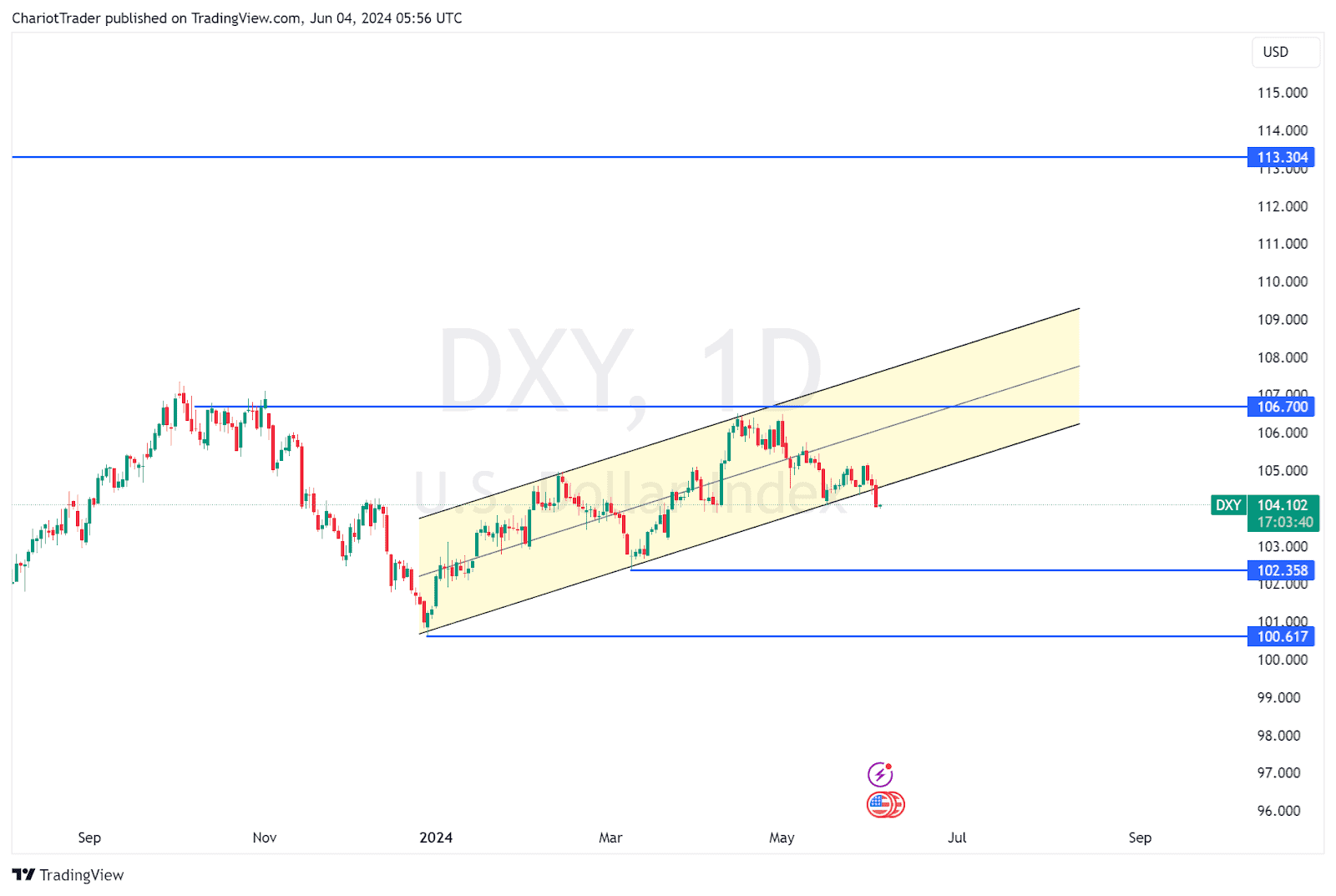

As DXY continues to break down, the markets are experiencing some mixed sentiments.

On one hand, the technicals of the DXY are helping the general markets rally. DXY has broken down from a weekly/daily parallel channel, and is expected to retest 102.58 or lower.

On the other hand, investors are now questioning how many rate cuts the Federal Reserve will introduce in 2024 – perhaps even not cutting at all this year.

For context, the last U.S inflation reading (April) was 3.36%, but it was previously at 3.1% in January. Additionally, investors were speculating that three rate cuts would happen in 2024, with the first coming in March, the second in June, and the third in September.

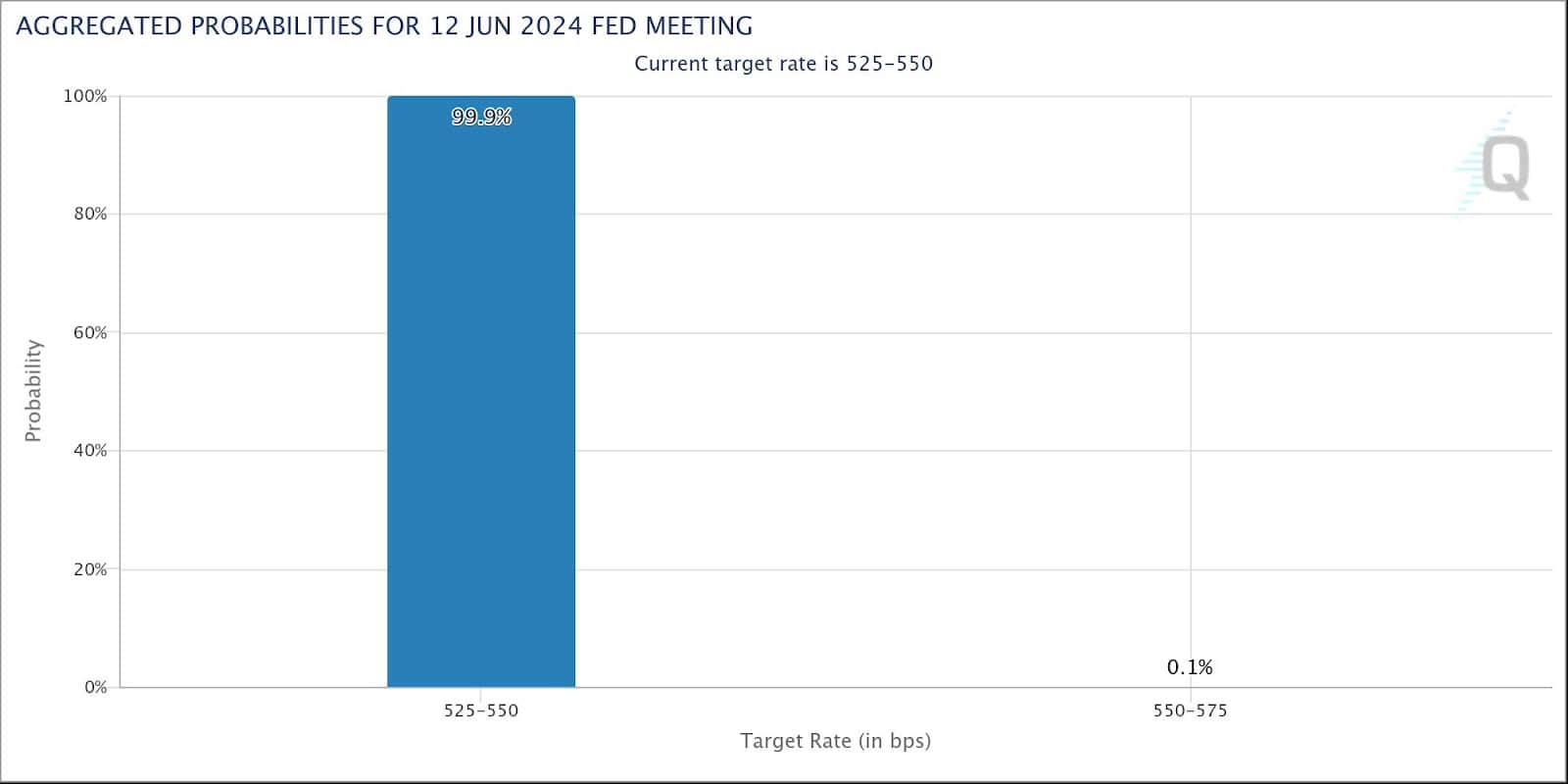

However, the current Fedwatch Tool reveals a telling story about the markets’ expectations in June. The aggregated probabilities for interest rates to be held is now sitting at 99.9%, instead of a previously higher expectation for a cut.

Source: Fedwatch Tool

So what can we expect this week?

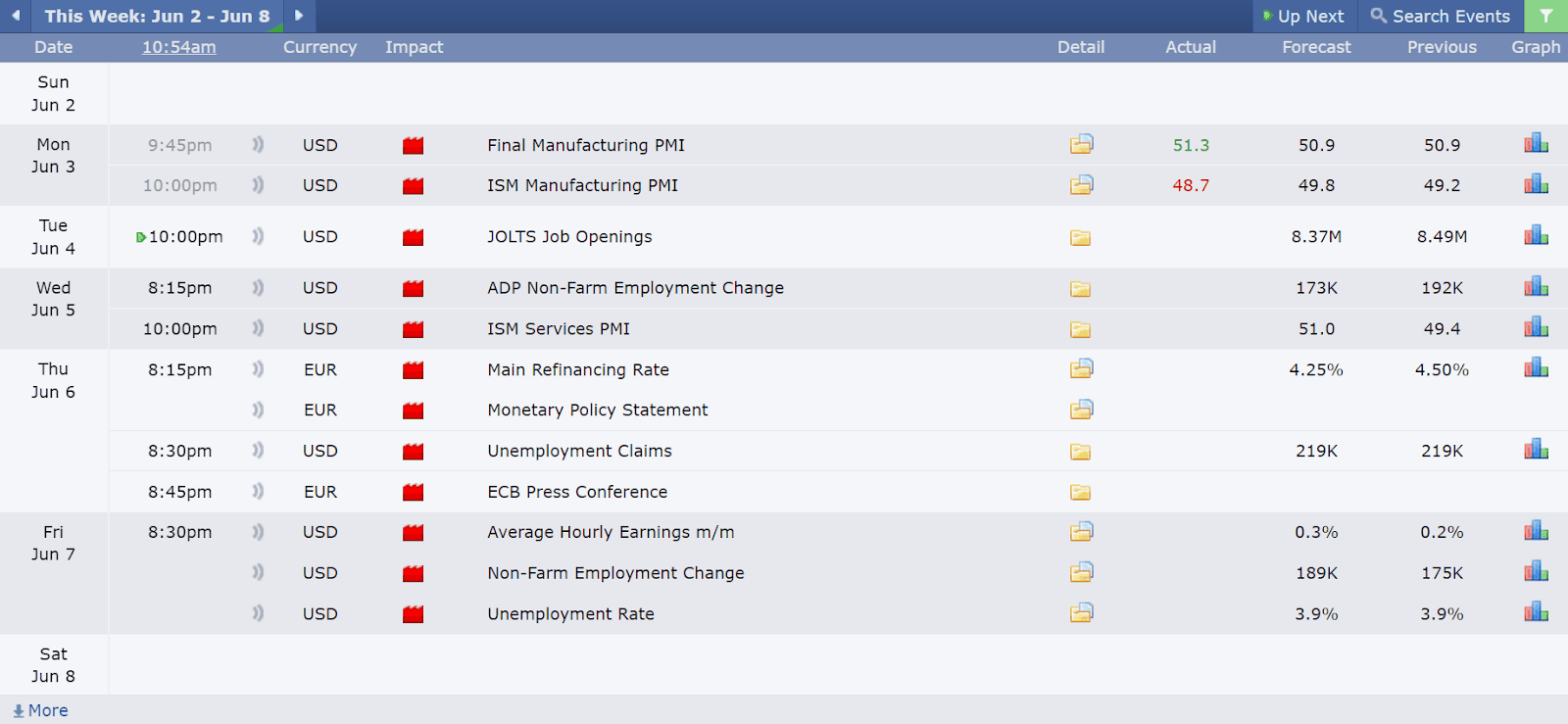

We’re in for a volatile week ahead because it is a high impact news week. Key news to keep an eye are:

- U.S. JOLTS Job Openings

- Euro Monetary Policy

- U.S. Non-Farm Employment Change

- U.S. Unemployment Rate

We’re in a situation where good economic news can be bad news, because whilst the economy is booming, the Federal Reserve wants employment rates to be low in order for inflation rates to be controlled. So if the unemployment rate has decreased, the market may anticipate the Federal Reserve to have a negative reaction (i.e. continuing to hold rates, delaying rate cuts, or rate hiking).

Currently, we are in a monetary policy driven market. So this week’s news will be crucial in determining how the markets will behave for the next coming weeks.

Source: Forex Factory

Euro Monetary Policy Could Dictate How Dollar Performs

Additionally, we need to pay attention to the European Central Bank’s Monetary Policy Statement.

The Euro Monetary Policy Statement is crucial in influencing the performance of the Dollar. A dovish statement could lead to a drop in the Euro against the Dollar due to interest rate differentials and potential currency swaps. This dynamic is significant as the Euro’s interest rate of 4.50% contrasts with the USD’s 5.50%, impacting currency exchange behaviors.

If the interest rate for Euro increases, it could encourage people to swap their dollars into Euros – causing the Dollar to drop even lower.

This is a significant indicator for the performance of the U.S Dollar, as EURUSD makes up over 60% of the market share in the DXY, which inversely correlates with the S&P 500, Nasdaq, and Bitcoin.