- Fed Chair Powell Keeps Market Participants Guessing on Rate Cuts

- Asian Currencies Arrest Slide but FX Intervention Talk Grows

- US Earnings Remain Robust as Markets Await Megacap Tech Earnings

- Commodities Mixed as Oil and Gold Chart Differing Trajectories

General Market Outlook

Middle East tensions appear to have taken a breath as markets await a retaliatory strike by Israel on the Islamic Republic of Iran. There have been mixed reports as to the scope and date of a potential strike by the Israeli Government which has left markets grappling with US Earnings season and comments from Central Bank officials for guidance.

Looking at US Equities and they are pointing a wee bit higher as we approach the US open. US Equities are on a four-day losing streak with the S&P 500 down slightly over 4% from its recent all-time high print. The Nasdaq 100 has been the biggest loser this week as Megacap Tech stocks, in particular, are feeling the heat of the potential “higher rates for longer narrative”.

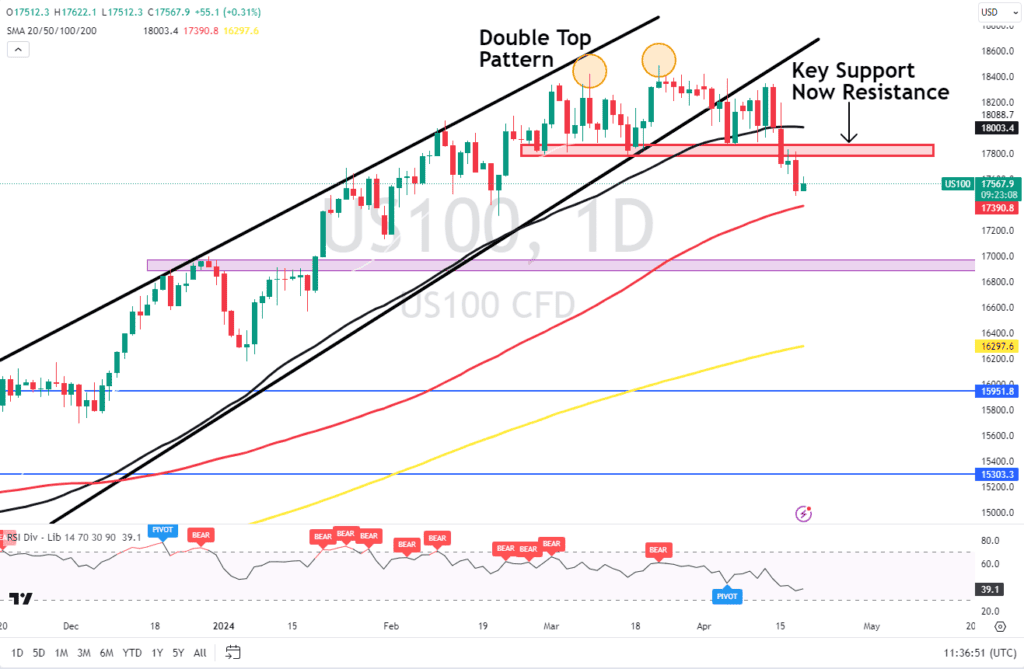

The Nasdaq 100 has broken below a key support level at 17800, breaking the 50-day MA in the process. Having printed a double top pattern on March 21, the Nasdaq has printed a lower high and lower low which is a sign that a downtrend may now be in play.

Key Technical Levels to Keep an Eye On:

Support:

- 17390 (100-day MA)

- 17000

- 16500

Resistance Levels:

- 17800

- 18003 (50-day MA)

- 18400

Nasdaq 100 Daily Chart

Source: TradingView

Comments from Federal Reserve Policymakers including Fed Chair Powell have further stoked the idea that rate cuts may come much later than market expectations. Bank of America has stated that their base case scenario remains a cut in December as the robustness of the US Economy keeps potential cuts at bay. Market participants remain cautious and are likely to remain so as earnings continue to filter through. The big question is “ can megacap stock earnings justify the current valuations” as that is likely to determine how much further markets can go in the near term.

FX Movers

Looking across markets, the USD remains at the forefront of FX discussions. It does appear as though the pushback to rate cuts has largely been priced in while the slight cooling of Geopolitical tension has eased the US Dollars safe-haven appeal. The DXY has slipped below the 106.00 handle offering some temporary respite.

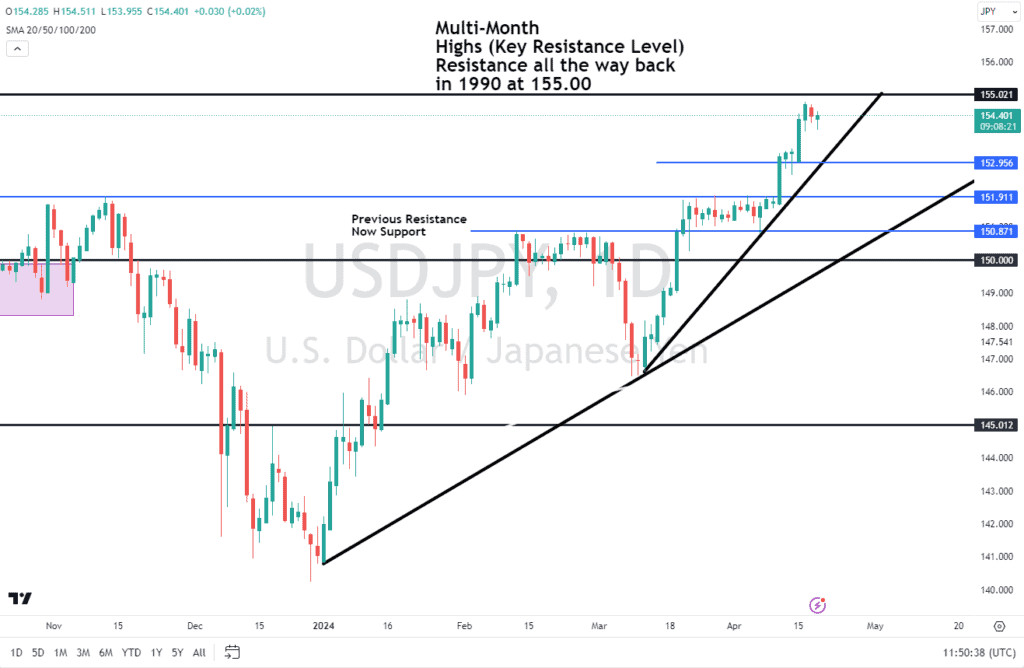

Asian currencies, most notably the Japanese Yen and the South Korean Won have been under intense pressure in recent weeks. USDJPY in particular, trading at levels last seen in 1990. In a meeting yesterday US Treasury Secretary Janet Yellen and her finance counterparts from Japan and South Korea emphasized their belief that excessive FX moves are not desirable. This has once stoked interest in a possible BoJ intervention or a potential joint intervention by the two nations to arrest the slump of their local currencies. This is worth keeping an eye on as FX intervention developments could lead to significant volatility in USDJPY in the coming days.

USDJPY Daily Chart

Source: TradingView

As you can see from the USDJPY chart above, having broken the multi-month resistance at the 152.00 handle, USDJPY has made a run toward the 155.00 mark. Given the rise of intervention chatter once more, will it be able to inject some life into the Yen moving forward?

Immediate support for USDJPY rests around the 153.00 handle with a break of this level and the ascending trendline opening up a retest of support at the 152.00 and 150.80 levels. Alternatively, a break of the 155.00 handle could see a quick run up toward the key psychological 160.00 handle.

The EUR and GBP have both benefitted from a weaker US Dollar over the past 24 hours but given that both Central Banks are on course to cut rates earlier than the FED, a sustained move higher remains in doubt. Given the progress on inflation in the Euro Area and calls from both ECB officials and Politicians, the ECB may lead the way when it comes to rate cuts which could cap gains against the US Dollar moving forward.

GBPUSD has gained a little ground but has been unable to reclaim the key 1.2500. The UK economy has seen some positive wage growth of late while sentiment around the economy has improved. Despite this the Bank of England (BoE) is also likely to cut rates ahead of the FED which may be the reason why the 1.2500 handle remains elusive.

Commodities

Gold has been steady this morning hanging around the $2380/oz mark. The respite in Middle East tensions and rate cut narrative have led to a rangebound trading week thus far which could continue into the weekend.

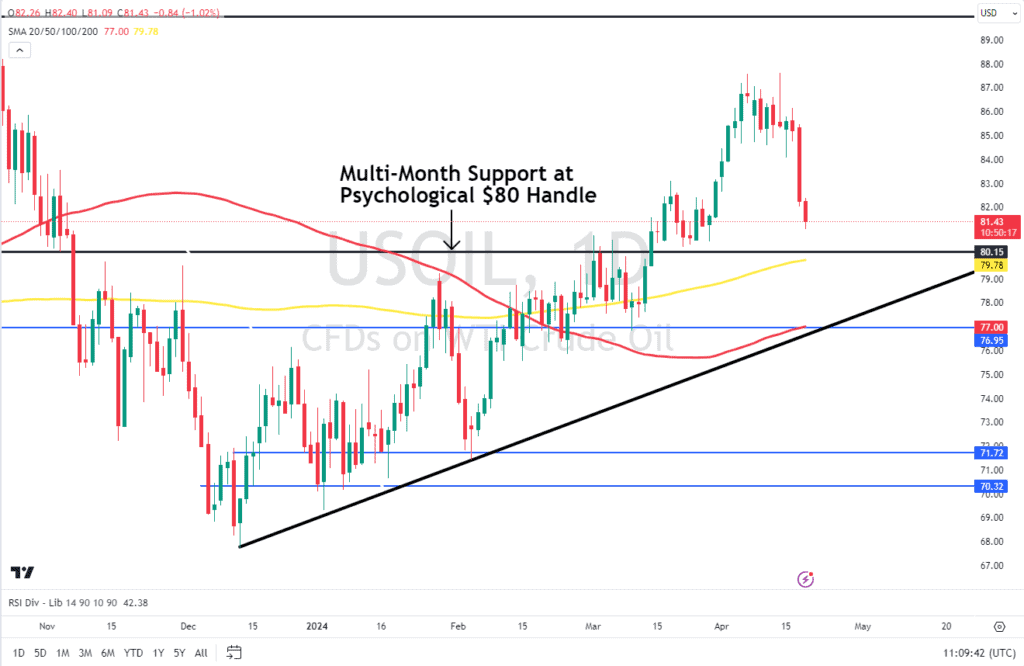

Oil prices have retreated significantly this week, down about 4.87% at the time of writing. It appears market participants had largely priced in a potential escalation of tensions in the Middle East. After the attack on Israel over the weekend, many analysts including myself expected a potential jump in price at the open. Having failed to materialize and with a retaliatory attack expected against Iran, concerns about the Hormuz Straight remain.

Oil Daily Chart

Source: TradingView

Looking at the Oil daily chart above, we are approaching a key area of support around the $80 a barrel mark. A break below this level has the potential to retest the ascending trendline around the $77 a barrel mark. This is a key inflection point as it coincides with a key support area and would be the third touch of the trendline. There is usually a case for a bounce following a third touch of a trendline, so with that in mind, a deeper pullback may present an opportunity for would-be longs to join the trend.

Economic Data Ahead

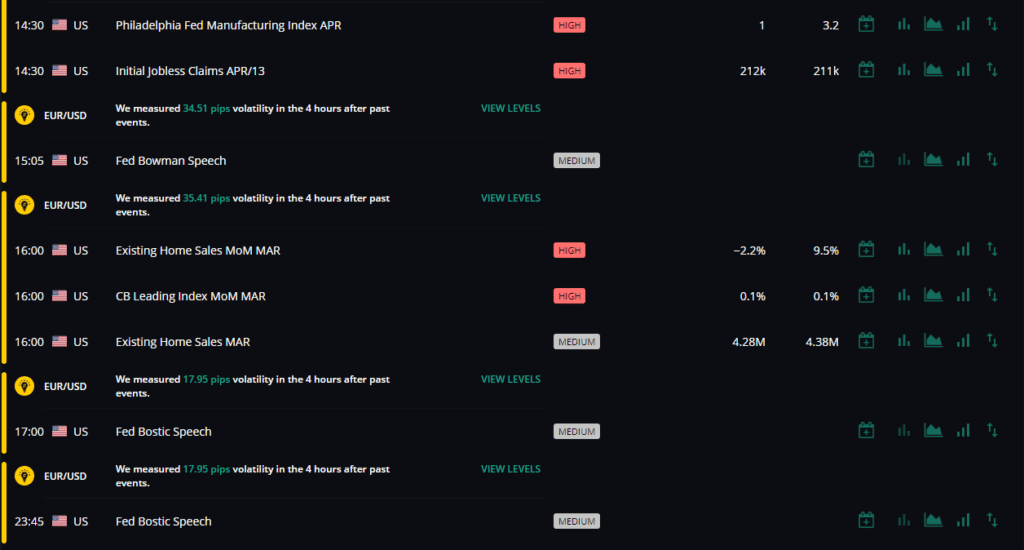

Looking ahead to the rest of the day, US earnings will continue to filter through as well as a host of Federal Reserve speakers. On the earnings front the most notable names are Blackstone and Netflix which will be reporting after the closing bell.

Federal Reserve policymakers could stoke some volatility in the US session as we have Rafael Bostic and Austan Goolsbee on the docket. Comments around rate cuts and the potential timing of them could stoke volatility in the short-term but are unlikely to have any lasting impact on market sentiment.

Source: FXIFY