- Opening Bell

- September 16, 2024

- 5 min read

Fed Rate Cut on the Horizon: Will the S&P 500 Wave 3 Ride Breakout or Bounce?

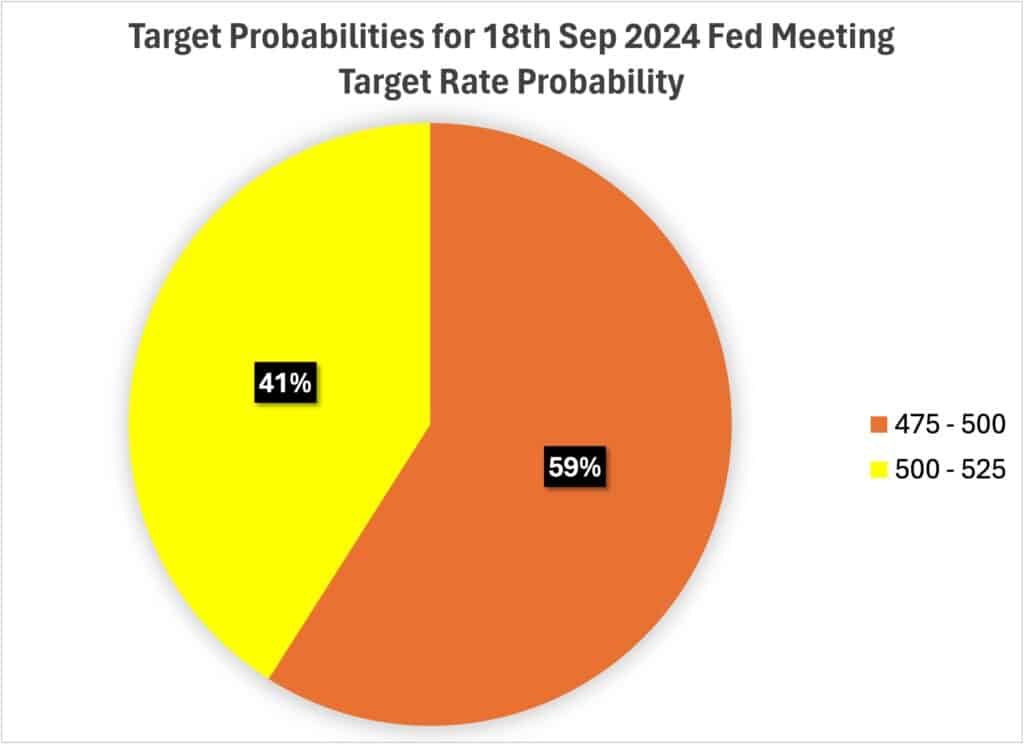

Data Source: CME Group

As the Federal Reserve’s September 2024 meeting approaches, market expectations are highly focused on the potential for a rate cut. The CME FedWatch tool indicates a 100% chance of easing, with a 59% likelihood of a 25-basis-point (bps) cut and a 41% chance of a 50-bps cut. This article outlines three potential scenarios and how the market might react both in the short term and over the longer horizon.

1. 25 bps Rate Cut: Cautious Optimism

A 25 bps rate cut would likely be a modest, anticipated move, signalling that the Fed is cautiously transitioning from inflation control to stimulating economic growth without overreacting. This cut could reflect the Fed’s confidence that inflation is easing while still showing a cautious approach.

- Short-term reaction:

- Equity markets may see a mild rally, as businesses benefit from lower borrowing costs.

- Bond yields may decline slightly as investors adjust to the lower rate environment.

- Long-term reaction:

- Continued positive sentiment in growth sectors such as technology and real estate.

- The overall market trajectory could remain stable as investors anticipate more gradual easing policies.

- Market Impact:

- Stocks might rally, but the enthusiasm could be tempered by the understanding that inflation risks remain on the Fed’s radar.

- The U.S. dollar may weaken, though the movement may be limited by external factors such as weaker foreign economies.

2. 50 bps Rate Cut: Bold Stimulus

A 50 bps rate cut would be a more aggressive signal from the Fed, indicating its desire to front-load the easing process and return to a neutral rate as quickly as possible. This would be a bolder move that suggests the Fed is confident that inflation is well under control.

- Short-term reaction:

- Strong rally in equity markets, especially in rate-sensitive sectors like real estate and technology.

- Bond yields would likely drop more significantly as the market absorbs the more aggressive stance on easing.

- Long-term reaction:

- Could create speculation of further cuts, sustaining bullish momentum in the market.

- There is potential for a larger liquidity boost to support corporate earnings and economic growth.

- Market Impact:

- Stocks are expected to rise more sharply, and investor sentiment may improve with the belief that the Fed is committed to expedited recovery.

- The U.S. dollar may experience a more pronounced depreciation as interest rate differentials narrow between the U.S. and other global markets, especially if foreign economies do not recover as strongly.

Technical Analysis: S&P 500 Potential Wave 3 Breakout

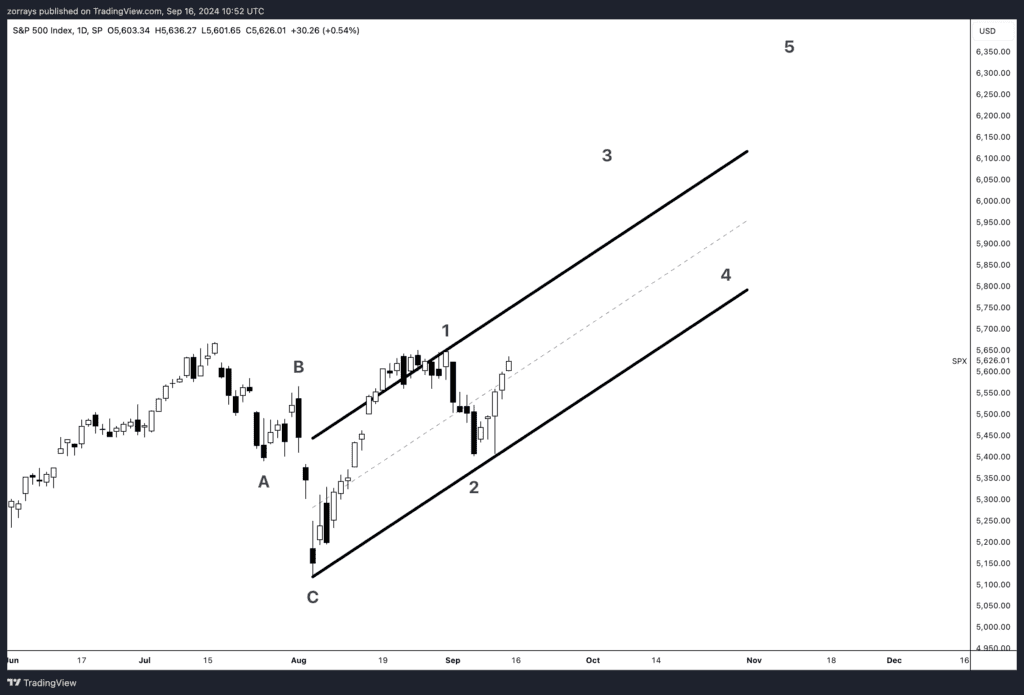

As we analyse the S&P 500’s current price action in light of the anticipated Fed rate cut (25 or 50 bps), the chart provided suggests that the market may be preparing for an impulsive move rather than a corrective one. This ties into the broader macroeconomic environment, where monetary easing could fuel further upward momentum in equities.

The Elliott Wave count displayed on the chart places the S&P 500 index within Wave 3 of an upward impulse, which traditionally is the strongest and longest wave in an Elliott Wave cycle. This aligns with our analysis that a 50 bps rate cut, in particular, could act as a significant catalyst for equity markets.

Key Characteristics of Wave 3

- Wave 3 is usually the most impulsive and powerful, often showing clear conviction from investors.

- It is characterised by strong volume and broad participation, as investor sentiment becomes more optimistic. Given the easing stance of the Fed, these characteristics may align well with the ongoing price action, particularly if the cut is 25 bps, which would signal aggressive support for growth.

- Breakout potential: Instead of bouncing off the upper bound of the ascending channel (denoted by Line 3 in the chart), Wave 3 could break through this resistance level, confirming the move as impulsive rather than corrective. This breakout would signal that the market is entering a period of sustained momentum rather than retracing.

Possible Market Reactions:

- Short-term reaction: If the Fed opts for a 50 bps cut, we could see an immediate breakout past the upper bound, as liquidity floods into the market and bullish sentiment dominates. A 25 bps cut might still support upward movement but could result in a slower breakout, particularly if investors remain cautious about the pace of future cuts.

- Long-term outlook: Once Wave 3 extends beyond the upper channel, the market could see strong follow-throughin the weeks ahead, with the possibility of higher highs beyond 6,000 in the S&P 500. This scenario assumes that the easing cycle continues and the soft landing narrative holds, reinforcing bullish sentiment.

What to Watch For:

- Volume and momentum: A decisive breakout with increased trading volume would confirm that the market is in an impulsive phase.

- Corrections or bounces: If the market fails to break through the upper channel, this could indicate a corrective retracement or loss of momentum. However, given the macro backdrop and Fed easing expectations, the impulsive scenario appears more likely.

Conclusion:

If the Wave 3 breakout materialises, the S&P 500 could see a significant rally fuelled by Fed rate cuts and broader liquidity. The nature of this move—whether impulsive or corrective—will be key in determining the next market phase. With the Fed leaning toward easing, there is a strong possibility that this move will be impulsive, driving further gains in the equity markets.

Which Path Will the Fed Take?

Whether the Fed cuts rates by 25 or 50 bps the market is poised for a period of adjustment. While a smaller cut may stabilise markets with modest optimism, a larger cut would likely spur stronger, sustained gains. Meanwhile, a rate hold accompanied by promises of future easing would introduce short-term volatility but might maintain long-term confidence in the Fed’s support for economic growth.