- Weekly Outlook

- November 1, 2024

- 3 min read

Rate Decisions and a High-Stakes Election: Markets Brace for a Pivotal Week

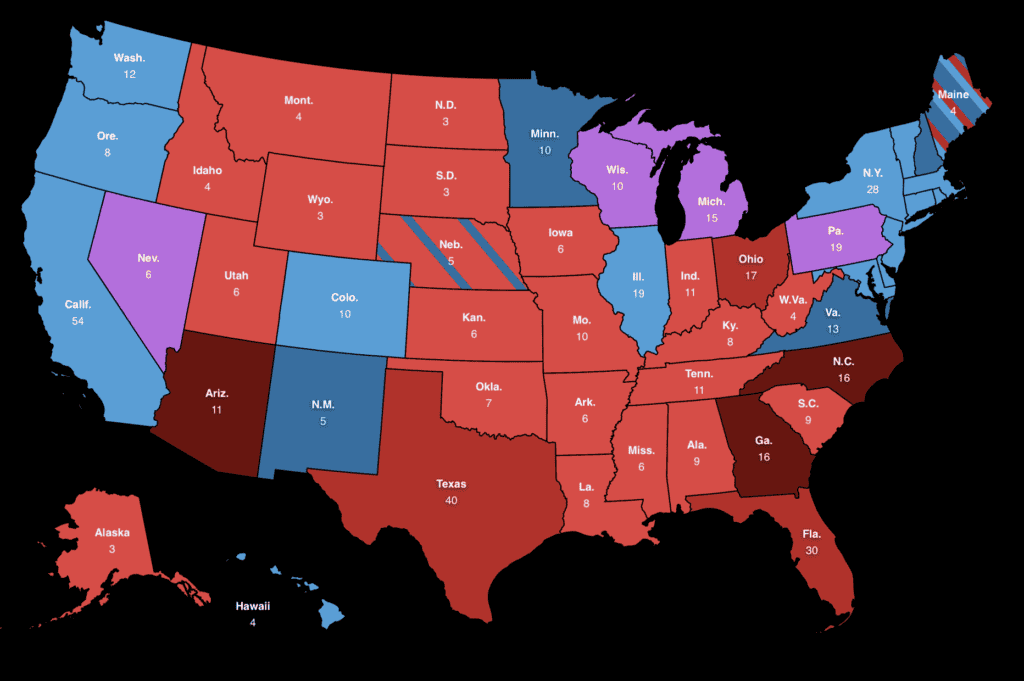

A High-Stakes Election

Source: CNN

Election (Tuesday):

The upcoming U.S. election will be pivotal for economic policy direction. While recent polling suggests a tight race, financial markets appear increasingly confident in a Trump victory. This optimism has bolstered U.S. equities, the dollar, and Treasury yields over the past few weeks. Should Trump win, these trends are likely to persist, as investors anticipate a more business-friendly, lower-tax environment. However, policies like increased tariffs, stricter immigration measures, and potentially higher borrowing costs could challenge growth in the medium to long term. Conversely, a win for Harris could bring stability, though her ability to push major policy changes through a divided Congress might be limited. Markets may view a Harris administration as a moderate outcome, with only slight tax increases and restrained spending, which could put pressure on the Federal Reserve to play a more active role in supporting growth through rate cuts.

Fed and Bank of England in the Spotlight

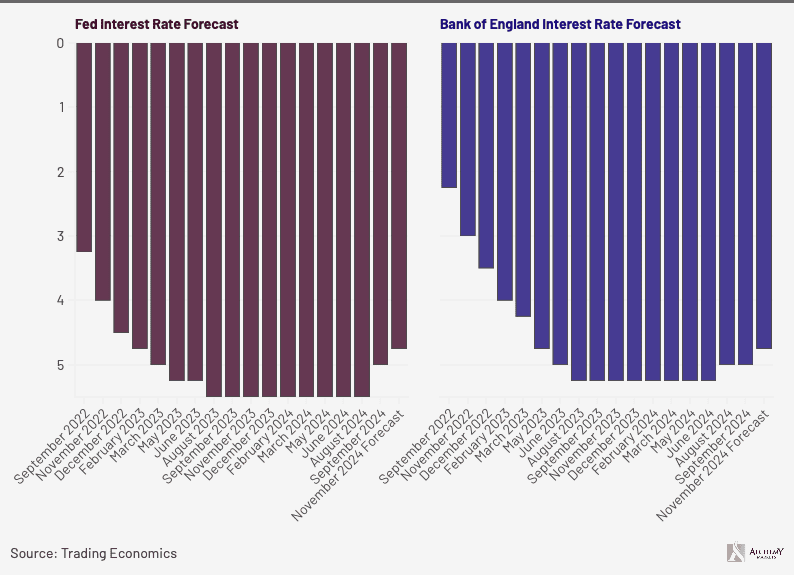

Federal Reserve Decision (Thursday):

Regardless of the election outcome, the Federal Reserve is expected to announce a 25-basis-point rate cut. Despite recent easing, the Fed’s stance on inflation remains cautious, with the focus shifting toward ensuring stability in the job market to support continued growth. Even with September’s notable rate reduction, monetary policy remains somewhat restrictive, leaving room for the Fed to cut rates further to encourage economic expansion. This shift back to a more neutral rate stance aligns with the Fed’s goal of a “soft landing” for the economy.

Bank of England Decision (Thursday):

A rate cut of 25 basis points is widely anticipated from the Bank of England, yet market participants are more focused on officials’ remarks regarding October’s budget. Although the Office for Budget Responsibility projects that the new budget will stimulate GDP and inflation into 2024, it may not substantially influence the Bank’s monetary policy outlook. Meanwhile, the lower-than-expected services inflation since August may hold greater significance for the Bank’s policy direction. In what could be a volatile week, the BoE is likely to maintain a cautious tone, avoiding direct commentary on market pricing, which is a rare stance for the Bank. Looking ahead, the next few inflation reports will be crucial in determining whether further rate cuts are on the horizon, with December being the next likely consideration for potential policy easing.

This week will be a defining one for both U.S. and U.K. markets, with high-stakes events that could influence economic trajectories well into next year.