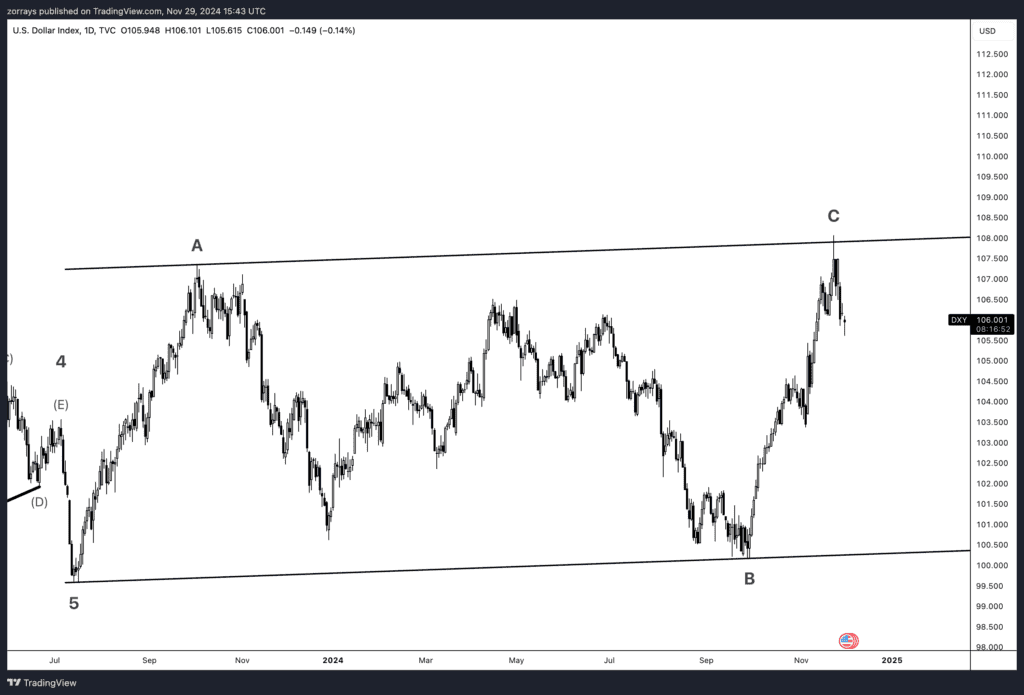

US Dollar Index (DXY): A Pivotal Juncture

The US Dollar Index (DXY) has also seen significant price action, reaching the 108.000 target that we previously anticipated. From this level, the index has bounced lower, respecting the boundaries of its well-established ascending channel.

Now, DXY traders face a critical juncture. The bounce suggests that buyers remain in control within the channel, but whether the index pushes higher or retraces further will depend on how markets interpret the upcoming NFP data. Until then, price action within the channel warrants cautious observation as the dollar’s direction remains unclear.

Conclusion: A Week of High Stakes

With the Federal Reserve’s next move hanging in the balance, the November NFP report will provide crucial insights into the health of the US labor market. The headline figure, alongside unemployment and wage growth, will shape the Fed’s December policy decision and the broader market outlook.

From a technical perspective, the SPX continues its bullish advance toward 6,300, while the DXY is navigating key support and resistance levels within its ascending channel. Next week’s developments will determine whether these trends hold or if market sentiment shifts in response to new economic realities.

Stay tuned for Friday’s report, as well as how the labor market and technical patterns across the SPX and DXY evolve in the lead-up to this pivotal release.