- Weekly Outlook

- June 13, 2025

- 3 min read

Central Banks Eye Rate Cuts as USD/CAD Nears Multi-Year Trendline Breakout

United States: The Fed Holds Steady, But Eyes Are on the Forecast

Federal Reserve Meeting (Wednesday)

This week’s Federal Reserve meeting is expected to be more about messaging than movement. The Fed will likely keep interest rates steady as inflation data remains tame and job growth slows. However, don’t mistake that for a dovish pivot. The first-quarter GDP dip of 0.2% was mainly due to businesses pulling forward imports to avoid tariffs—not a true sign of weak demand.

Looking ahead, Q2 could see growth bounce to nearly 4%, and inflation may heat up again as tariffs bite into prices. With unemployment still near historic lows, the Fed has reason to remain cautious.

Market Watch: The Fed’s updated dot plot and economic projections will be closely dissected. Markets still expect two rate cuts—one in September, one in December—so any deviation from this could stir volatility.

Retail Sales & Industrial Production (Tuesday)

Retail and industrial figures might come in soft. Auto sales fell in May, which will likely drag retail figures down. And with the ISM Manufacturing PMI showing weakness, don’t expect much from industrial production either.

United Kingdom: Inflation Set to Dip, But BoE Still in No Rush

CPI Inflation Report (Wednesday)

UK inflation could cool slightly thanks to more subdued service-sector costs. The April data was skewed by Easter and a miscalculated road tax increase, which the Office for National Statistics has since admitted to overestimating. That error correction should pull services inflation down by almost 1%.

Bank of England Meeting (Thursday)

A rate cut is not expected, but the recent poor jobs report could sway a few more policymakers to vote for one. Likely, two or even three members will dissent. Still, the BoE’s stance remains cautious: any cuts will be “gradual and limited.” Most analysts now eye August for the next move.

Switzerland: SNB Set for a Cut as Inflation Dips Below Zero

Swiss National Bank Meeting (Thursday)

Swiss inflation has dipped back into the negative, making a rate cut from the SNB all but certain. A 25 basis point cut is the base case, taking the rate down to -0.25%. Another cut in September could follow.

A more aggressive 50bp move can’t be ruled out if the SNB wants to act decisively and preempt any deflationary spiral.

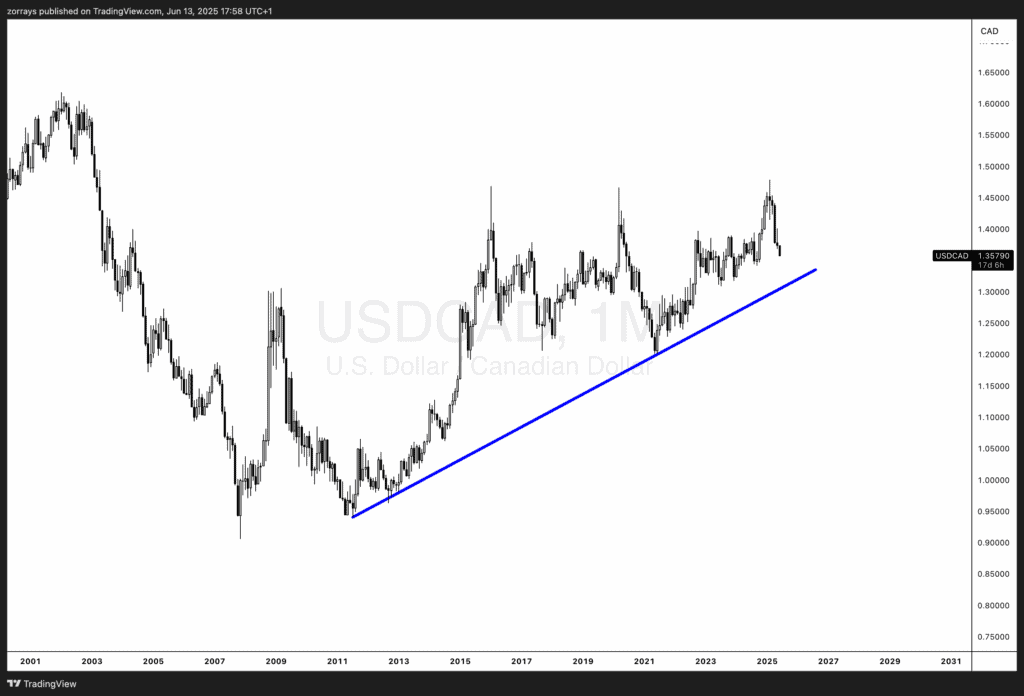

Chart of the Week: USD/CAD Approaches Major Post-2008 Trendline

USD/CAD – Monthly Timeframe Analysis

The USD/CAD is approaching a long-standing upward trendline that dates back to the aftermath of the 2008 financial crisis. This trendline has acted as solid support through multiple economic cycles and global shocks.

As we edge closer to this key technical level, the market faces two possibilities:

- A Break Below – Signaling a deeper correction or even a shift in macro sentiment toward CAD strength.

- A Strong Bounce – Reaffirming the long-term bullish bias in favor of the U.S. dollar.

Either way, this is a make-or-break level. A significant move looks imminent.