- Weekly Outlook

- October 18, 2024

- 6min read

A Packed Earnings Week and Major Central Bank Decision Looms

As we head deeper into the Q3 2024 earnings season, the spotlight shifts to several big names in the coming week, including Amazon (AMZN), Google (GOOGL), and Tesla (TSLA). These corporate heavyweights are poised to release their quarterly financial results, which could significantly impact market sentiment and drive volatility in both stock and currency markets. Alongside these corporate earnings, the Bank of Canada (BoC) is expected to make an important interest rate decision that could influence the trajectory of the Canadian dollar.

In this weekly outlook, we’ll explore what to expect from the BoC decision, its implications for USD/CAD, key U.S. economic data releases, and dive into the earnings reports from top companies.

Bank of Canada: Fourth Rate Cut Expected, but the Magnitude is Uncertain

Next week, the Bank of Canada is expected to announce a fourth consecutive rate cut. While inflation has finally dipped below the central bank’s target, and unemployment is trending higher, the economy is still showing signs of growth. This creates a dilemma for policymakers.

Will the BoC opt for a 25 basis point (bp) cut, or could they surprise markets with a more aggressive 50bp reduction?

Many market participants are leaning towards the central bank maintaining its recent pace with a 25bp cut, although a 50bp cut is still on the table as a possibility. A larger cut would accelerate the shift towards more neutral policy rates. However, we narrowly favor the BoC sticking with the 25bp approach, given the current economic backdrop. Nevertheless, the chance of a 50bp cut cannot be ruled out entirely, especially if policymakers aim to signal a faster return to neutral rates.

Impact on USD/CAD: Can the Loonie Recover?

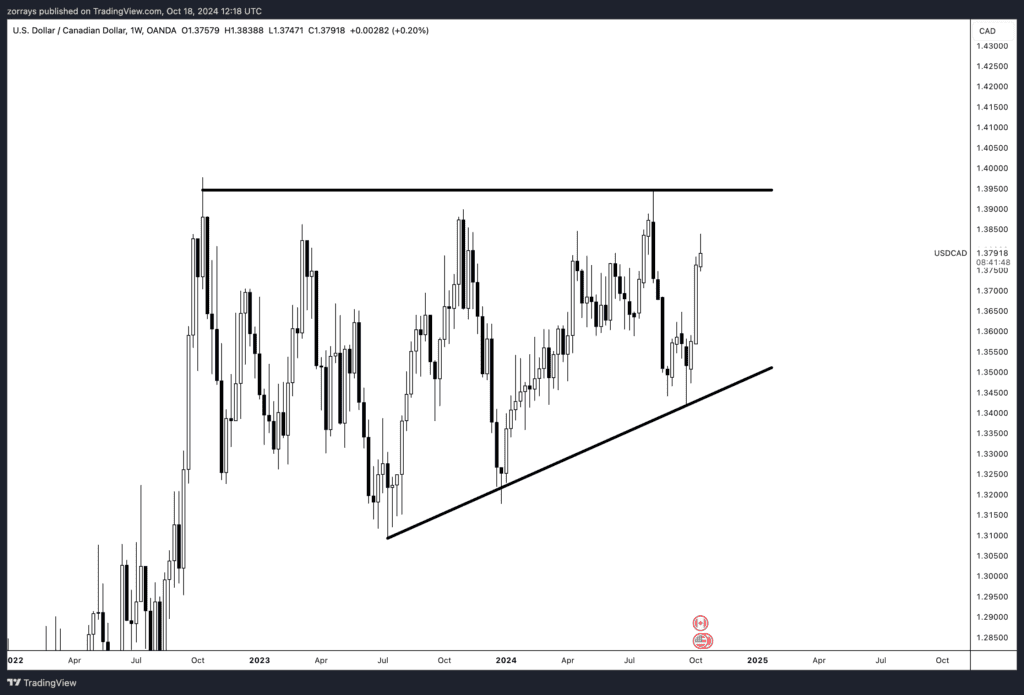

The USD/CAD pair has been on a rally, driven by a widening gap between the U.S. and Canadian two-year swap rates. Since early October, this gap has widened from 50bp to 80bp, reflecting dovish expectations for Canadian rates and hawkish moves in the U.S. Federal Reserve.

This widening gap has propelled USD/CAD to the 1.38 mark, limiting the Canadian dollar’s ability to benefit from its traditionally lower risk profile. However, next week presents an interesting dynamic. If the BoC opts for a 25bp cut, this could trigger a correction in the Canadian dollar, sending it higher as markets have largely priced in a 50bp move that isn’t guaranteed.

Even if the BoC cuts by 50bp, the likelihood of further dovish repricing in the Canadian OIS curve is low, with markets already pricing in another 25bp cut in December. As a result, we believe there’s room for the Canadian dollar to appreciate, particularly against other commodity currencies like the Australian dollar (AUD) and New Zealand dollar (NZD), which are more exposed to external risks.

Key U.S. Economic Data: Signs of Slowing Growth?

Next week also brings some critical data releases from the U.S., including building permits and the University of Michigan Consumer Expectations Index. These reports are leading indicators of economic health and can provide a clearer picture of where the U.S. GDP is heading.

- Building Permits: A drop in building permits could signal a slowdown in the housing market, an essential driver of the U.S. economy. Any decline here could add to concerns about slowing economic growth.

- Michigan Consumer Expectations: This indicator measures how confident consumers feel about their financial outlook, and is closely watched as a gauge of future consumer spending, which drives about 70% of U.S. economic activity.

Together, these data points will help us gauge the trajectory of the U.S. economy, influencing both the dollar and broader market sentiment. If the data disappoints, we could see increasing caution from investors, while positive surprises might lend support to the USD and U.S. equities.

Earnings Season Highlights: What to Watch for

The earnings season heats up next week with major corporations releasing their Q3 results, providing insights into how businesses have fared amid slowing economic growth and inflationary pressures. Investors will be closely watching not just the revenue and earnings per share (EPS) results, but also forward guidance that could impact the markets.

Here’s a look at the most anticipated earnings reports for the upcoming week:

| Company | Ticker | Revenue Forecast | EPS Forecast |

|---|---|---|---|

| Alphabet A | GOOGL | $86.35B | $1.84 |

| Amazon | AMZN | $157.23B | $1.14 |

| Tesla | TSLA | $25.41B | $0.59 |

| Verizon | VZ | $33.5B | $1.18 |

| General Motors | GM | $44.92B | $2.4 |

| Coca-Cola | KO | $11.65B | $0.75 |

| AT&T | T | $30.45B | $0.5689 |

| Boeing | BA | $18.59B | -$1.54 |

| eBay | EBAY | $2.55B | $1.18 |

Corporate Earnings Outlook

- Google (GOOGL) and Amazon (AMZN): Both tech giants are expected to post significant revenues, with Google’s forecast revenue at $86.35B and Amazon projected to reach $157.23B. Investors will be particularly interested in how both companies are navigating the cloud market competition and ad spending.

- Tesla (TSLA): Tesla’s Q3 report will be closely scrutinized for any hints on its future vehicle deliveries and profitability. Analysts forecast revenue of $25.41B and an EPS of $0.59.

- Coca-Cola (KO) and General Motors (GM): Coca-Cola is a bellwether for consumer sentiment, with revenue expected at $11.65B, while General Motors’ results will provide insight into how automakers are coping with inflation and supply chain disruptions, with forecasted revenue at $44.92B.

- Verizon (VZ) and AT&T (T): Both telecom giants are set to report next week. With Verizon’s revenue expected at $33.5B and AT&T’s at $30.45B, these companies will likely focus on subscriber growth and 5G deployment.

- Boeing (BA): After struggling with production issues, Boeing’s earnings will reflect the challenges in the aerospace industry, with analysts expecting $18.59B in revenue but a negative EPS of -$1.54.

- eBay (EBAY): eBay is forecast to report revenue of $2.55B and an EPS of $1.18. Investors will focus on how well the company has managed to attract and retain customers in a highly competitive e-commerce landscape.

Conclusion

Next week promises to be a pivotal one for both the stock and currency markets, with several major earnings reports and a crucial interest rate decision from the Bank of Canada. Whether the BoC opts for a 25bp or 50bp cut, the Canadian dollar is likely to experience volatility, with potential for appreciation if markets are caught off-guard by a more conservative approach. On the U.S. side, leading economic indicators such as building permits and consumer expectations will provide further clues about the health of the economy and future direction of the USD. Meanwhile, corporate earnings from Amazon, Google, Tesla, and others will set the tone for market performance in the near term.