- Weekly Outlook

- September 26, 2025

- 4min read

RBA on Hold, Soft ISMs, and a Fragile NFP—What It Means for AUDUSD, DXY, and the S&P 500

RBA Rate Decision (Tue, Sep 30 – likely hold at 3.60%)

Consensus is firmly for no change, with polls and market-implied odds pointing to the RBA holding the cash rate at 3.60% while it waits on Q3 inflation. The tone may stay cautious given a recent nudge higher in monthly CPI to ~3% y/y.

Second-order take: a hold paired with “watchful” guidance keeps rate-cut hopes centered on late-2025; unless the statement leans dovish on growth, AUDUSD may struggle to extend upside beyond risk-on bursts, as policy divergence vs. a still-data-dependent Fed limits carry appeal. A hawkish hold (inflation vigilance) could even cap AUD rallies on the day.

ISM Manufacturing (Wed, Oct 1 – consensus ~49, still contracting)

Manufacturing remains below 50, with expectations clustered around the high-40s after August’s sub-50 print, reinforcing a “cooling but not collapsing” narrative. It’s also crucial to watch the New Orders sub-index, one of the better forward-looking gauges showing early signs of growth. On the inflation front, several ISM participants have flagged prices paid as sticky, suggesting persistent inflationary pressures despite softness in output.

Second-order take: a sub-50 outcome typically leans dollar-negative at the margin if yields slip, but the DXY reaction will hinge on prices/employment sub-indices. A weaker factory read alongside benign prices could support the “more Fed cuts ahead” trade, modestly helping the S&P 500 via duration and multiple support—though valuations leave equities sensitive to any upside surprise in prices paid.

ISM Services (Fri, Oct 3 – watch 51–52 range)

Services have been the growth anchor, with August at 52. A print holding ~51–52 would signal momentum but also keep an eye on new orders and prices paid.

Second-order take: a steady services headline with softer prices would be the “goldilocks” mix—mildly bearish DXY, constructive for S&P 500 breadth. Conversely, firm services and sticky prices paid could lift yields and the dollar, pressuring long-duration equities even if the headline looks healthy.

US Nonfarm Payrolls (Fri, Oct 3 – consensus drifting lower; ~40–75k, UR ~4.3%)

Latest previews point to a very soft NFP (Reuters around ~39k) and unemployment near 4.3%, with markets laser-focused on whether revisions keep showing downshifts. There’s also a risk of release delays if government funding issues flare.

Second-order take: a weak print with cooler wages cements the Fed-easing path—bearish DXY and supportive for S&P 500 via lower real yields. But too weak (near zero or negative) could pivot the narrative to growth scare, steepen credit spreads, and flip equities lower even as the dollar softens. Upside jobs surprises would do the opposite: firmer DXY, pressure on high-multiple tech, and more two-way volatility.

Technical Analysis Outlook

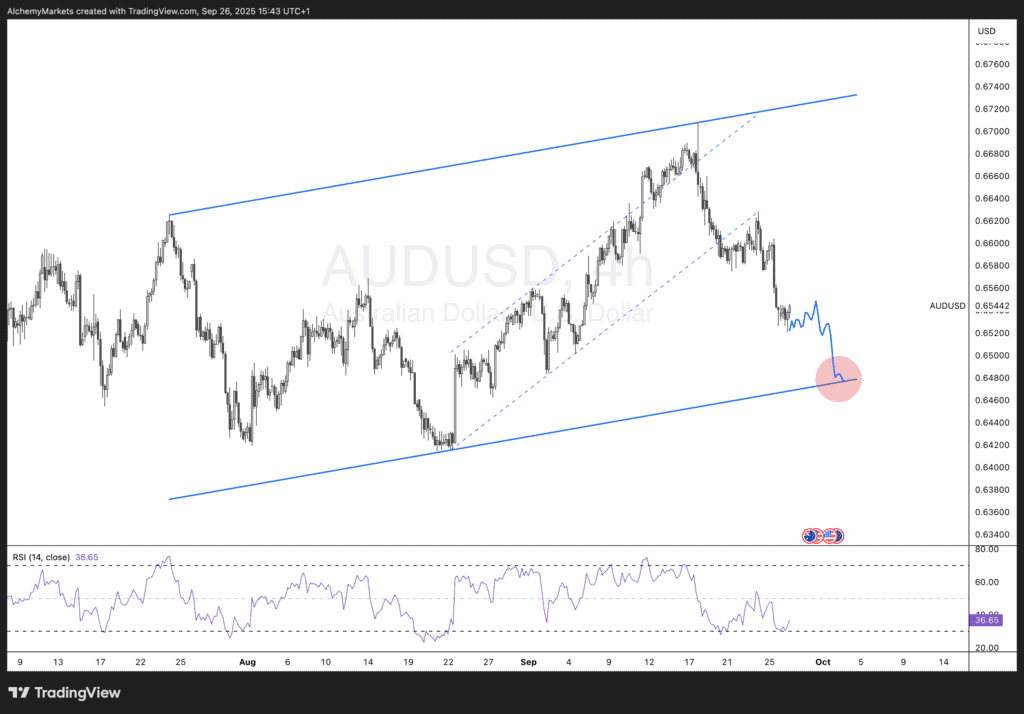

AUDUSD

The pair remains in a well-defined rising channel, with recent weakness dragging it closer towards the lower boundary. The RSI is flirting with oversold territory, suggesting downside momentum could extend but a reaction at channel support near 0.6480–0.6500 is pivotal. A rebound here would keep the broader bullish structure intact, but a clean break below could open the door to a deeper retracement. Traders should watch how price behaves around the highlighted support zone—failure to hold would flip sentiment decisively bearish.

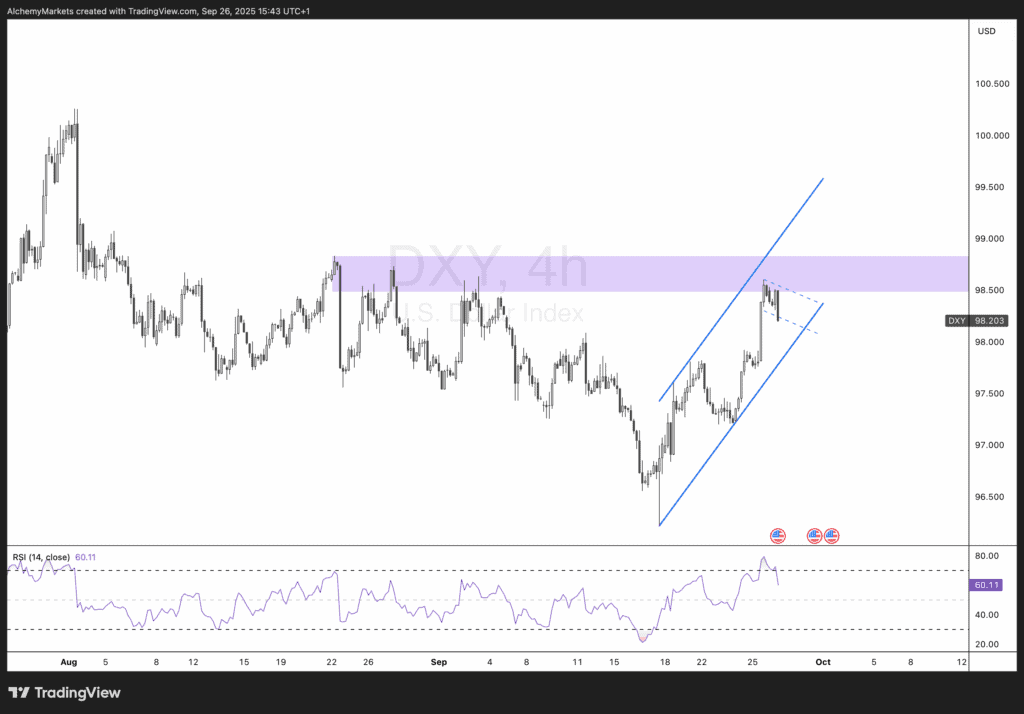

DXY (US Dollar Index)

The dollar has rallied into the 98.50 resistance zone, where momentum now looks stretched following its recent climb. The rising wedge pattern suggests waning bullish conviction, with the RSI near overbought levels reinforcing caution. Next week, “no bad news is good news” remains the theme for the dollar, but any unexpected dovish Fed signals or softer data could see DXY reject this resistance and unwind lower toward 97.50 or below. Conversely, if risk sentiment sours, DXY could attempt another push above resistance before supply reasserts itself.

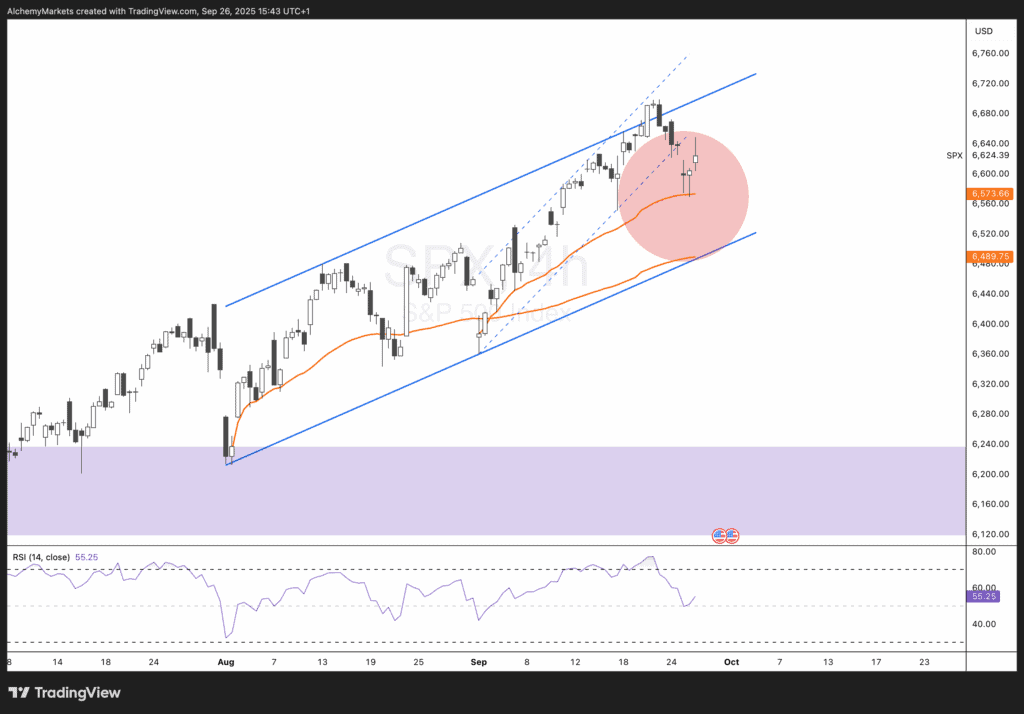

S&P 500 (SPX)

The index has retreated from the channel top and is now probing the anchored VWAP from the 2nd September low, a key pivot for trend continuation. The RSI is mid-range, leaving room for movement in either direction, while the 50-day moving average provides an additional support layer nearby. For now, the bias tilts cautious: if macro data signals forward-looking economic weakness or reignites inflation fears, SPX could break beneath the VWAP and extend towards the channel floor around 6,480–6,500. Holding above, however, would reinforce resilience and could set up another leg higher.