- Weekly Outlook

- June 22, 2025

- 5 min read

Powell, PCE, Housing & U.S.-Iran Tensions Stir 20% Correction Risk

As we head into the final stretch of June, the U.S. financial markets find themselves at a crossroads. After weeks of mixed economic signals, political pressure, and lingering inflation concerns, the landscape has been further complicated by rising geopolitical tensions. The recent escalation between the U.S., Israel, and Iran—including U.S. strikes on Iranian nuclear sites—has injected a fresh dose of uncertainty into global markets.

Oil prices have spiked, safe-haven flows into Treasuries and gold are rising, and investors are reassessing risk. Against this backdrop, this week brings a powerful mix of macro catalysts: Federal Reserve Chair Powell’s congressional testimony, a crucial core PCE inflation print, and a slew of housing market data. Meanwhile, technical patterns on the S&P 500 hint at a possible breakout—but rising volatility suggests the road ahead may be anything but smooth.

1. Powell’s Testimony (Tuesday): A Balancing Act

This week’s primary market-moving event is Fed Chair Jerome Powell’s semi-annual testimony before Congress. Expect fireworks—not just from market participants, but from politicians too.

In a politically charged environment, some Republican lawmakers, aligning with former President Trump’s calls, are expected to pressure Powell to cut rates. But don’t expect Powell to budge. Instead, he’s likely to reiterate the Fed’s independence and emphasize that data—not politics—will guide policy.

For traders and investors, Powell’s language around tariff-driven inflation and labor market trends will be critical. The Fed remains data-dependent, and clarity may not emerge until December’s FOMC meeting. So, for now, the market is still pricing in one rate cut for 2025, unless labor weakness demands a sharper response.

2. Core PCE Inflation (Friday): Calm Before the Storm

The core PCE deflator, the Fed’s preferred inflation metric, is forecast to increase by just 0.1% month-on-month. On the surface, this looks benign and might calm market nerves temporarily.

However, this low reading is misleading—it’s the calm before a potential tariff-driven inflation storm. New tariffs are likely to show up in price data beginning in July, and if inflation proves stickier than expected, the Fed may delay any cuts further into 2025.

Investors should view Friday’s data as the final soft reading before the inflation narrative potentially turns hotter again.

3. Housing Market Data (Wednesday): A Slow-Motion Crunch

A slew of housing reports on Wednesday will shine a spotlight on a sector that’s flashing red. The story is one of deep stress:

- Mortgage rates have skyrocketed from under 3% to around 7%.

- Home prices are up 50% since the pandemic, making affordability the worst in decades.

- Inventory is rising, while homebuilder sentiment is crashing to new cycle lows.

All signs point to a slowdown in sales and construction activity, and the risk of outright price declines is growing. The housing market, once a pillar of economic strength, now looks more like a drag on growth.

Global tensions spike as U.S. joins Israel–Iran hostilities, rattling risk assets.

After the U.S. carried out strikes on Iranian nuclear sites, investors swiftly repriced global risk: oil surged ~18% from mid‑June lows, sparking fears of $100+/barrel crude should the Strait of Hormuz be targeted. Equities initially held firm thanks to demand optimism and ample U.S. shale supply cushioning the blow. Still, analysts caution that any prolonged conflict or disruption to Gulf oil flows could trigger broad risk-off sentiment, pressing the dollar higher and igniting demand for haven assets like gold and Treasuries.

Market outlook: choppy waters ahead with a tilt toward caution. In the near term, expect elevated volatility. A short-lived diplomatic lull could offer a rally window, but investor optimism is fragile. Broker models, such as RBC, warn of potential S&P 500 downside of up to 20% if escalation intensifies, particularly through energy‑price inflation pressuring margins and growth forecasts . For now, hover near support bands, watch oil and Treasury yields closely, and prepare for sharp intraday moves. Equities remain vulnerable until clear progress on de‑escalation or Iranian restraint emerges.

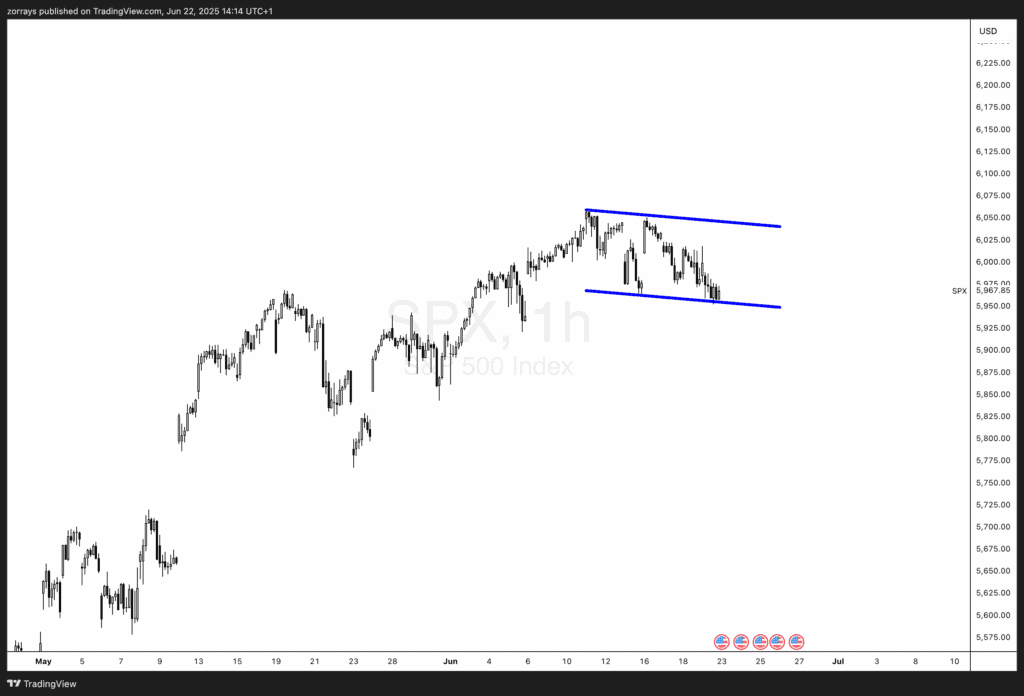

Technical Outlook: S&P 500 (SPX) Faces Breakdown Risk

Looking at the hourly chart of the S&P 500 Index (SPX), price action has formed a downward sloping flag pattern—a consolidation structure typically seen as a bullish continuation setup.

However, while the textbook expectation might suggest a break to the upside, market volatility and macro risks suggest caution.

This week presents a high-stakes setup for financial markets. Powell’s message on policy independence, the direction of core inflation, and deepening housing strain are already heavy weights. But now, investors must also factor in geopolitical instability, which has the potential to drive sharp market dislocations—particularly through the energy channel.

While equity bulls may eye a technical bounce, the broader tone remains fragile. Any further escalation in the Middle East could trigger a broad risk-off move, tightening financial conditions and stalling global growth sentiment. In the meantime, staying nimble, watching oil and yields, and respecting key technical levels will be key to navigating the volatility ahead.