- Chart of the Day

- October 18, 2024

- 4 min read

Netflix’s Blockbuster Q3 2024: Ready to Stream Higher Pre-Market After Strong Earnings

Netflix is kicking off Q4 2024 on a high, with its stock set to open nearly 6% higher pre-market following its impressive Q3 earnings. After experiencing a dip of nearly 8% earlier in October, investor confidence has been reignited by the company’s solid performance and positive forward guidance. Here’s a breakdown of Netflix’s Q3 results, its outlook for the next quarter, and the technical setup that could pave the way for further gains.

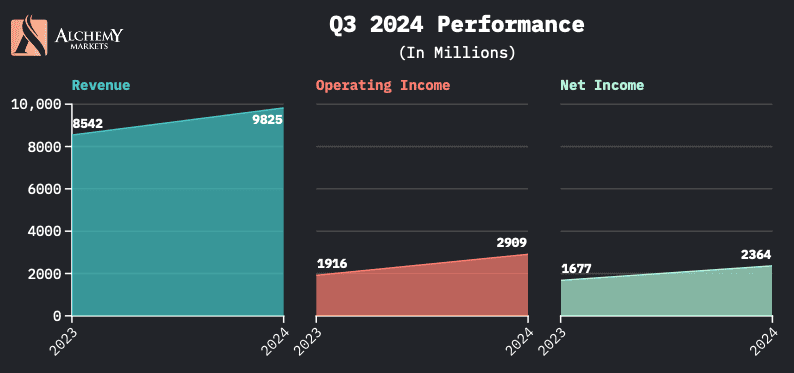

Q3 2024 Performance: Strong Growth and Profitability

Data Source: Netflix

Netflix reported a 15% year-over-year revenue increase in Q3 2024, totaling $9.8 billion. This growth exceeded the company’s initial forecasts, marking an important milestone with an operating margin of 30%, up from 22% last year. The operating income soared 52% to $2.9 billion, significantly boosting earnings per share (EPS) to $5.40, a 45% jump from $3.73 in Q3 2023.

This strong performance can be attributed to several hit shows and films, including The Perfect Couple and Beverly Hills Cop: Axel F, which drove engagement and increased paid memberships. Netflix’s decision to crack down on password sharing continues to bear fruit, with paid memberships increasing 14% year-over-year, reaching 282.7 million globally.

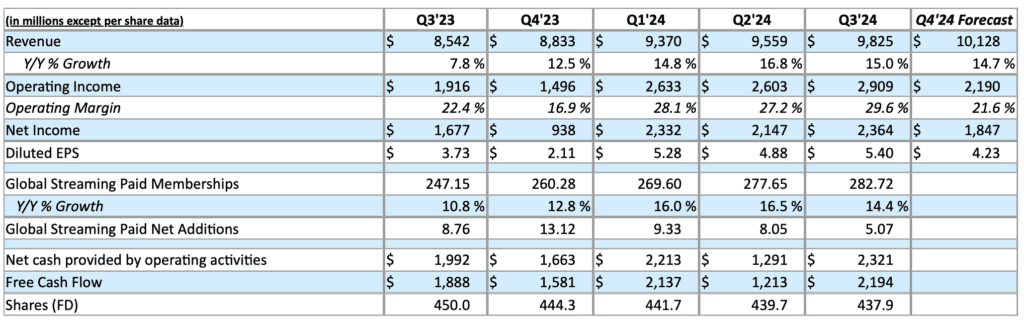

Forward Guidance: A Bullish Outlook for Q4 2024

Data Source: Netflix

Looking ahead, Netflix is optimistic about Q4 2024, projecting 15% revenue growth and a robust content lineup. New releases such as Squid Game Season 2 and the highly anticipated Jake Paul vs. Mike Tyson fight are expected to fuel engagement. The company anticipates an operating margin of 22%, which would represent a five-percentage-point improvement compared to Q4 2023.

For the full year, Netflix is now guiding for an operating margin of 27%, up from its previous forecast of 26%, reflecting the company’s strong cost management and focus on growing its advertising business. Netflix has been rapidly scaling its ad-supported tier, which grew 35% in membership quarter-over-quarter. As this initiative gains traction, it will play a pivotal role in driving future revenue growth.

Red Flags to Watch

Despite Netflix’s strong Q3 performance, there are a few areas that warrant attention as we move into Q4:

- LATAM Market Softness: Latin America was the only region to report negative paid membership growth in Q3, likely due to recent price hikes and a weaker content slate. This softness could be a concern if it extends into future quarters.

- Monetisation of Ads Tier: While membership in Netflix’s ad-supported tier grew impressively, the company admits there’s work to be done in improving ad monetisation. It has built up a significant ad inventory but will need time to scale revenues from this channel.

- Content Spending: Netflix continues to invest heavily in content, adding over $4 billion to its content assets in Q3 alone. This significant spending will need to translate into continued high engagement to justify the costs.

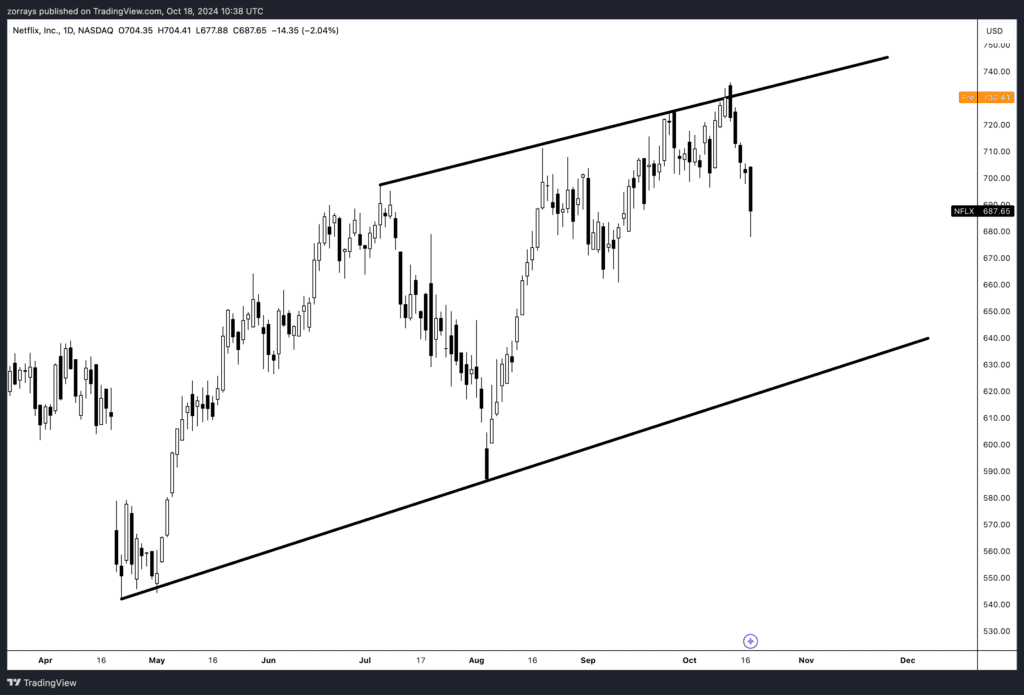

Technicals: Possible Breakout from a Rising Wedge

On the technical side, Netflix’s stock has been trading within a rising wedge pattern, which traditionally signals a potential reversal. Since October 11th, the stock had dropped nearly 8%, but today’s pre-market action shows the stock could open nearly 6% higher, signaling renewed bullish sentiment.

A rising wedge often leads to a breakdown, but with Netflix’s strong forward guidance and content pipeline, there’s a chance the stock could break to the upside. If it breaches the upper boundary of the wedge, we could see Netflix test resistance at $475, with the potential to push towards $500 as we progress through Q4. However, a failure to break the wedge could see the stock pull back, especially if macroeconomic conditions or regional performance falter.

Conclusion: With a stellar Q3 performance and an optimistic outlook for Q4 2024, Netflix is poised for a strong finish to the year. The company’s heavy investments in content and its burgeoning ad-supported tier are critical drivers of its growth story, though challenges remain in Latin America and in fully monetising its ad inventory. From a technical perspective, Netflix’s stock is in a critical rising wedge pattern, and today’s pre-market rally could signal the beginning of a new bullish phase if it breaks to the upside.