- Opening Bell

- October 15, 2025

- 3 min read

USD/JPY – Powell’s Subtle Pivot Meets Yen Strength

Powell’s Quiet Turn Toward Caution

Yesterday, Fed Chair Jerome Powell delivered what at first sounded like a dry lecture about the Fed’s balance sheet — but underneath, it was a carefully worded hint that the tightening cycle is nearly done.

In simple terms, Powell said:

“We’ve drained a lot of liquidity out of the system since COVID. Money markets are starting to tighten, and we don’t want to overdo it.”

That’s Fed-speak for: we might soon stop shrinking the balance sheet (QT) — meaning the Fed could soon let more liquidity remain in the system. This is essentially a stealth form of easing, even if interest rates don’t drop immediately.

He also acknowledged that the job market is cooling and growth is uneven, suggesting the Fed is just as worried about a slowdown as it is about inflation. By emphasizing a “meeting-by-meeting” approach, Powell gave himself flexibility — but markets read it as dovish (softer on rates).

The takeaway? The Fed is quietly pivoting from “fighting inflation” toward “protecting liquidity.” That puts downward pressure on the U.S. dollar — especially against currencies where the central bank (like Japan’s BOJ) is starting to sound slightly less dovish.

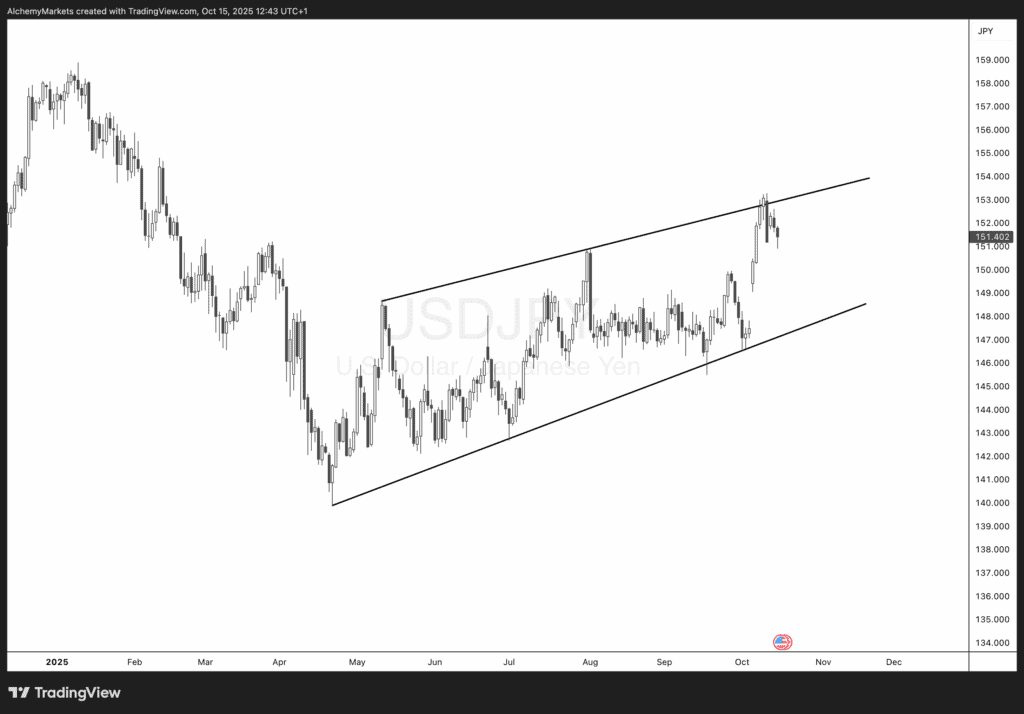

Technical Picture: USD/JPY in a Rising Wedge

Let’s connect that macro tone with the chart.

On the USD/JPY daily chart, price action has been forming a clear rising wedge pattern since May — a structure often seen before a reversal.

After testing the upper boundary of that wedge near 152.00, USD/JPY has pulled back. This rejection from resistance comes as markets digest Powell’s dovish undertones and as yields soften slightly.

- Upper resistance: Around 152.00–152.30

- Lower support trendline: Around 147.00

- Current price: ~151.40

Technically, a break below the 150.00 level would confirm a short-term bearish shift and open the door toward 147.00, the next major support and the wedge’s lower boundary.

The Trade Logic: Macro Meets Chart

When we align the macro backdrop with the chart:

- Powell’s “cautious pause” cools the dollar narrative.

- Japan’s authorities remain on intervention watch — they’ve shown discomfort with USD/JPY above 152.00.

- Rising wedge + rejection = a setup where a short pullback makes sense.

If U.S. yields continue to edge lower and the Fed narrative leans dovish, USD/JPY could unwind recent gains and gravitate back toward 147.00 in the near term — a retracement of roughly 400 pips.

That would align both technical structure and macro psychology: the Fed easing off, the dollar losing steam, and the yen regaining some footing.

In Summary

- Macro Tone: Powell hinted at slowing QT — stealth easing ahead.

- Market Implication: Dollar softens as liquidity fears replace inflation fears.

- Technical Setup: USD/JPY rejected wedge top near 152; eyes 147 next.

So today’s “Chart of the Day” tells a unified story:

A Fed stepping back + a technical ceiling = room for USD/JPY to breathe lower.