The DXY and EXY are inversely correlated, and both charts are printing interesting patterns to watch on the weekly timeframe with macro implications. Let’s dive into it.

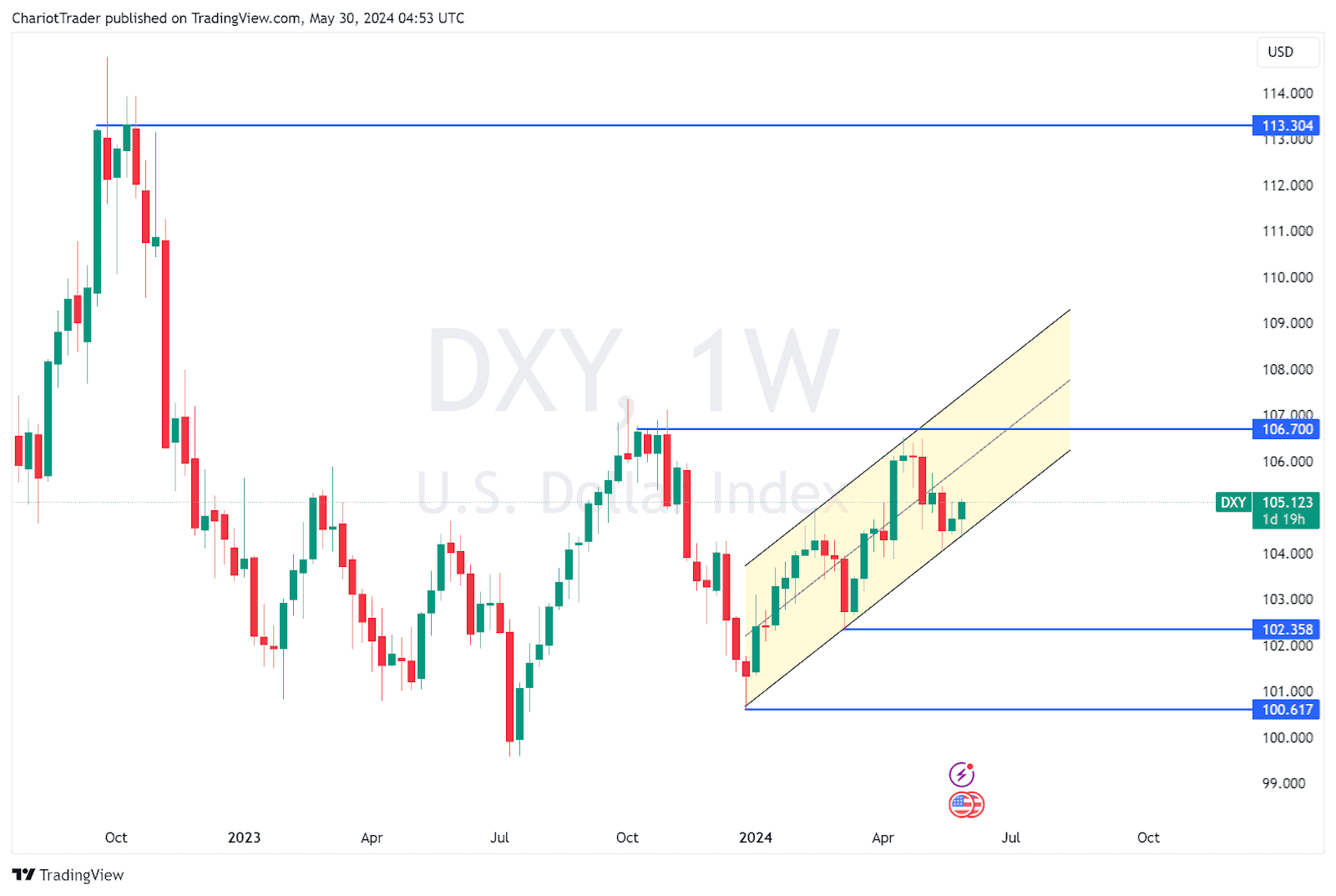

DXY Bounces Off Weekly Channel Low

The U.S Dollar Index is consolidating in an ascending channel, which can be seen from the weekly timeframe. After bouncing off the lower trendline, the U.S Dollar is regaining some strength.

While technically a bearish pattern, the channel remains unbroken (confirming the beginning of a downward move). Therefore, the U.S Dollar could retest the midpoint of the channel, or even pivot high at ~106.700.

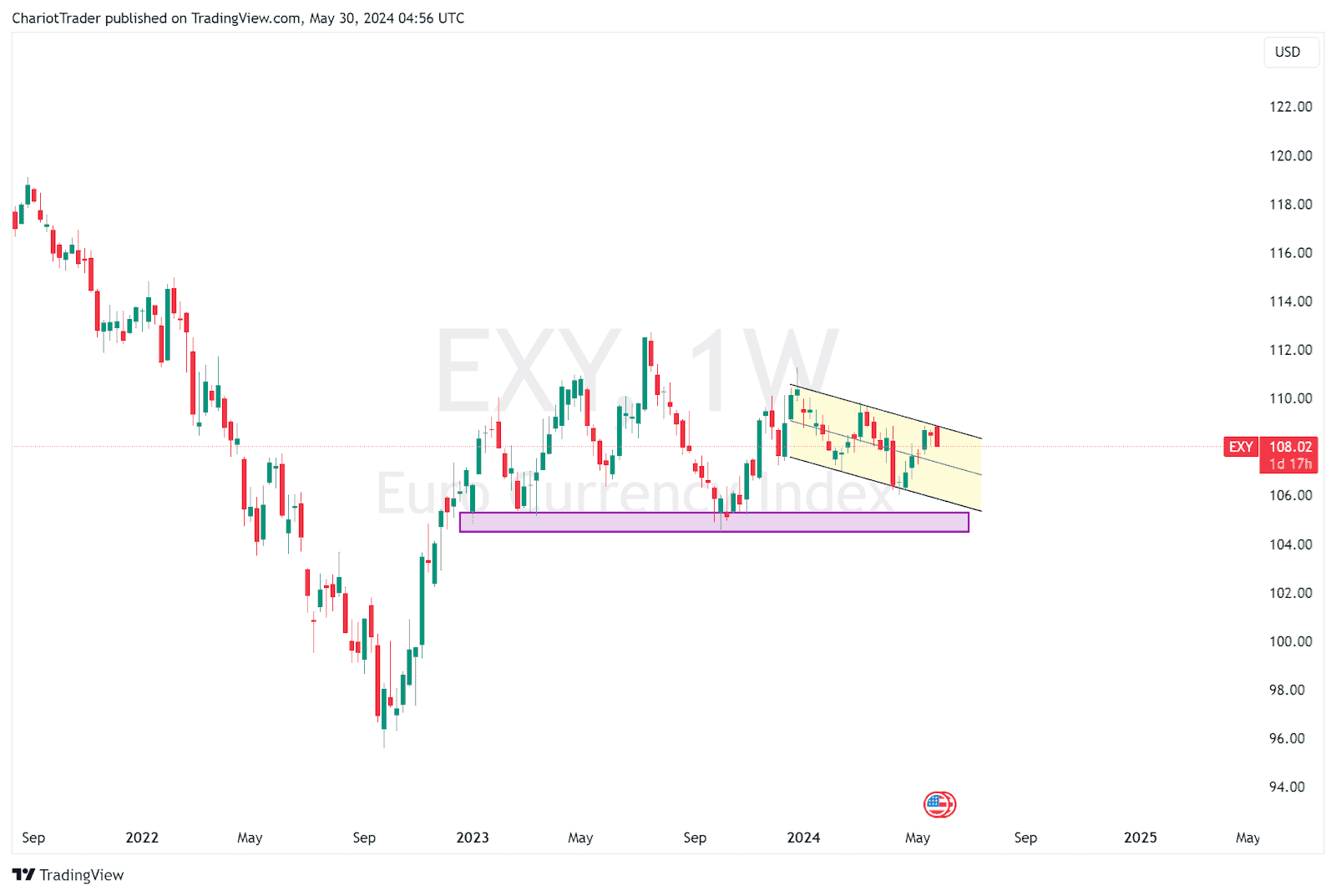

EXY Rejected at Weekly Channel Top

By contrast, the EXY (Euro Currency Index) is consolidating in a descending channel pattern on the weekly timeframe. The EXY was rejected at the highs of the channel, inversely correlating with the DXY.

With the Euro taking up 60% or more of the trades against the USD, it makes perfect sense why the Dollar Index and Euro Currency Index would be inversely correlated.

In light of the recent bounce on the DXY, we could see the dollar gain some strength in the coming days or weeks, leading to assets across the board (including Euro and EXY) to drop against it.

If the EXY does drop to the support levels at approximately ~105.000 and hold, we may see a major reversal begin – causing the DXY to plummet. This will help EURUSD gain momentum, and more importantly, assets across the board to rally.