- Opening Bell

- August 14, 2024

- 4 min read

Following the RBNZ’s rate cut, we anticipate no unexpected rise in CPI.

As we step into today’s trading session, the focus remains heavily on the interplay between monetary policy shifts, particularly those from the Reserve Bank of New Zealand (RBNZ) and the Federal Reserve, alongside the looming U.S. Consumer Price Index (CPI) data. The foreign exchange market has been navigating the waves of these economic developments, with the NZD/USD pair taking centre stage amid a complex backdrop of interest rate dynamics, inflation expectations, and technical market structures.

Monetary Policy Overview and Impact on NZD/USD

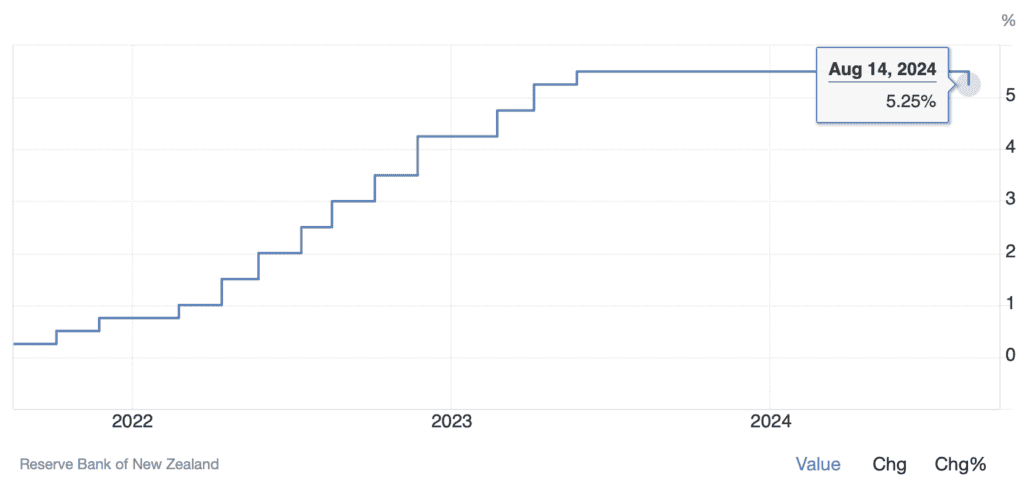

The recent monetary policy statement from the RBNZ revealed a reduction in the Official Cash Rate (OCR) by 25 basis points to 5.25%. This move is seen as a tempering of monetary restraint as inflation within New Zealand begins to converge on the RBNZ’s target band of 1-3%. While this easing signals a more dovish stance, the global context, especially the potential rate cuts from the Federal Reserve, will be crucial in shaping the NZD/USD outlook.

Short-Term Correction:

- Pre-Fed Rate Cut Scenario: The NZD/USD pair could face downward pressure due to the RBNZ’s rate cut, particularly because the USD is still backed by higher interest rates. However, if markets start to fully price in the Fed’s dovish tone and the possibility of rate cuts, the USD might weaken, offering some support to the NZD/USD pair.

Medium-Term Outlook:

- Post-Fed Rate Cut: Should the Fed move ahead with rate cuts as anticipated, possibly starting in September, the interest rate differential may narrow, providing a tailwind for the NZD/USD. If New Zealand’s inflation remains under control, the market might view the RBNZ’s cuts as adequate, potentially bolstering the NZD. Additionally, a stable or improving global economic environment could further support the Kiwi dollar.

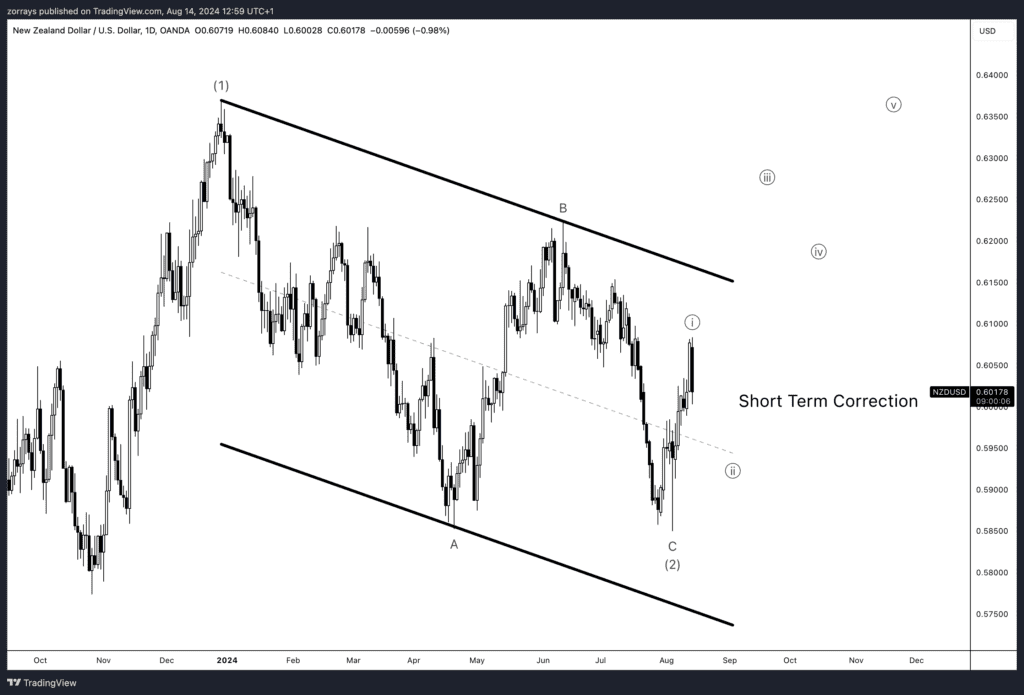

Technical Analysis: NZD/USD Poised for Short-Term Correction

Based on the latest technical chart analysis, the NZD/USD is signaling a short-term correction before a potential continuation. The chart pattern suggests that the pair is in the process of completing a corrective wave, typically a setup that precedes a resumption of the broader trend.

Key Technical Observations:

- The pair is currently correcting within a descending channel, indicating a bearish short-term outlook.

- Wave analysis points to a potential continuation of the downward move before the next leg higher, possibly triggered by a weakening USD post-Fed cuts.

Market Focus: U.S. MoM Core CPI and Its Implications

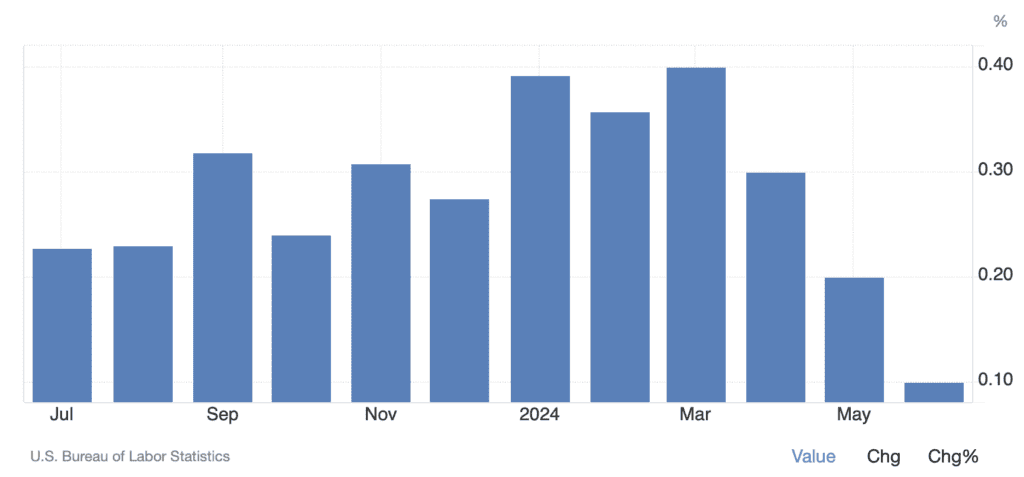

Today’s spotlight will also be on the U.S. inflation data, particularly the Month-on-Month (MoM) Core CPI. Expectations are centered around a 0.2% increase, slightly up from June’s 0.1%. This release will be crucial as it could shape market sentiment and influence the Fed’s decision-making process.

USD Impact:

- CPI and Risk Sentiment: A soft U.S. Producer Price Index (PPI) print has already given global risk sentiment a lift. If the Core CPI comes in at or below expectations, it could reinforce the Fed’s dovish stance, potentially clearing the way for USD weakness and risk-on trading.

- Potential USD Reaction: Historically, a benign CPI print has led to a softening USD. We anticipate that a 0.2% MoM core print could catalyze a USD decline, especially if the CPI aligns with the PPI’s implications for a subdued inflation outlook.

In conclusion, today’s trading session will be heavily influenced by the interplay between central bank policies and inflation data. Traders should keep a close eye on the NZD/USD for signs of a short-term correction, and monitor the U.S. CPI data, which could pave the way for a broader move in the USD. The evolving narrative around rate differentials and inflation expectations will continue to dictate market dynamics, offering opportunities for strategic positioning in the forex markets.

Stay tuned for further developments as we move through the trading day.