- Weekly Outlook

- July 25, 2025

- 4min read

Fed’s Balancing Act in Focus as Inflation Lingers and USDJPY Eyes Key Breakout

With inflation running hot and the labor market showing signs of softening, the Federal Reserve enters a pivotal week. A flurry of economic data will give markets more clarity on whether the U.S. economy is gradually cooling or nearing a point of policy shift. Here’s a breakdown of the key developments to watch.

Core PCE Deflator (Thursday): A Clearer View of Inflation

The Core Personal Consumption Expenditures (PCE) deflator, the Fed’s preferred measure of inflation, is forecast to rise 0.3% month-over-month. That’s slightly hotter than the 0.2% increase seen in the Consumer Price Index (CPI), due to differences in component weighting.

This reading is important because it strips out food and energy volatility, offering a more stable view of inflation trends. Despite ongoing political pressure to lower interest rates, Fed Chair Jerome Powell is expected to remain cautious, keeping the door open to future rate cuts while emphasizing the need for sustained disinflation.

Second-Quarter GDP (Wednesday): Strength with a Caveat

Q2 GDP growth could exceed expectations at 3.3%, well above the 2.5% consensus. This stronger-than-anticipated number is likely driven by:

- A notable collapse in imports, which boosts net trade.

- Strong investment, suggesting continued private sector resilience.

However, this bounce is seen as a reversal of Q1 distortions when companies rushed to import goods ahead of the April 2 tariff increases. The average of Q1 and Q2 GDP may offer a more balanced view. What matters more in this release is the consumer spending data, which has slowed since late 2024. Concerns over tariffs, employment, and financial market swings have dampened household enthusiasm for spending, which has been a key driver of post-pandemic growth.

Employment Cost Index (Thursday): Wage Pressures Ease

The Employment Cost Index (ECI), another major indicator followed closely by the Fed, is expected to show a quarterly rise of 0.8%, down from 0.9% previously. This slight cooling in wage growth aligns with evidence of slower hiring activity.

As wage growth slows, inflation pressures could ease further, providing the Fed with more flexibility later in the year. However, wage inflation remains elevated by historical standards, and the Fed is likely to want further confirmation before pivoting policy.

Jobs Report (Friday): Gradual Labor Market Softening

Nonfarm payrolls for July are expected to show gains of around 100,000 to 120,000 jobs. While still positive, this represents a clear slowdown from the stronger monthly averages seen earlier in the recovery.

The unemployment rate is forecast to rise modestly to 4.2%, following an unexpected dip to 4.1% in June. The data continues to suggest a cooling labor market—neither overheating nor collapsing. For the Fed, such moderation is welcome news, but not yet enough to warrant immediate action.

Federal Reserve Decision (Wednesday): Holding Pattern Remains

Despite softer economic data, the Fed is widely expected to hold rates steady at this week’s meeting. The central bank continues to grapple with:

- Persistent inflation, exacerbated by new tariff impacts.

- Modest but positive growth trends.

- Softening, but still relatively strong, labor market dynamics.

While markets are pricing in a 16 basis point probability of a 25-basis-point rate cut in September, this may be premature. July and August inflation data will likely remain elevated due to ongoing cost pressures from tariffs and wage lags.

Current projections suggest the Fed’s first and possibly only rate cut in 2025 will come in December, likely amounting to a 50 basis point move—contingent on meaningful improvement in inflation data.

Additional Reports to Watch

In addition to the headline data, markets will closely watch:

- The ISM Manufacturing Index

- The JOLTS job openings report

These metrics will provide further insight into business sentiment and hiring dynamics—critical components of the Fed’s decision-making calculus.

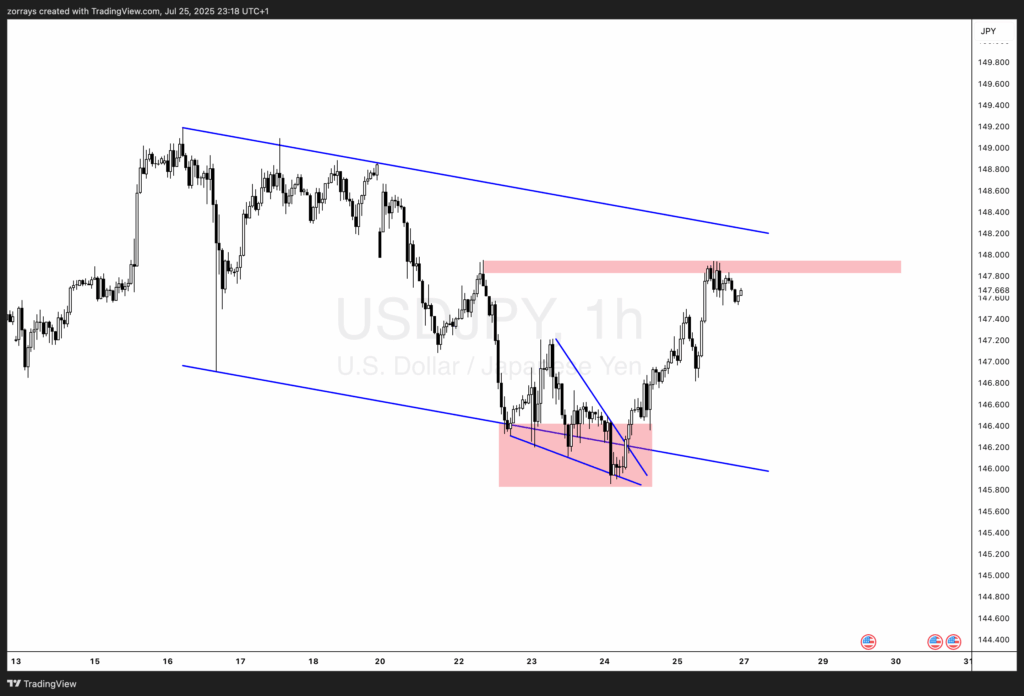

USDJPY Technical Outlook:

We tweeted this setup right from the bottom of the flag formation, and price action has played out beautifully. After breaking out of the falling wedge, USDJPY surged higher and is now stalling just below the key resistance zone around 147.900. This area has acted as a short-term cap, but momentum remains strong. If bulls manage to break and close above this key level, we could see continued upside towards the upper boundary of the descending channel, possibly eyeing a move back toward 148.50 and beyond. Keep an eye on a confirmed breakout for bullish continuation.

Economy Is Cooling, But Not Crashing

This week’s economic calendar is stacked with high-impact data points. Taken together, they are likely to reinforce the narrative that the U.S. economy is slowing in a measured way, not collapsing. While inflation is still too high for the Fed to declare victory, signs of labor market softening and easing wage growth may give policymakers confidence that their restrictive stance is working.

For now, the Fed will remain cautious, watching data closely. Markets, meanwhile, should be prepared for continued volatility as rate cut timing remains a moving target.