- Strong Jobs Report Keeps US Dollar Supported

- Gold Prints Fresh Highs on China ETF Frenzy

- Oil Retreats as Middle East Peace Talks Gather Pace

- Big Week Ahead with Q1 Earnings Releases and US CPI Data

General Market Outlook

The US dollar has started the week on the front foot following Friday’s better-than-expected US payrolls statistics. Market participants also appear to be keeping a watchful eye on geopolitical unrest in the Middle East with peace talks underway in Egypt. This in part could explain a 1% drop in oil prices, one of the many movers in what could be a busy week.

Let’s take a quick look back at the implication of the US jobs report on Friday which demonstrated the resilience of the US economy despite the high interest rate environment. This also saw a shift in market expectations regarding the start date of potential rate cuts by the US Federal Reserve and is the driving force for the US Dollars positive start to the week.

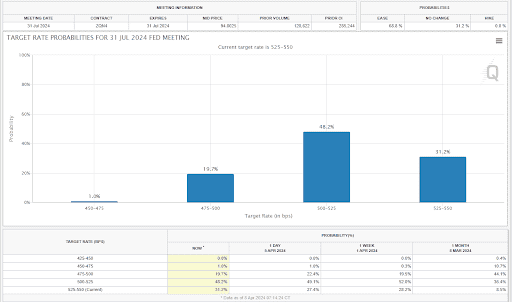

Market participants have eased rate cut expectations for July, with the probability of a 25bps cut down to 48.2% from 52% a week ago.

Source: CME FedWatch Tool

FX Movers

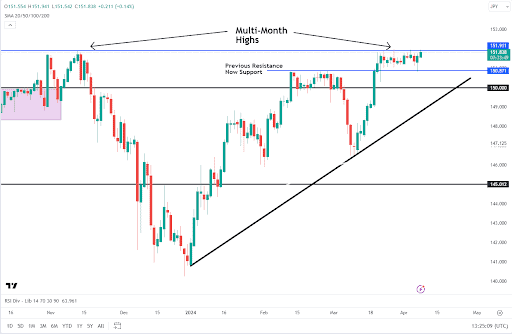

Looking across the FX markets and the Dollar dominating with USDJPY remaining the most interesting of the bunch. The strength of the Dollar in early trade has left the pair trading on the cusp of the 152.00 resistance level. This is a multi-month resistance area and a level that BoJ and Japanese officials have cited in recent weeks. Japan’s top FX diplomat Masato Kanda last week stated that a move above the 152.00 level may lead to intervention of some sort. In the Asian session, the Japan Business Lobby Keidanren Chief chimed in on the Current weakness of the Yen, calling it excessive.

USDJPY Daily Chart

Source: TradingView

As you can see from the USDJPY chart above, the range between the 150.00 and 152.00 mark has seen selloffs in the past. The moves were facilitated by intervention from the Bank of Japan and the Finance Ministry which led to a near 1000 pip drop in November-December 2023. Is history about to repeat itself?

The strength of the US Dollar has made a break of 152.00 a strong possibility and with very little in the way of historical price action to analyze. However, the looming threat of intervention could weigh on bulls and cap gains which is something to be wary of moving forward.

EURUSD has surprised in early trade holding firm and pushing just above the 1.0830 mark despite US Dollar strength. EU Sentix Investors Confidence data showed that investor morale continues to recover with a print of -5.9, up from -10.5 in March. As the Euro Area continues to look for positives, Germany and its economy remain a concern for the bloc. If this recovery and improved sentiment is to continue then Germany will need to do so as well.

Commodities

Gold surprised overnight following the news of talks around a peace deal for the Israel-Palestine conflict. The safe haven precious metal roared to fresh highs around $2354.97/oz before retreating toward the $2330.00 handle. The improved sentiment around the Middle East and US Dollar strength should in theory have led to a poor start to the week for the precious metal which continues to defy expectations and soar. Part of the rally in Asian trade can be attributed to a buying frenzy in China. Trading for the China AMC CSI SH-SZ-HK Gold Industry Equity ETF was halted until 10:30 am local time as the premium surged 30%. Demand for the precious metal remains high with around $600 million of net inflows to Gold ETFs globally over the past week.

This comes as the PBoC themselves were in a buying frenzy over the past few months, with the Central Bank expected to continue in a similar vain. This does not bode well for those hoping for a significant correction in the precious metal, but a short-term pullback remains very much on the cards.

Oil prices opened the trading week about 1% down from Friday’s close on the back of Middle East peace talks. The broader outlook and fears around tight supply remain unchanged and could keep oil moving higher. Despite peace talks the global geopolitical situation around oil prices remains uncertain with Russia-Ukraine still posing concerns as well following attacks on Russian refineries last week.

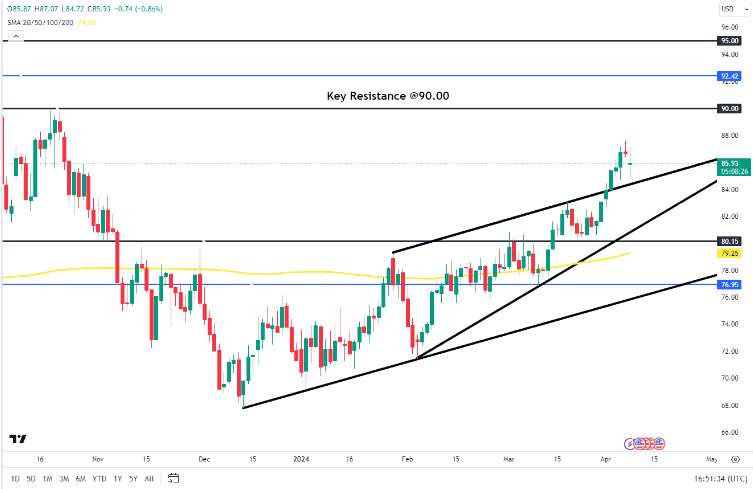

Oil Daily Chart

Source: TradingView

Looking at the oil chart above, we have broken above the rising wedge pattern before opening with a gap to the downside this morning. Price has recovered and risen for the majority of the European session with Friday’s daily close price proving an obstacle around 86.67.

A break above this level would bring Friday’s high into focus at 87.59 with little to no resistance areas above until the psychological 90.00 handle. At this stage, I am not sure what will help in moderating oil prices as the tensions in the Middle East are not the only thing affecting sentiment and driving prices.

The Day and Week Ahead

US Equity Futures were muted in pre-session trade, a trend that could continue into the US session. Markets are of course still digesting the Jobs report while a big week of economic data will be joined by the kick-off of first-quarter corporate earnings season, which gets underway Friday. Among the big names to report this week are JPMorgan, Citigroup, and Wells Fargo.

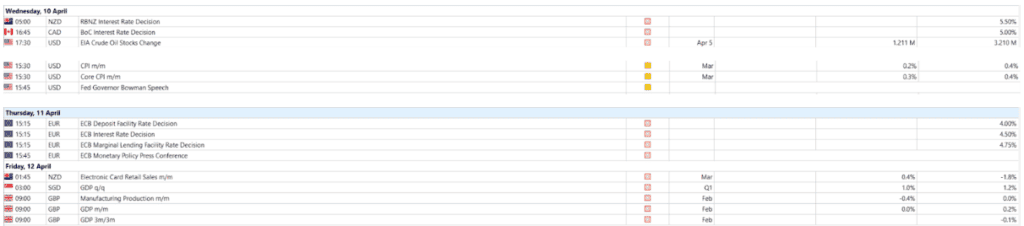

Looking at the economic calendar, the high-impact releases start on Wednesday with the RBNZ rate decision. Although marked as medium-impact data on the Calendar, US inflation numbers will also be released on Wednesday afternoon (UK Time) with a hotter-than-expected reading likely to result in US Dollar strength and weakness in US Equities. A hotter reading would be a sign that the Federal Reserve may need to adopt a more hawkish stance than we have heard of late and I for one would not be surprised by such an occurrence.

Source: Alchemy Markets