- Chart of the Day

- May 15, 2025

- 3min read

Gold (XAU/USD) Bounces from Channel Support: Is a Reversal in Play or Bearish Continuation Ahead?

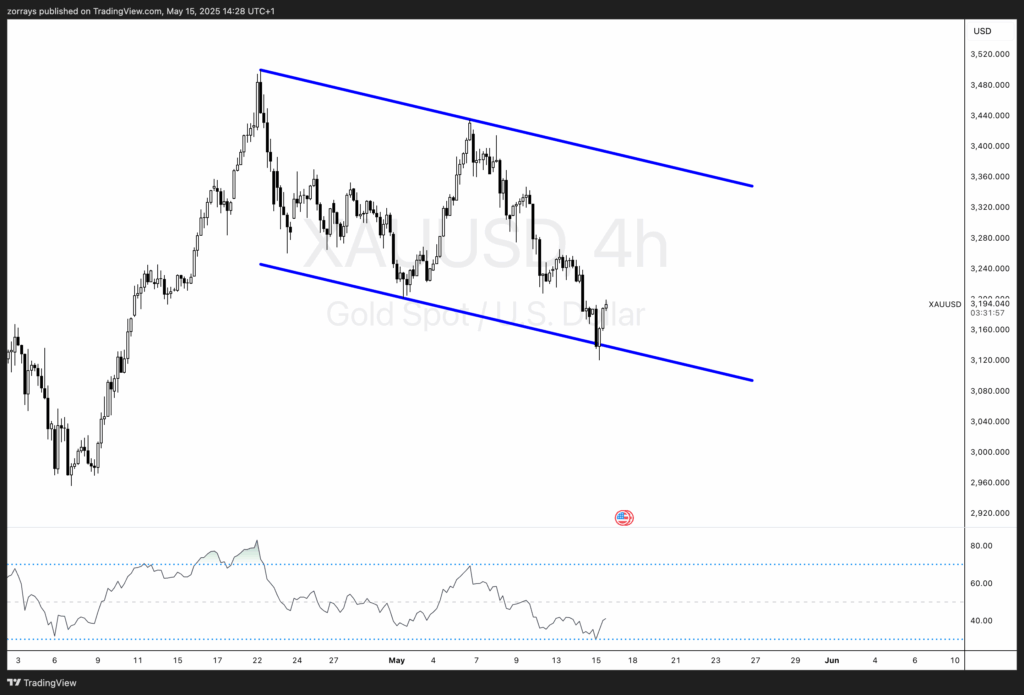

Gold (XAU/USD) is currently at a technical inflection point. On the 4-hour chart, price action has shown a clear bounce from the lower boundary of a descending channel. This move may signal a potential reversal toward the upper bounds of the channel, or merely a temporary relief within a broader bearish structure.

Technical Overview

Gold has been in a sustained downward channel, making lower highs and lower lows since late April. This descending channel has provided clean technical structure, and recent price action respects it well.

The latest candlesticks show price testing and rebounding from the lower channel support, around the $3,120 level. This area has historically acted as a demand zone and has held firm once again. The RSI on the 4-hour chart was approaching oversold levels, suggesting that bearish momentum may be losing steam in the short term.

If bulls manage to push price higher from here, the next resistance lies near the midline of the channel around $3,240, and beyond that, the upper boundary near $3,360. A clear break above this channel would signal a shift in structure, potentially opening the door to a new bullish leg.

On the flip side, failure to sustain above the lower boundary and a clean breakdown could mark the beginning of a stronger bearish trend, with next support targets near $3,080 and $3,000.

Fundamental Context

While the technicals show the possibility of a short-term bounce, fundamentals remain mixed and could be the deciding factor on whether this is a reversal or just a temporary reprieve.

1. U.S. Inflation and Fed Outlook:

April’s CPI data came in cooler than expected, with core inflation slowing down. This soft print has led to increased market speculation that the Federal Reserve could begin cutting interest rates as soon as September. Lower rates typically support gold prices by reducing the opportunity cost of holding non-yielding assets.

2. U.S.-China Trade Sentiment:

Recent easing of trade tensions between the U.S. and China has slightly diminished the safe-haven demand for gold. Reduced geopolitical risks can lead to less urgency in gold buying, which may cap upside momentum in the near term.

3. Central Bank Demand:

Central banks, particularly China, remain net buyers of gold. This sustained accumulation provides long-term support to gold prices, reflecting a global diversification away from the U.S. dollar.

4. U.S. Dollar and Treasury Yields:

The U.S. dollar remains relatively strong, and Treasury yields have stayed elevated, which creates headwinds for gold in the short term. A reversal in either of these could help gold regain strength.

Outlook

The bounce from the lower channel support could be the first signal of a short-term rebound, especially if the fundamental backdrop supports further upside. However, until we see a confirmed breakout from the descending channel, the broader trend remains bearish.

Traders should closely watch whether gold can hold above the $3,120 level in the next 24–48 hours. A confirmed bullish structure above $3,240 would strengthen the case for a near-term reversal, while a drop below $3,100 would likely mark the beginning of a deeper selloff.

This remains a key technical and macro juncture for gold.